PAGE 2

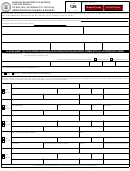

I WOULD LIKE TO CHANGE FROM A TRANSIENT EMPLOYER TO A REGULAR EMPLOYER. (MUST HAVE FILED 24 CONSECUTIVE MONTHS IN MISSOURI.)

8.

M

M

D

D

9. CHANGE THE CORPORATION TAXABLE YEAR END TO:

10. CHANGE MAILING ADDRESS FOR:

ALL TAX TYPES

SALES/USE TAX

EMPLOYER WITHHOLDING TAX

CORPORATE INCOME / FRANCHISE TAX

IN CARE OF (NOT REQUIRED)

STREET, ROUTE OR PO BOX

CITY

STATE

ZIP CODE

COUNTY

___ ___ ___ ___ ___

11. CLOSE THE FOLLOWING BUSINESS LOCATION FOR:

SALES TAX

CONSUMER’S USE TAX

VENDOR’S USE TAX

EMPLOYER WITHHOLDING TAX

BUSINESS NAME

STREET OR HIGHWAY ADDRESS (DO NOT USE PO BOX, RURAL ROUTE, HCR, ETC.)

M

M

D

D

Y

Y

Y

Y

CITY (ENTER “UNINCORPORATED” IF NOT WITHIN A CITY’S LIMITS)

STATE

ZIP

COUNTY

DATE OF

CLOSING

__ __ __ __ __

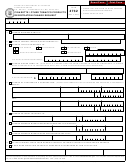

12. OPEN THE FOLLOWING NEW PHYSICAL BUSINESS LOCATION FOR:

SALES TAX

CONSUMER’S USE TAX

VENDOR’S USE TAX

EMPLOYER WITHHOLDING TAX

BUSINESS NAME

STREET OR HIGHWAY ADDRESS (DO NOT USE PO BOX, RURAL ROUTE, HCR, ETC.)

M

M

D

D

Y

Y

Y

Y

CITY

STATE

ZIP

COUNTY

TAXABLE

SALES BEGIN

__ __ __ __ __

DATE

(To find out if this location is inside the city limits or in a district, go to https://dors.mo.gov/tax/strgis/index.jsp)

Is this business located inside the city limits of any city or municipality in Missouri?

No

Yes — Specify the city: ________________________________________________________________________________________

Is this business located inside a district(s)? For example, ambulance, fire, tourism, community or transportation development.

No

Yes — Specify the district name(s): ________________________________________________________________________________

DO YOU LEASE/RENT MOTOR VEHICLES FROM THIS LOCATION, THAT WERE PURCHASED SALES TAX EXEMPT, TO MISSOURI CUSTOMERS? . . . .

YES

NO

DO YOU SELL POST-SECONDARY EDUCATIONAL TEXTBOOKS? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU SELL FOOD ITEMS FROM THIS LOCATION THAT ARE EXEMPT FROM STATE SALES TAX? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU SELL DOMESTIC UTILITIES AT THIS LOCATION? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU SELL CIGARETTES OR OTHER TOBACCO PRODUCTS FROM THIS LOCATION? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU MAKE RETAIL SALES OF AVIATION JET FUEL TO MISSOURI CUSTOMERS? (PLEASE PROVIDE A LIST OF ALL APPLICABLE LOCATIONS AND

ANSWER QUESTIONS A AND B FOR EACH LOCATION) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

A. If yes, are your sales made at:

(1) an airport located in Missouri? (Your account will be registered for retail sales tax) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

(2) a location outside Missouri and the fuel is transported into Missouri? (Your account will be registered for vendor’s use tax). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

B. Is the airport located in Missouri identified on the National Plan of Integrated Airport Systems (NPIAS)? (Your account will be registered for retail sales of

aviation jet fuel). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU USE, STORE, OR CONSUME AVIATION JET FUEL IN MISSOURI WHERE THE SELLER DOES NOT COLLECT TAX? . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

If yes, is the fuel stored, used, or consumed in an airport that is eligible to apply for federal grant funds? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

(If yes, your account will be registered for consumer’s use tax of jet fuel. Please provide a list of applicable locations)

____________________________________________________________________________________________________

DO YOU MAKE RETAIL SALES OF NEW TIRES? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU MAKE RETAIL SALES OF LEAD-ACID BATTERIES? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU MAKE RETAIL SALES OF QUALIFYING SALES TAX HOLIDAY BACK-TO-SCHOOL PURCHASES? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU MAKE RETAIL SALES OF ENERGY STAR CERTIFIED APPLIANCES THAT QUALIFY FOR THE “SHOW ME GREEN SALES TAX HOLIDAY”? . . . .

YES

NO

DO YOU PROVIDE TELECOMMUNICATIONS SERVICE SUBJECT TO MISSOURI RETAIL SALES TAX? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU MAKE RETAIL SALES OF QUALIFYING UTILITIES OR ITEMS USED OR CONSUMED IN MANUFACTURING OR MINING,

RESEARCH AND DEVELOPMENT OR PROCESSING RECOVERED MATERIALS? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

DO YOU SELL ANY TYPE OF ALCOHOLIC BEVERAGE? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

COMMENTS

UNDER PENALTIES OF PERJURY, I DECLARE THAT THE ABOVE INFORMATION AND ANY ATTACHED SUPPLEMENTS ARE TRUE, COMPLETE, AND

CORRECT. ADDING PERSONS TO THE ACCOUNT INDICATES THEY HAVE DIRECT SUPERVISION OR CONTROL OVER TAX MATTERS. THE APPLICATION

MUST BE SIGNED BY THE OWNER, IF THE BUSINESS IS A SOLE OWNERSHIP; PARTNER, IF THE BUSINESS IS A PARTNERSHIP; REPORTED OFFICER, IF

THE BUSINESS IS A CORPORATION, OR BY A MEMBER IF THE BUSINESS IS A L.L.C AS REPORTED ON THE APPLICATION.

SIGNATURE

PRINTED NAME

No digital signatures allowed

TITLE

DATE(MM/DD/YYYY)

__ __ / __ __ / __ __ __ __

RETURN THIS FORM TO: TAXATION DIVISION, PO BOX 3300, JEFFERSON CITY, MO 65105-3300

IF YOU HAVE QUESTIONS: Phone: (573) 751-5860 TDD (800) 735-2966 FAX: 573-522-1722

E-mail: businesstaxregister@dor.mo.gov

DOR-126 (02-2013)

1

1 2

2