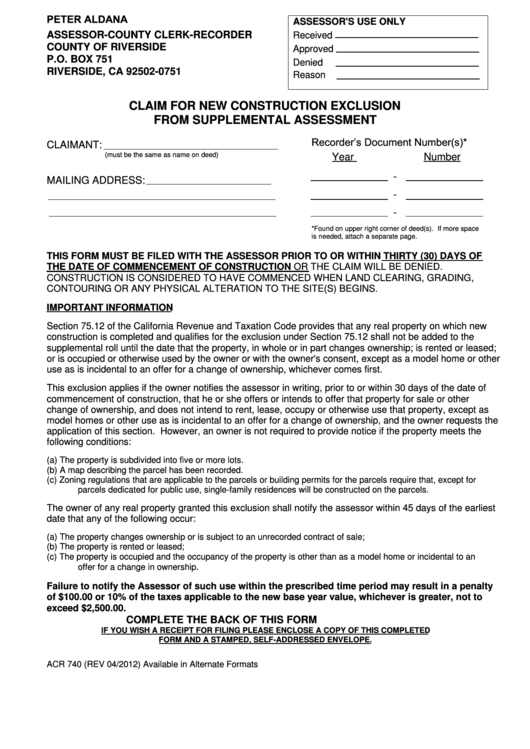

PETER ALDANA

ASSESSOR'S USE ONLY

ASSESSOR-COUNTY CLERK-RECORDER

Received

COUNTY OF RIVERSIDE

Approved

P.O. BOX 751

Denied

RIVERSIDE, CA 92502-0751

Reason

CLAIM FOR NEW CONSTRUCTION EXCLUSION

FROM SUPPLEMENTAL ASSESSMENT

Recorder’s Document Number(s)*

CLAIMANT:

(must be the same as name on deed)

Year

Number

-

MAILING ADDRESS:

-

-

*Found on upper right corner of deed(s). If more space

is needed, attach a separate page.

THIS FORM MUST BE FILED WITH THE ASSESSOR PRIOR TO OR WITHIN THIRTY (30) DAYS OF

THE DATE OF COMMENCEMENT OF CONSTRUCTION OR THE CLAIM WILL BE DENIED.

CONSTRUCTION IS CONSIDERED TO HAVE COMMENCED WHEN LAND CLEARING, GRADING,

CONTOURING OR ANY PHYSICAL ALTERATION TO THE SITE(S) BEGINS.

IMPORTANT INFORMATION

Section 75.12 of the California Revenue and Taxation Code provides that any real property on which new

construction is completed and qualifies for the exclusion under Section 75.12 shall not be added to the

supplemental roll until the date that the property, in whole or in part changes ownership; is rented or leased;

or is occupied or otherwise used by the owner or with the owner's consent, except as a model home or other

use as is incidental to an offer for a change of ownership, whichever comes first.

This exclusion applies if the owner notifies the assessor in writing, prior to or within 30 days of the date of

commencement of construction, that he or she offers or intends to offer that property for sale or other

change of ownership, and does not intend to rent, lease, occupy or otherwise use that property, except as

model homes or other use as is incidental to an offer for a change of ownership, and the owner requests the

application of this section. However, an owner is not required to provide notice if the property meets the

following conditions:

(a)

The property is subdivided into five or more lots.

(b)

A map describing the parcel has been recorded.

(c)

Zoning regulations that are applicable to the parcels or building permits for the parcels require that, except for

parcels dedicated for public use, single-family residences will be constructed on the parcels.

The owner of any real property granted this exclusion shall notify the assessor within 45 days of the earliest

date that any of the following occur:

(a)

The property changes ownership or is subject to an unrecorded contract of sale;

(b)

The property is rented or leased;

(c)

The property is occupied and the occupancy of the property is other than as a model home or incidental to an

.

offer for a change in ownership

Failure to notify the Assessor of such use within the prescribed time period may result in a penalty

of $100.00 or 10% of the taxes applicable to the new base year value, whichever is greater, not to

exceed $2,500.00.

COMPLETE THE BACK OF THIS FORM

IF YOU WISH A RECEIPT FOR FILING PLEASE ENCLOSE A COPY OF THIS COMPLETED

FORM AND A STAMPED, SELF-ADDRESSED ENVELOPE.

ACR 740 (REV 04/2012)

Available in Alternate Formats

1

1 2

2