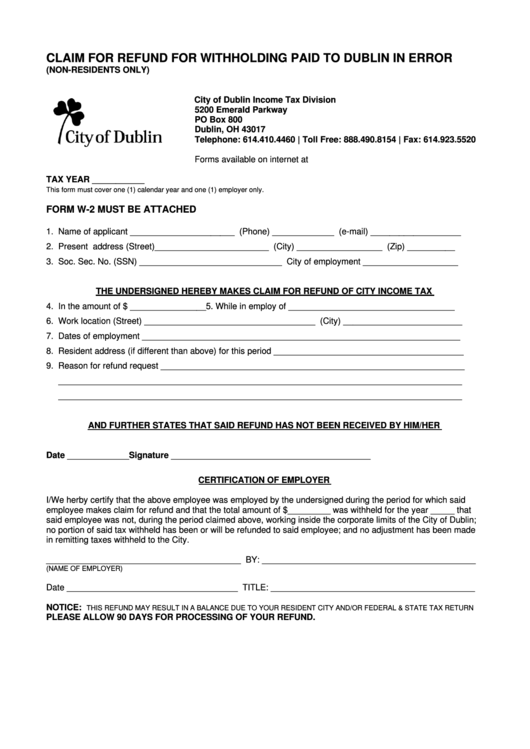

CLAIM FOR REFUND FOR WITHHOLDING PAID TO DUBLIN IN ERROR

(NON-RESIDENTS ONLY)

City of Dublin Income Tax Division

5200 Emerald Parkway

PO Box 800

Dublin, OH 43017

Telephone: 614.410.4460 | Toll Free: 888.490.8154 | Fax: 614.923.5520

Forms available on internet at

TAX YEAR ___________

This form must cover one (1) calendar year and one (1) employer only.

FORM W-2 MUST BE ATTACHED

1. Name of applicant ______________________ (Phone) _____________ (e-mail) ___________________

2. Present address (Street) ________________________ (City) __________________ (Zip) __________

3. Soc. Sec. No. (SSN) ______________________________ City of employment ____________________

THE UNDERSIGNED HEREBY MAKES CLAIM FOR REFUND OF CITY INCOME TAX

4. In the amount of $ ________________ 5. While in employ of ___________________________________

6. Work location (Street) ____________________________________ (City) _________________________

7. Dates of employment ___________________________________________________________________

8. Resident address (if different than above) for this period ________________________________________

9. Reason for refund request ________________________________________________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

AND FURTHER STATES THAT SAID REFUND HAS NOT BEEN RECEIVED BY HIM/HER

Date _____________ Signature __________________________________________

CERTIFICATION OF EMPLOYER

I/We herby certify that the above employee was employed by the undersigned during the period for which said

employee makes claim for refund and that the total amount of $_________ was withheld for the year _____ that

said employee was not, during the period claimed above, working inside the corporate limits of the City of Dublin;

no portion of said tax withheld has been or will be refunded to said employee; and no adjustment has been made

in remitting taxes withheld to the City.

_________________________________________ BY: _____________________________________________

(NAME OF EMPLOYER)

Date ____________________________________ TITLE: ___________________________________________

NOTICE:

THIS REFUND MAY RESULT IN A BALANCE DUE TO YOUR RESIDENT CITY AND/OR FEDERAL & STATE TAX RETURN

PLEASE ALLOW 90 DAYS FOR PROCESSING OF YOUR REFUND.

1

1