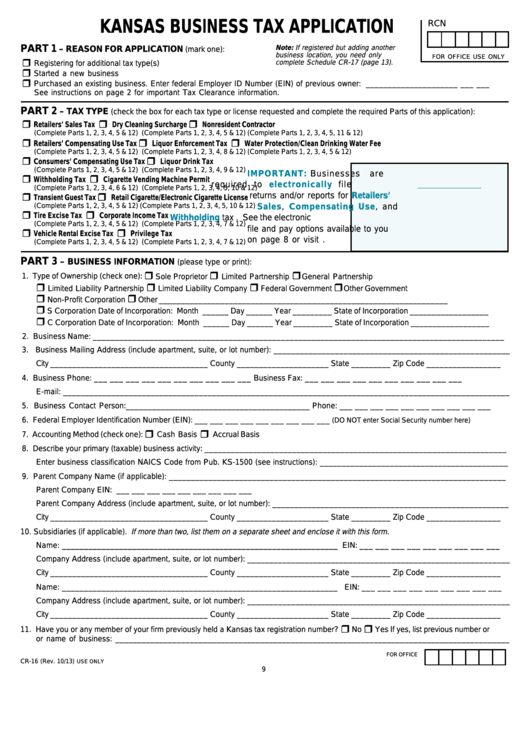

KANSAS BUSINESS TAX APPLICATION

RCN

PART 1

Note: If registered but adding another

– REASON FOR APPLICATION

(mark one):

business location, you need only

FOR OFFICE USE ONLY

ˆ

complete Schedule CR-17 (page 13).

Registering for additional tax type(s)

ˆ

Started a new business

ˆ

Purchased an existing business. Enter federal Employer ID Number (EIN) of previous owner: ___ ___ ___ ___ ___ ___ ___ ___ ___

See instructions on page 2 for important Tax Clearance information.

PART 2

– TAX TYPE

(check the box for each tax type or license requested and complete the required Parts of this application):

ˆ

ˆ

ˆ

Retailers’ Sales Tax

Dry Cleaning Surcharge

Nonresident Contractor

(Complete Parts 1, 2, 3, 4, 5 & 12)

(Complete Parts 1, 2, 3, 4, 5 & 12)

(Complete Parts 1, 2, 3, 4, 5, 11 & 12)

ˆ

ˆ

ˆ

Retailers’ Compensating Use Tax

Liquor Enforcement Tax

Water Protection/Clean Drinking Water Fee

(Complete Parts 1, 2, 3, 4, 5 & 12)

(Complete Parts 1, 2, 3, 4, 8 & 12)

(Complete Parts 1, 2, 3, 4, 5 & 12)

ˆ

ˆ

Consumers’ Compensating Use Tax

Liquor Drink Tax

(Complete Parts 1, 2, 3, 4, 5 & 12)

(Complete Parts 1, 2, 3, 4, 9 & 12)

IMPORTANT:

Businesses

are

ˆ

ˆ

Withholding Tax

Cigarette Vending Machine Permit

required to

electronically

file

(Complete Parts 1, 2, 3, 4, 6 & 12)

(Complete Parts 1, 2, 3, 4, 5, 10 & 12)

ˆ

ˆ

returns and/or reports for

Retailers’

Transient Guest Tax

Retail Cigarette/Electronic Cigarette License

(Complete Parts 1, 2, 3, 4, 5 & 12)

(Complete Parts 1, 2, 3, 4, 5, 10 & 12)

Sales,

Compensating

Use, and

ˆ

ˆ

Tire Excise Tax

Corporate Income Tax

Withholding

tax . See the electronic

(Complete Parts 1, 2, 3, 4, 5 & 12)

(Complete Parts 1, 2, 3, 4, 7 & 12)

file and pay options available to you

ˆ

ˆ

Vehicle Rental Excise Tax

Privilege Tax

on page 8 or visit .

(Complete Parts 1, 2, 3, 4, 5 & 12)

(Complete Parts 1, 2, 3, 4, 7 & 12)

PART 3

– BUSINESS INFORMATION

(please type or print):

ˆ

ˆ

ˆ

1. Type of Ownership (check one):

Sole Proprietor

Limited Partnership

General Partnership

ˆ

ˆ

ˆ

ˆ

Limited Liability Partnership

Limited Liability Company

Federal Government

Other Government

ˆ

ˆ

Non-Profit Corporation

Other __________________________________________________________________

ˆ

S Corporation

Date of Incorporation: Month ______ Day ______ Year _________

State of Incorporation __________________

ˆ

C Corporation

Date of Incorporation: Month ______ Day ______ Year _________

State of Incorporation __________________

2. Business Name: ______________________________________________________________________________________________

3. Business Mailing Address (include apartment, suite, or lot number): ______________________________________________________

City ____________________________________ County _____________________ State _________ Zip Code _________________

4. Business Phone: ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

Business Fax: ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

E-mail: ______________________________________________________________________________________________________

5. Business Contact Person: __________________________________________

Phone: ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

6. Federal Employer Identification Number (EIN): ___ ___ ___ ___ ___ ___ ___ ___ ___

(DO NOT enter Social Security number here)

ˆ

ˆ

7. Accounting Method (check one):

Cash Basis

Accrual Basis

8. Describe your primary (taxable) business activity: _____________________________________________________________________

Enter business classification NAICS Code from Pub. KS-1500 (see instructions): ___________________________________________

9. Parent Company Name (if applicable): _____________________________________________________________________________

Parent Company EIN: ___ ___ ___ ___ ___ ___ ___ ___ ___

Parent Company Address (include apartment, suite, or lot number): ______________________________________________________

City ____________________________________ County _____________________ State _________ Zip Code _________________

10. Subsidiaries (if applicable). If more than two, list them on a separate sheet and enclose it with this form.

Name: _______________________________________________________________ EIN: ___ ___ ___ ___ ___ ___ ___ ___ ___

Company Address (include apartment, suite, or lot number): ____________________________________________________________

City ____________________________________ County _____________________ State _________ Zip Code _________________

Name: _______________________________________________________________ EIN: ___ ___ ___ ___ ___ ___ ___ ___ ___

Company Address (include apartment, suite, or lot number): ____________________________________________________________

City ____________________________________ County _____________________ State _________ Zip Code _________________

ˆ

ˆ

11. Have you or any member of your firm previously held a Kansas tax registration number?

No

Yes If yes, list previous number or

or name of business: __________________________________________________________________________________________

FOR OFFICE

CR-16 (Rev. 10/13)

USE ONLY

9

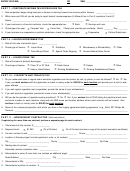

1

1 2

2 3

3 4

4