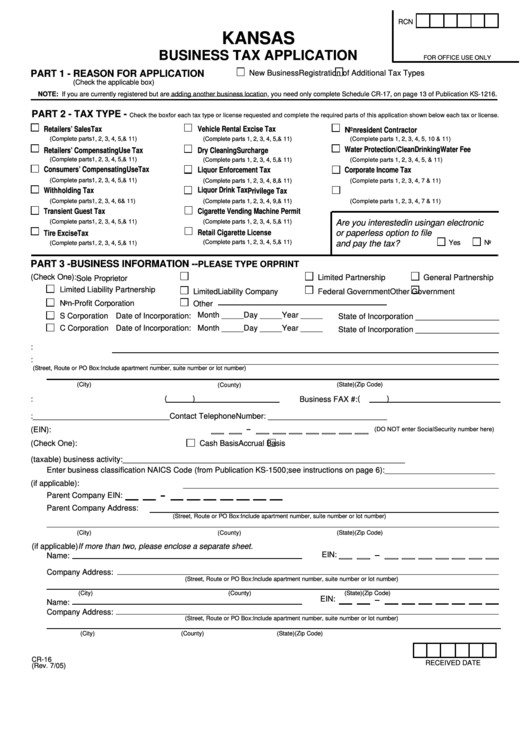

Form Cr-16 - Business Tax Application - Kansas

ADVERTISEMENT

RCN

KANSAS

BUSINESS TAX APPLICATION

FOR OFFICE USE ONLY

PART 1 - REASON FOR APPLICATION

New Business

Registration of Additional Tax Types

(Check the applicable box)

NOTE: If you are currently registered but are adding another business location, you need only complete Schedule CR-17, on page 13 of Publication KS-1216.

PART 2 - TAX TYPE -

Check the box for each tax type or license requested and complete the required parts of this application shown below each tax or license.

Vehicle Rental Excise Tax

Retailers’ Sales Tax

Nonresident Contractor

(Complete parts 1, 2, 3, 4, 5, & 11)

(Complete parts 1, 2, 3, 4, 5, & 11)

(Complete parts 1, 2, 3, 4, 5, 10 & 11)

Water Protection/Clean Drinking Water Fee

Dry Cleaning Surcharge

Retailers’ Compensating Use Tax

(Complete parts 1, 2, 3, 4, 5, & 11)

(Complete parts 1, 2, 3, 4, 5, & 11)

(Complete parts 1, 2, 3, 4, 5, & 11)

Consumers’ Compensating Use Tax

Liquor Enforcement Tax

Corporate Income Tax

(Complete parts 1, 2, 3, 4, 5, & 11)

(Complete parts 1, 2, 3, 4, 8, & 11)

(Complete parts 1, 2, 3, 4, 7 & 11)

Liquor Drink Tax

Withholding Tax

Privilege Tax

(Complete parts 1, 2, 3, 4, 6 & 11)

(Complete parts 1, 2, 3, 4, 9, & 11)

(Complete parts 1, 2, 3, 4, 7 & 11)

Transient Guest Tax

Cigarette Vending Machine Permit

(Complete parts 1, 2, 3, 4, 5, & 11)

(Complete parts 1, 2, 3, 4, 5, & 11)

Are you interested in using an electronic

Retail Cigarette License

or paperless option to file

Tire Excise Tax

(Complete parts 1, 2, 3, 4, 5, & 11)

Yes

No

and pay the tax?

(Complete parts 1, 2, 3, 4, 5, & 11)

PART 3 - BUSINESS INFORMATION --

PLEASE TYPE OR PRINT

1.

Type of Ownership (Check One):

Limited Partnership

General Partnership

Sole Proprietor

Limited Liability Partnership

Limited Liability Company

Federal Government

Other Government

Non-Profit Corporation

Other

Month _____ Day _____ Year _____

S Corporation

Date of Incorporation:

State of Incorporation ___________________

C Corporation

Date of Incorporation:

Month _____ Day _____ Year _____

State of Incorporation ___________________

2.

Business Name:

3.

Business Mailing Address:

(Street, Route or PO Box: Include apartment number, suite number or lot number)

(City)

(County)

(State)

(Zip Code)

(

)

(

)

4.

Business Telephone Number:

Business FAX #:

5.

Business Contact Person: _______________________________ Contact Telephone Number: ___________________________

6.

Federal Employer Identification Number (EIN):

(DO NOT enter Social Security number here)

7.

Accounting Method (Check One):

Cash Basis

Accrual Basis

8.

Describe your primary (taxable) business activity: ________________________________________________________________

Enter business classification NAICS Code (from Publication KS-1500; see instructions on page 6): _________________________

9.

Parent Company Name (if applicable):

Parent Company EIN:

Parent Company Address:

(Street, Route or PO Box: Include apartment number, suite number or lot number)

(City)

(State)

(Zip Code)

(County)

10. Subsidiaries (if applicable) If more than two, please enclose a separate sheet.

EIN:

Name:

Company Address:

(Street, Route or PO Box: Include apartment number, suite number or lot number)

(City)

(County)

(State)

(Zip Code)

EIN:

Name:

Company Address:

(Street, Route or PO Box: Include apartment number, suite number or lot number)

(City)

(County)

(State)

(Zip Code)

CR-16

RECEIVED DATE

(Rev. 7/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4