Ira Distribution Request Form

Download a blank fillable Ira Distribution Request Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Ira Distribution Request Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset Form

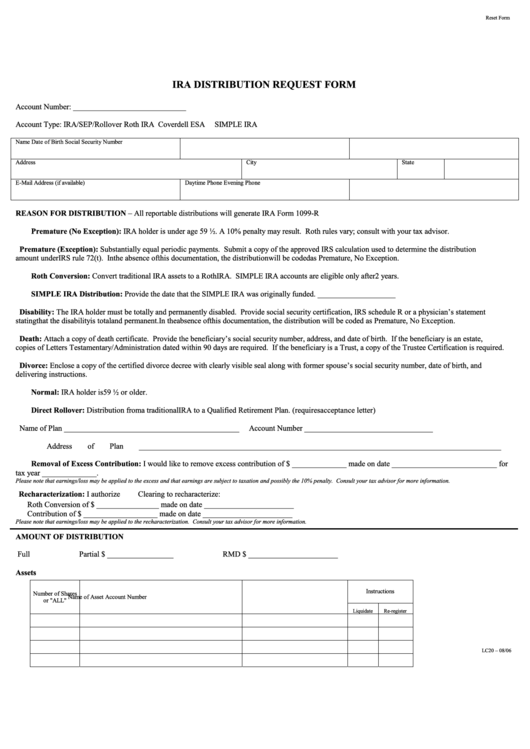

IRA DISTRIBUTION REQUEST FORM

Account Number: _____________________________

Account Type:

IRA/SEP/Rollover

Roth IRA

Coverdell ESA

SIMPLE IRA

Name

Date of Birth

Social Security Number

Address

City

State

ZIP Code

E-Mail Address (if available)

Daytime Phone

Evening Phone

REASON FOR DISTRIBUTION – All reportable distributions will generate IRA Form 1099-R

Premature (No Exception): IRA holder is under age 59 ½. A 10% penalty may result. Roth rules vary; consult with your tax advisor.

Premature (Exception): Substantially equal periodic payments. Submit a copy of the approved IRS calculation used to determine the distribution

amount under IRS rule 72(t). In the absence of this documentation, the distribution will be coded as Premature, No Exception.

Roth Conversion: Convert traditional IRA assets to a Roth IRA. SIMPLE IRA accounts are eligible only after 2 years.

SIMPLE IRA Distribution: Provide the date that the SIMPLE IRA was originally funded. ____________________

Disability: The IRA holder must be totally and permanently disabled. Provide social security certification, IRS schedule R or a physician’s statement

stating that the disability is total and permanent. In the absence of this documentation, the distribution will be coded as Premature, No Exception.

Death: Attach a copy of death certificate. Provide the beneficiary’s social security number, address, and date of birth. If the beneficiary is an estate,

copies of Letters Testamentary/Administration dated within 90 days are required. If the beneficiary is a Trust, a copy of the Trustee Certification is required.

Divorce: Enclose a copy of the certified divorce decree with clearly visible seal along with former spouse’s social security number, date of birth, and

delivering instructions.

Normal: IRA holder is 59 ½ or older.

Direct Rollover: Distribution from a traditional IRA to a Qualified Retirement Plan. (requires acceptance letter)

Name of Plan _____________________________________________

Account Number _________________________________

Address of Plan _____________________________________________________________________________________________

Removal of Excess Contribution: I would like to remove excess contribution of $ ______________ made on date ___________________________ for

tax year ______________.

Please note that earnings/loss may be applied to the excess and that earnings are subject to taxation and possibly the 10% penalty. Consult your tax advisor for more information.

Recharacterization: I authorize

Clearing to recharacterize:

Roth Conversion of $ ________________ made on date _______________________

Contribution of $ ___________________ made on date _______________________

Please note that earnings/loss may be applied to the recharacterization. Consult your tax advisor for more information.

AMOUNT OF DISTRIBUTION

Full

Partial $ _________________

RMD $ _______________________

Assets

Instructions

Number of Shares

Name of Asset

Account Number

or "ALL"

Liquidate

Re-register

LC20 – 08/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3