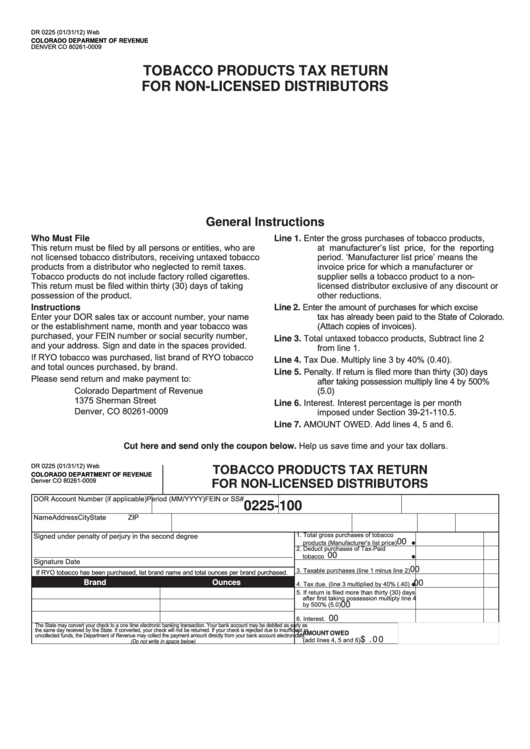

DR 0225 (01/31/12) Web

COLORADO DEPARMENT OF REVENUE

DENVER CO 80261-0009

TOBACCO PRODUCTS TAX RETURN

FOR NON-LICENSED DISTRIBUTORS

General Instructions

Enter the gross purchases of tobacco products,

Who Must File

Line 1.

This return must be filed by all persons or entities, who are

at manufacturer’s list price, for the reporting

not licensed tobacco distributors, receiving untaxed tobacco

period. ‘Manufacturer list price’ means the

products from a distributor who neglected to remit taxes.

invoice price for which a manufacturer or

Tobacco products do not include factory rolled cigarettes.

supplier sells a tobacco product to a non-

This return must be filed within thirty (30) days of taking

licensed distributor exclusive of any discount or

possession of the product.

other reductions.

Enter the amount of purchases for which excise

Instructions

Line 2.

Enter your DOR sales tax or account number, your name

tax has already been paid to the State of Colorado.

or the establishment name, month and year tobacco was

(Attach copies of invoices).

purchased, your FEIN number or social security number,

Total untaxed tobacco products, Subtract line 2

Line 3.

and your address. Sign and date in the spaces provided.

from line 1.

If RYO tobacco was purchased, list brand of RYO tobacco

Tax Due. Multiply line 3 by 40% (0.40).

Line 4.

and total ounces purchased, by brand.

Penalty. If return is filed more than thirty (30) days

Line 5.

Please send return and make payment to:

after taking possession multiply line 4 by 500%

(5.0)

Colorado Department of Revenue

1375 Sherman Street

Interest. Interest percentage is per month

Line 6.

Denver, CO 80261-0009

imposed under Section 39-21-110.5.

AMOUNT OWED. Add lines 4, 5 and 6.

Line 7.

Cut here and send only the coupon below. Help us save time and your tax dollars.

DR 0225 (01/31/12) Web

TOBACCO PRODUCTS TAX RETURN

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0009

FOR NON-LICENSED DISTRIBUTORS

DOR Account Number (if applicable)

Period (MM/YYYY)

FEIN or SS#

0225-100

Name

Address

City

State

ZIP

Signed under penalty of perjury in the second degree

1. Total gross purchases of tobacco

00

products (Manufacturer’s list price) .........

2. Deduct purchases of Tax-Paid

00

tobacco products.....................................

Signature

Date

00

3. Taxable purchases (line 1 minus line 2)

If RYO tobacco has been purchased, list brand name and total ounces per brand purchased.

00

Brand

Ounces

4. Tax due. (line 3 multiplied by 40% (.40) ..

5. If return is filed more than thirty (30) days

after first taking possession multiply line 4

00

by 500% (5.0)

00

6. Interest. ..................................... _______.

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as

the same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or

7. AMOUNT OWED

uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

$

. 0 0

(add lines 4, 5 and 6)

(Do not write in space below)

1

1