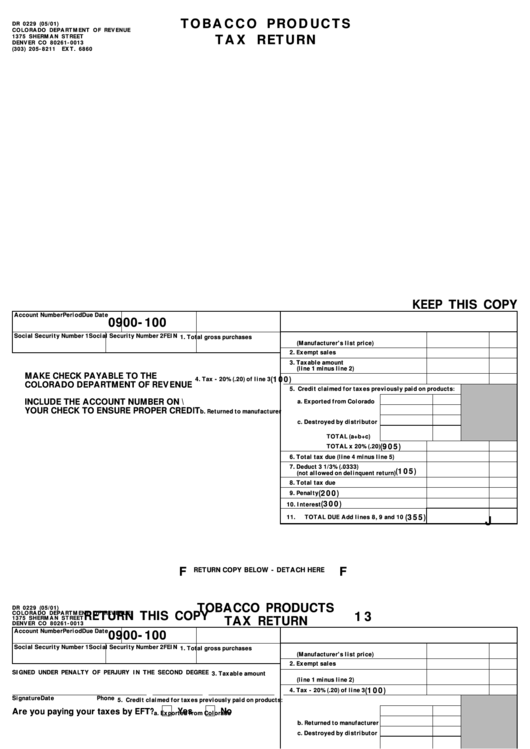

Form Dr 0229 - Tobacco Products Tax Return - State Of Colorado

ADVERTISEMENT

TOBACCO PRODUCTS

DR 0229 (05/01)

COLORADO DEPARTMENT OF REVENUE

TAX RETURN

1375 SHERMAN STREET

DENVER CO 80261-0013

(303) 205-8211

EXT. 6860

KEEP THIS COPY

Account Number

Period

Due Date

0900-100

Social Security Number 1

Social Security Number 2

FEIN

1. Total gross purchases

(Manufacturer's list price)

2. Exempt sales

3. Taxable amount

(line 1 minus line 2)

MAKE CHECK PAYABLE TO THE

(100)

4. Tax - 20% (.20) of line 3

COLORADO DEPARTMENT OF REVENUE

5. Credit claimed for taxes previously paid on products:

INCLUDE THE ACCOUNT NUMBER ON \

a. Exported from Colorado

YOUR CHECK TO ENSURE PROPER CREDIT

b. Returned to manufacturer

c. Destroyed by distributor

TOTAL (a+b+c)

(905)

TOTAL x 20% (.20)

6. Total tax due (line 4 minus line 5)

7. Deduct 3 1/3% (.0333)

(105)

(not allowed on delinquent return)

8. Total tax due

(200)

9. Penalty

(300)

10. Interest

J

(355)

11.

TOTAL DUE Add lines 8, 9 and 10

F

F

RETURN COPY BELOW - DETACH HERE

TOBACCO PRODUCTS

DR 0229 (05/01)

13

RETURN THIS COPY

COLORADO DEPARTMENT OF REVENUE

TAX RETURN

1375 SHERMAN STREET

DENVER CO 80261-0013

Account Number

Period

Due Date

0900-100

Social Security Number 1

Social Security Number 2

FEIN

1. Total gross purchases

(Manufacturer's list price)

2. Exempt sales

SIGNED UNDER PENALTY OF PERJURY IN THE SECOND DEGREE

3. Taxable amount

(line 1 minus line 2)

(100)

4. Tax - 20% (.20) of line 3

Signature

Date

Phone

5. Credit claimed for taxes previously paid on products:

Are you paying your taxes by EFT?

Yes

No

a. Exported from Colorado

b. Returned to manufacturer

c. Destroyed by distributor

TOTAL (a+b+c)

TOTAL x 20% (.20)

(905)

6. Total tax due (line 4 minus line 5)

7. Deduct 3 1/3% (.0333)

(105)

(not allowed on delinquent return)

8. Total tax due

(200)

9. Penalty

(300)

10. Interest

J

(355)

11.

TOTAL DUE Add lines 8, 9 and 10

DO NOT WRITE BELOW THIS LINE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1