Form E-554 - Consumer Use Tax Return - North Carolina Department Of Revenue

ADVERTISEMENT

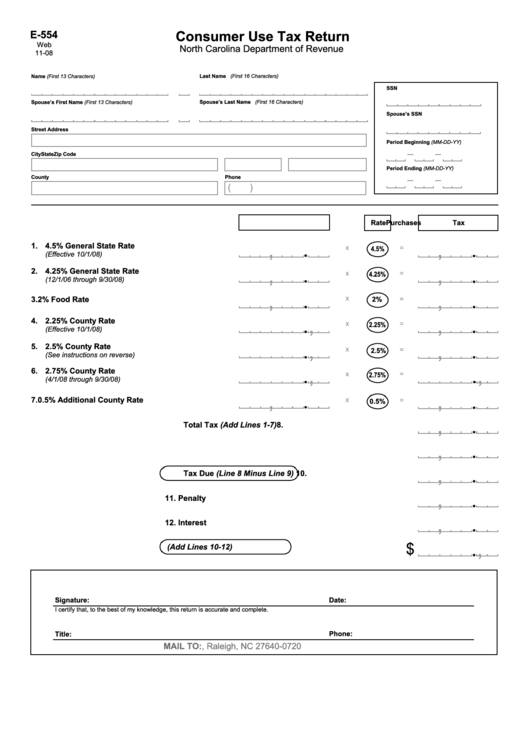

Consumer Use Tax Return

E-554

Web

North Carolina Department of Revenue

11-08

Name (First 13 Characters)

M.I.

Last Name (First 16 Characters)

SSN

Spouse’s First Name (First 13 Characters)

M.I.

Spouse’s Last Name (First 16 Characters)

Spouse’s SSN

Street Address

Period Beginning (MM-DD-YY)

City

State

Zip Code

Period Ending (MM-DD-YY)

County

Phone

(

)

Purchases

Rate

Tax

.

,

,

.

1.

4.5% General State Rate

x

=

4.5%

(Effective 10/1/08)

.

,

,

.

2.

4.25% General State Rate

x

=

4.25%

(12/1/06 through 9/30/08)

,

.

,

.

x

3. 2% Food Rate

=

2%

,

.

,

.

4.

2.25% County Rate

x

=

2.25%

(Effective 10/1/08)

,

.

,

.

5.

2.5% County Rate

x

=

2.5%

(See instructions on reverse)

,

.

,

.

6.

2.75% County Rate

x

=

2.75%

(4/1/08 through 9/30/08)

,

.

,

.

7. 0.5% Additional County Rate

x

=

0.5%

,

.

8.

Total Tax (Add Lines 1-7)

,

.

9. Credit for Sales or Use Tax Paid to Another State

,

.

10.

Tax Due (Line 8 Minus Line 9)

,

.

11. Penalty

,

.

12. Interest

,

.

$

13. Total Due (Add Lines 10-12)

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Title:

Phone:

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0720

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1