Application Opt Refund Form - Capital Tax Collection Bureau

ADVERTISEMENT

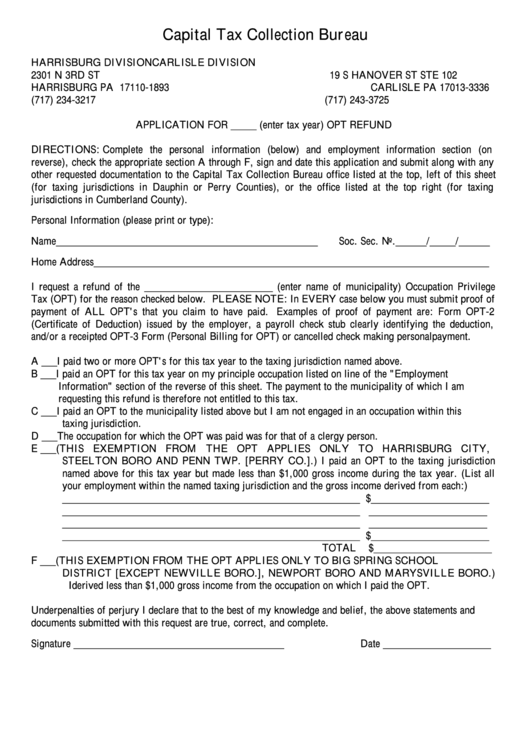

Capital Tax Collection Bureau

HARRISBURG DIVISION

CARLISLE DIVISION

2301 N 3RD ST

19 S HANOVER ST STE 102

HARRISBURG PA 17110-1893

CARLISLE PA 17013-3336

(717) 234-3217

(717) 243-3725

APPLICATION FOR _____ (enter tax year) OPT REFUND

DIRECTIONS: Complete the personal information (below) and employment information section (on

reverse), check the appropriate section A through F, sign and date this application and submit along with any

other requested documentation to the Capital Tax Collection Bureau office listed at the top, left of this sheet

(for taxing jurisdictions in Dauphin or Perry Counties), or the office listed at the top right (for taxing

jurisdictions in Cumberland County).

Personal Information (please print or type):

Name___________________________________________________

Soc. Sec. No.______/_____/______

Home Address_____________________________________________________________________________

I request a refund of the _________________________ (enter name of municipality) Occupation Privilege

Tax (OPT) for the reason checked below. PLEASE NOTE: In EVERY case below you must submit proof of

payment of ALL OPT's that you claim to have paid. Examples of proof of payment are: Form OPT-2

(Certificate of Deduction) issued by the employer, a payroll check stub clearly identifying the deduction,

and/or a receipted OPT-3 Form (Personal Billing for OPT) or cancelled check making personal payment.

A ___ I paid two or more OPT's for this tax year to the taxing jurisdiction named above.

B ___ I paid an OPT for this tax year on my principle occupation listed on line of the "Employment

Information" section of the reverse of this sheet. The payment to the municipality of which I am

requesting this refund is therefore not entitled to this tax.

C ___ I paid an OPT to the municipality listed above but I am not engaged in an occupation within this

taxing jurisdiction.

D ___ The occupation for which the OPT was paid was for that of a clergy person.

E ___ (THIS EXEMPTION FROM THE OPT APPLIES ONLY TO HARRISBURG CITY,

STEELTON BORO AND PENN TWP. [PERRY CO.].) I paid an OPT to the taxing jurisdiction

named above for this tax year but made less than $1,000 gross income during the tax year. (List all

your employment within the named taxing jurisdiction and the gross income derived from each:)

__________________________________________________________ $_______________________

__________________________________________________________ _______________________

__________________________________________________________ _______________________

__________________________________________________________ $_______________________

TOTAL

$_______________________

F ___ (THIS EXEMPTION FROM THE OPT APPLIES ONLY TO BIG SPRING SCHOOL

DISTRICT [EXCEPT NEWVILLE BORO.], NEWPORT BORO AND MARYSVILLE BORO.)

I derived less than $1,000 gross income from the occupation on which I paid the OPT.

Under penalties of perjury I declare that to the best of my knowledge and belief, the above statements and

documents submitted with this request are true, correct, and complete.

Signature _________________________________________

Date _____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2