Application For Exemption From The Local Services Tax - Pennsylvania Capital Tax Collection Bureau - 2010

ADVERTISEMENT

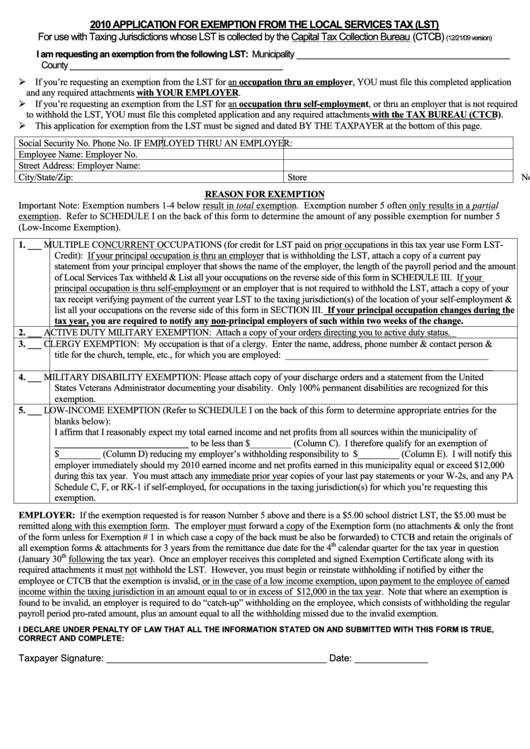

2010 APPLICATION FOR EXEMPTION FROM THE LOCAL SERVICES TAX (LST)

For use with Taxing Jurisdictions whose LST is collected by the Capital Tax Collection Bureau (CTCB)

(12/21/09 version)

I am requesting an exemption from the following LST: Municipality ______________________________________________

County ______________________________________________

If you’re requesting an exemption from the LST for an occupation thru an employer, YOU must file this completed application

and any required attachments with YOUR EMPLOYER.

If you’re requesting an exemption from the LST for an occupation thru self-employment, or thru an employer that is not required

to withhold the LST, YOU must file this completed application and any required attachments with the TAX BUREAU (CTCB).

This application for exemption from the LST must be signed and dated BY THE TAXPAYER at the bottom of this page.

Social Security No.

Phone No.

IF EMPLOYED THRU AN EMPLOYER:

Employee Name:

Employer No.

Street Address:

Employer Name:

City/State/Zip:

Store No./Location:

REASON FOR EXEMPTION

Important Note: Exemption numbers 1-4 below result in total exemption. Exemption number 5 often only results in a partial

exemption. Refer to SCHEDULE I on the back of this form to determine the amount of any possible exemption for number 5

(Low-Income Exemption).

1. ___

MULTIPLE CONCURRENT OCCUPATIONS (for credit for LST paid on prior occupations in this tax year use Form LST-

Credit): If your principal occupation is thru an employer that is withholding the LST, attach a copy of a current pay

statement from your principal employer that shows the name of the employer, the length of the payroll period and the amount

of Local Services Tax withheld & List all your occupations on the reverse side of this form in SCHEDULE III. If your

principal occupation is thru self-employment or an employer that is not required to withhold the LST, attach a copy of your

tax receipt verifying payment of the current year LST to the taxing jurisdiction(s) of the location of your self-employment &

list all your occupations on the reverse side of this form in SECTION III. If your principal occupation changes during the

tax year, you are required to notify any non-principal employers of such within two weeks of the change.

ACTIVE DUTY MILITARY EXEMPTION: Attach a copy of your orders directing you to active duty status.

2. ___

3. ___

CLERGY EXEMPTION: My occupation is that of a clergy. Enter the name, address, phone number & contact person &

title for the church, temple, etc., for which you are employed: ____________________________________________

_______________________________________________________________________________________________

4. ___

MILITARY DISABILITY EXEMPTION: Please attach copy of your discharge orders and a statement from the United

States Veterans Administrator documenting your disability. Only 100% permanent disabilities are recognized for this

exemption.

5. ___

LOW-INCOME EXEMPTION (Refer to SCHEDULE I on the back of this form to determine appropriate entries for the

blanks below):

I affirm that I reasonably expect my total earned income and net profits from all sources within the municipality of

_____________________________ to be less than $_________ (Column C). I therefore qualify for an exemption of

$_________ (Column D) reducing my employer’s withholding responsibility to $_________ (Column E). I will notify this

employer immediately should my 2010 earned income and net profits earned in this municipality equal or exceed $12,000

during this tax year. You must attach any immediate prior year copies of your last pay statements or your W-2s, and any PA

Schedule C, F, or RK-1 if self-employed, for occupations in the taxing jurisdiction(s) for which you’re requesting this

exemption.

EMPLOYER: If the exemption requested is for reason Number 5 above and there is a $5.00 school district LST, the $5.00 must be

remitted along with this exemption form. The employer must forward a copy of the Exemption form (no attachments & only the front

of the form unless for Exemption # 1 in which case a copy of the back must be also be forwarded) to CTCB and retain the originals of

th

all exemption forms & attachments for 3 years from the remittance due date for the 4

calendar quarter for the tax year in question

th

(January 30

following the tax year). Once an employer receives this completed and signed Exemption Certificate along with its

required attachments it must not withhold the LST. However, you must begin or reinstate withholding if notified by either the

employee or CTCB that the exemption is invalid, or in the case of a low income exemption, upon payment to the employee of earned

income within the taxing jurisdiction in an amount equal to or in excess of $12,000 in the tax year. Note that where an exemption is

found to be invalid, an employer is required to do “catch-up” withholding on the employee, which consists of withholding the regular

payroll period pro-rated amount, plus an amount equal to all the withholding missed due to the invalid exemption.

I DECLARE UNDER PENALTY OF LAW THAT ALL THE INFORMATION STATED ON AND SUBMITTED WITH THIS FORM IS TRUE,

CORRECT AND COMPLETE:

Taxpayer Signature: __________________________________________ Date: ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2