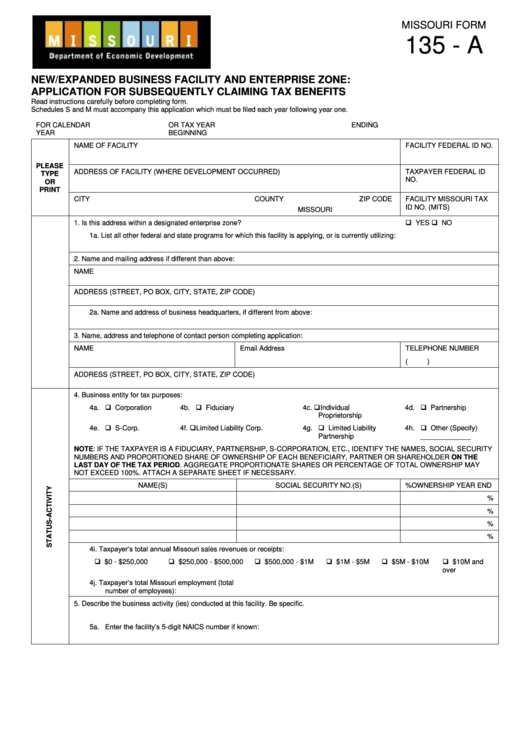

MISSOURI FORM

135 - A

NEW/EXPANDED BUSINESS FACILITY AND ENTERPRISE ZONE:

APPLICATION FOR SUBSEQUENTLY CLAIMING TAX BENEFITS

Read instructions carefully before completing form.

Schedules S and M must accompany this application which must be filed each year following year one.

FOR CALENDAR

OR TAX YEAR

ENDING

YEAR

BEGINNING

NAME OF FACILITY

FACILITY FEDERAL ID NO.

PLEASE

ADDRESS OF FACILITY (WHERE DEVELOPMENT OCCURRED)

TAXPAYER FEDERAL ID

TYPE

NO.

OR

PRINT

CITY

COUNTY

ZIP CODE

FACILITY MISSOURI TAX

ID NO. (MITS)

MISSOURI

YES NO

1.

Is this address within a designated enterprise zone?

1a. List all other federal and state programs for which this facility is applying, or is currently utilizing:

2.

Name and mailing address if different than above:

NAME

ADDRESS (STREET, PO BOX, CITY, STATE, ZIP CODE)

2a. Name and address of business headquarters, if different from above:

3.

Name, address and telephone of contact person completing application:

NAME

Email Address

TELEPHONE NUMBER

(

)

ADDRESS (STREET, PO BOX, CITY, STATE, ZIP CODE)

4.

Business entity for tax purposes:

4a. Corporation

4b. Fiduciary

4c. Individual

4d. Partnership

Proprietorship

4e. S-Corp.

Limited Liability Corp.

4g. Limited Liability

4h. Other (Specify)

4f.

Partnership

_____________

NOTE: IF THE TAXPAYER IS A FIDUCIARY, PARTNERSHIP, S-CORPORATION, ETC., IDENTIFY THE NAMES, SOCIAL SECURITY

NUMBERS AND PROPORTIONED SHARE OF OWNERSHIP OF EACH BENEFICIARY, PARTNER OR SHAREHOLDER ON THE

LAST DAY OF THE TAX PERIOD. AGGREGATE PROPORTIONATE SHARES OR PERCENTAGE OF TOTAL OWNERSHIP MAY

NOT EXCEED 100%. ATTACH A SEPARATE SHEET IF NECESSARY.

NAME(S)

SOCIAL SECURITY NO.(S)

%OWNERSHIP YEAR END

%

%

%

%

Taxpayer’s total annual Missouri sales revenues or receipts:

4i.

$0 - $250,000

$250,000 - $500,000

$500,000 - $1M

$1M - $5M

$5M - $10M

$10M and

over

Taxpayer’s total Missouri employment (total

4j.

number of employees):

5.

Describe the business activity (ies) conducted at this facility. Be specific.

5a. Enter the facility’s 5-digit NAICS number if known:

1

1 2

2 3

3