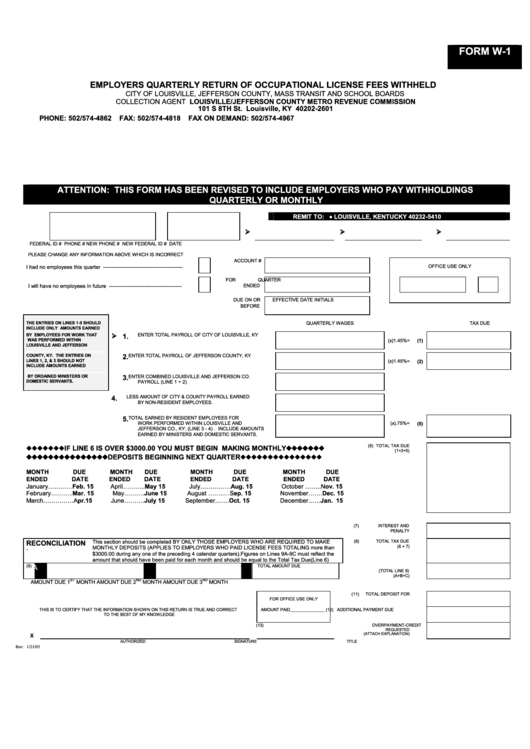

Form W-1 - Employers Quarterly Return Of Occupational License Fees Withheld

ADVERTISEMENT

FORM W-1

EMPLOYERS QUARTERLY RETURN OF OCCUPATIONAL LICENSE FEES WITHHELD

CITY OF LOUISVILLE, JEFFERSON COUNTY, MASS TRANSIT AND SCHOOL BOARDS

COLLECTION AGENT LOUISVILLE/JEFFERSON COUNTY METRO REVENUE COMMISSION

101 S 8TH St. Louisville, KY 40202-2601

PHONE: 502/574-4862

FAX: 502/574-4818

FAX ON DEMAND: 502/574-4967

ATTENTION: THIS FORM HAS BEEN REVISED TO INCLUDE EMPLOYERS WHO PAY WITHHOLDINGS

QUARTERLY OR MONTHLY

REMIT TO: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

FEDERAL ID #

PHONE #

NEW PHONE #

NEW FEDERAL ID #

DATE

PLEASE CHANGE ANY INFORMATION ABOVE WHICH IS INCORRECT

ACCOUNT #

OFFICE USE ONLY

I had no employees this quarter -----------------------------------------------

FOR QUARTER

I will have no employees in future -------------------------------------------

ENDED

DUE ON OR

EFFECTIVE DATE

INITIALS

BEFORE

THE ENTRIES ON LINES 1-5 SHOULD

QUARTERLY WAGES

TAX DUE

INCLUDE ONLY AMOUNTS EARNED

BY EMPLOYEES FOR WORK THAT

ENTER TOTAL PAYROLL OF CITY OF LOUISVILLE, KY

1.

WAS PERFORMED WITHIN

(x)1.45%=

(1)

LOUISVILLE AND JEFFERSON

COUNTY, KY. THE ENTRIES ON

2.

ENTER TOTAL PAYROLL OF JEFFERSON COUNTY, KY

LINES 1, 2, & 3 SHOULD NOT

(x)1.45%=

(2)

INCLUDE AMOUNTS EARNED

BY ORDAINED MINISTERS OR

3.

ENTER COMBINED LOUISVILLE AND JEFFERSON CO.

DOMESTIC SERVANTS.

PAYROLL (LINE 1 + 2)

LESS AMOUNT OF CITY & COUNTY PAYROLL EARNED

4.

BY NON-RESIDENT EMPLOYEES.

5.

TOTAL EARNED BY RESIDENT EMPLOYEES FOR

WORK PERFORMED WITHIN LOUISVILLE AND

(x).75%=

(5)

JEFFERSON CO., KY. (LINE 3 - 4) . INCLUDE AMOUNTS

EARNED BY MINISTERS AND DOMESTIC SERVANTS.

(6) TOTAL TAX DUE

IF LINE 6 IS OVER $3000.00 YOU MUST BEGIN MAKING MONTHLY

(1+2+5)

DEPOSITS BEGINNING NEXT QUARTER

MONTH

DUE

MONTH

DUE

MONTH

DUE

MONTH

DUE

ENDED

DATE

ENDED

DATE

ENDED

DATE

ENDED

DATE

January…………Feb. 15

April………..May 15

July……………Aug. 15

October ……..Nov. 15

February………..Mar. 15

May……….June 15

August ……..…Sep. 15

November…….Dec. 15

March……………Apr.15

June……….July 15

September…….Oct. 15

December……Jan. 15

(7)

INTEREST AND

PENALTY

RECONCILIATION

This section should be completed BY ONLY THOSE EMPLOYERS WHO ARE REQUIRED TO MAKE

(8)

TOTAL TAX DUE

(6 + 7)

MONTHLY DEPOSITS (APPLIES TO EMPLOYERS WHO PAID LICENSE FEES TOTALING more than

-

$3000.00 during any one of the preceding 4 calendar quarters).Figures on Lines 9A-9C must reflect the

amount that should have been paid for each month and should be equal to the Total Tax Due(Line 6)

(9)

A

B

C

(10)

TOTAL AMOUNT DUE

(TOTAL LINE 9)

(A+B+C)

ST

ND

RD

AMOUNT DUE 1

MONTH

AMOUNT DUE 2

MONTH

AMOUNT DUE 3

MONTH

(11)

TOTAL DEPOSIT FOR

FOR OFFICE USE ONLY

THIS IS TO CERTIFY THAT THE INFORMATION SHOWN ON THIS RETURN IS TRUE AND CORRECT

AMOUNT PAID_______________

(12) ADDITIONAL PAYMENT DUE

TO THE BEST OF MY KNOWLEDGE

(13) OVERPAYMENT-CREDIT

REQUESTED

(ATTACH EXPLANATION)

X

AUTHORIZED SIGNATURE

TITLE

Rev: 1/21/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1