PRINT

CLEAR

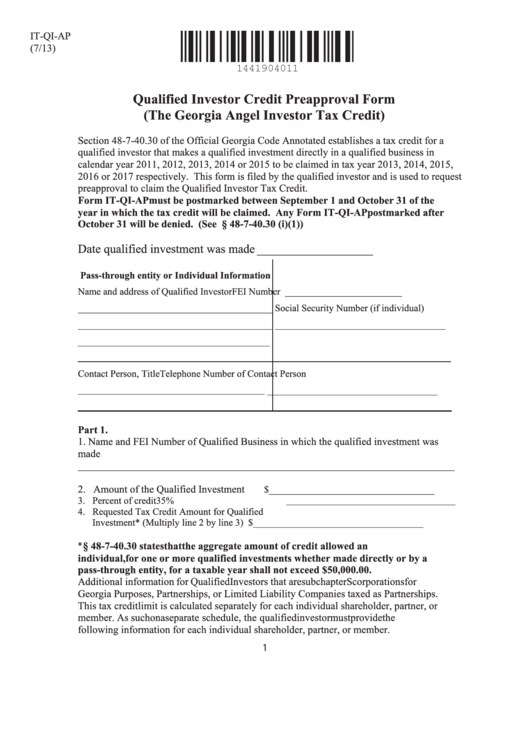

IT-QI-AP

(7/13)

Qualified Investor Credit Preapproval Form

(The Georgia Angel Investor Tax Credit)

Section 48-7-40.30 of the Official Georgia Code Annotated establishes a tax credit for a

qualified investor that makes a qualified investment directly in a qualified business in

calendar year 2011, 2012, 2013, 2014 or 2015 to be claimed in tax year 2013, 2014, 2015,

2016 or 2017 respectively. This form is filed by the qualified investor and is used to request

preapproval to claim the Qualified Investor Tax Credit.

Form IT-QI-AP must be postmarked between September 1 and October 31 of the

year in which the tax credit will be claimed. Any Form IT-QI-AP postmarked after

October 31 will be denied. (See O.C.G.A. § 48-7-40.30 (i)(1))

Date qualified investment was made __________________

Pass-through entity or Individual Information

Name and address of Qualified Investor

FEI Number ________________________

________________________________________

Social Security Number (if individual)

________________________________________

___________________________________

Contact Person, Title

Telephone Number of Contact Person

___________________________________

Part 1.

1. Name and FEI Number of Qualified Business in which the qualified investment was

made

________________________________________________________________________

2. Amount of the Qualified Investment

$__________________________________

3. Percent of credit

35%

4. Requested Tax Credit Amount for Qualified

Investment* (Multiply line 2 by line 3)

$___________________________________

*O.C.G.A. § 48-7-40.30 states that the aggregate amount of credit allowed an

individual, for one or more qualified investments whether made directly or by a

pass-through entity, for a taxable year shall not exceed $50,000.00.

Additional information for Qualified Investors that are subchapter S corporations for

Georgia Purposes, Partnerships, or Limited Liability Companies taxed as Partnerships.

This tax credit limit is calculated separately for each individual shareholder, partner, or

member. As such on a separate schedule, the qualified investor must provide the

following information for each individual shareholder, partner, or member.

1

1

1 2

2 3

3 4

4