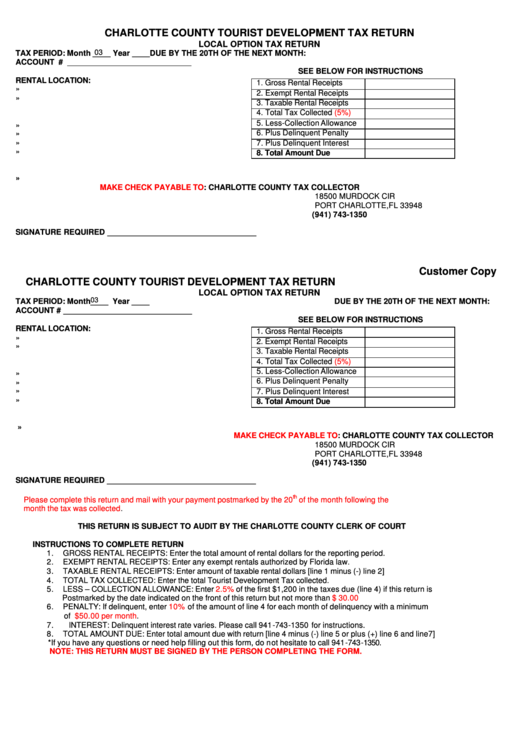

CHARLOTTE COUNTY TOURIST DEVELOPMENT TAX RETURN

LOCAL OPTION TAX RETURN

03

TAX PERIOD: Month ____ Year ____

DUE BY THE 20TH OF THE NEXT MONTH:

ACCOUNT # ____________________________

SEE BELOW FOR INSTRUCTIONS

RENTAL LOCATION:

1. Gross Rental Receipts

»

2. Exempt Rental Receipts

»

3. Taxable Rental Receipts

4. Total Tax Collected

(5%)

5. Less-Collection Allowance

»

6. Plus Delinquent Penalty

»

»

7. Plus Delinquent Interest

»

8. Total Amount Due

»

MAKE CHECK PAYABLE

TO: CHARLOTTE COUNTY TAX COLLECTOR

18500 MURDOCK CIR

PORT CHARLOTTE,FL 33948

(941) 743-1350

SIGNATURE REQUIRED __________________________________

Customer Copy

CHARLOTTE COUNTY TOURIST DEVELOPMENT TAX RETURN

LOCAL OPTION TAX RETURN

03

TAX PERIOD: Month____ Year ____

DUE BY THE 20TH OF THE NEXT MONTH:

ACCOUNT # _____________________________

SEE BELOW FOR INSTRUCTIONS

RENTAL LOCATION:

1. Gross Rental Receipts

»

2. Exempt Rental Receipts

»

3. Taxable Rental Receipts

4. Total Tax Collected

(5%)

5. Less-Collection Allowance

»

6. Plus Delinquent Penalty

»

»

7. Plus Delinquent Interest

»

8. Total Amount Due

»

MAKE CHECK PAYABLE

TO: CHARLOTTE COUNTY TAX COLLECTOR

18500 MURDOCK CIR

PORT CHARLOTTE,FL 33948

(941) 743-1350

SIGNATURE REQUIRED __________________________________

th

Please complete this return and mail with your payment postmarked by the 20

of the month following the

month the tax was

collected.

THIS RETURN IS SUBJECT TO AUDIT BY THE CHARLOTTE COUNTY CLERK OF COURT

INSTRUCTIONS TO COMPLETE RETURN

1.

GROSS RENTAL RECEIPTS: Enter the total amount of rental dollars for the reporting period.

2.

EXEMPT RENTAL RECEIPTS: Enter any exempt rentals authorized by Florida law.

3.

TAXABLE RENTAL RECEIPTS: Enter amount of taxable rental dollars [line 1 minus (-) line 2]

4.

TOTAL TAX COLLECTED: Enter the total Tourist Development Tax collected.

5.

LESS – COLLECTION ALLOWANCE: Enter

2.5%

of the first $1,200 in the taxes due (line 4) if this return is

Postmarked by the date indicated on the front of this return but not more than

$ 30.00

6.

PENALTY: If delinquent, enter

10%

of the amount of line 4 for each month of delinquency with a minimum

of

$50.00 per

month.

7.

INTEREST: Delinquent interest rate varies. Please call 941-743-1350 for instructions.

8.

TOTAL AMOUNT DUE: Enter total amount due with return [line 4 minus (-) line 5 or plus (+) line 6 and line7]

*If you have any questions or need help filling out this form, do not hesitate to call 941-743-1350.

NOTE: THIS RETURN MUST BE SIGNED BY THE PERSON COMPLETING THE FORM.

1

1 2

2