Form Rct-121 - Gross Premium Tax - 2007

ADVERTISEMENT

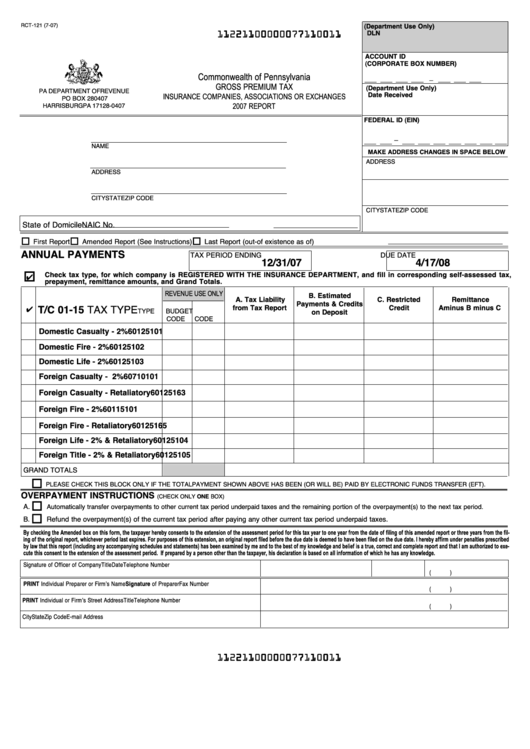

RCT-121 (7-07)

(Department Use Only)

1 1 2 2 1 1 0 0 0 0 0 0 7 7 1 1 0 0 1 1

DLN

ACCOUNT ID

(CORPORATE BOX NUMBER)

Commonwealth of Pennsylvania

_

GROSS PREMIUM TAX

(Department Use Only)

PA DEPARTMENT OF REVENUE

Date Received

INSURANCE COMPANIES, ASSOCIATIONS OR EXCHANGES

PO BOX 280407

HARRISBURG PA 17128-0407

2007 REPORT

FEDERAL ID (EIN)

_

NAME

MAKE ADDRESS CHANGES IN SPACE BELOW

ADDRESS

ADDRESS

CITY

STATE

ZIP CODE

CITY

STATE

ZIP CODE

State of Domicile

NAIC No.

First Report

Amended Report (See Instructions)

Last Report (out-of existence as of

)

ANNUAL PAYMENTS

TAX PERIOD ENDING

DUE DATE

12/31/07

4/17/08

Check tax type, for which company is REGISTERED WITH THE INSURANCE DEPARTMENT, and fill in corresponding self-assessed tax,

prepayment, remittance amounts, and Grand Totals.

REVENUE USE ONLY

B. Estimated

A. Tax Liability

C. Restricted

Remittance

Payments & Credits

from Tax Report

Credit

A minus B minus C

T/C 01-15 TAX TYPE

TYPE

BUDGET

on Deposit

CODE

CODE

Domestic Casualty - 2%

60

125101

Domestic Fire - 2%

60

125102

Domestic Life - 2%

60

125103

Foreign Casualty - 2%

60

710101

Foreign Casualty - Retaliatory

60

125163

Foreign Fire - 2%

60

115101

Foreign Fire - Retaliatory

60

125165

Foreign Life - 2% & Retaliatory

60

125104

Foreign Title - 2% & Retaliatory

60

125105

GRAND TOTALS

PLEASE CHECK THIS BLOCK ONLY IF THE TOTAL PAYMENT SHOWN ABOVE HAS BEEN (OR WILL BE) PAID BY ELECTRONIC FUNDS TRANSFER (EFT).

OVERPAYMENT INSTRUCTIONS

(CHECK ONLY ONE BOX)

A.

Automatically transfer overpayments to other current tax period underpaid taxes and the remaining portion of the overpayment(s) to the next tax period.

B.

Refund the overpayment(s) of the current tax period after paying any other current tax period underpaid taxes.

By checking the Amended box on this form, the taxpayer hereby consents to the extension of the assessment period for this tax year to one year from the date of filing of this amended report or three years from the fil-

ing of the original report, whichever period last expires. For purposes of this extension, an original report filed before the due date is deemed to have been filed on the due date. I hereby affirm under penalties prescribed

by law that this report (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is a true, correct and complete report and that I am authorized to exe-

cute this consent to the extension of the assessment period. If prepared by a person other than the taxpayer, his declaration is based on all information of which he has any knowledge.

Signature of Officer of Company

Title

Date

Telephone Number

(

)

PRINT Individual Preparer or Firm’s Name

Signature of Preparer

Fax Number

(

)

PRINT Individual or Firm’s Street Address

Title

Telephone Number

(

)

City

State

Zip Code

E-mail Address

1 1 2 2 1 1 0 0 0 0 0 0 7 7 1 1 0 0 1 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4