Form Reg-1 - Connecticut

ADVERTISEMENT

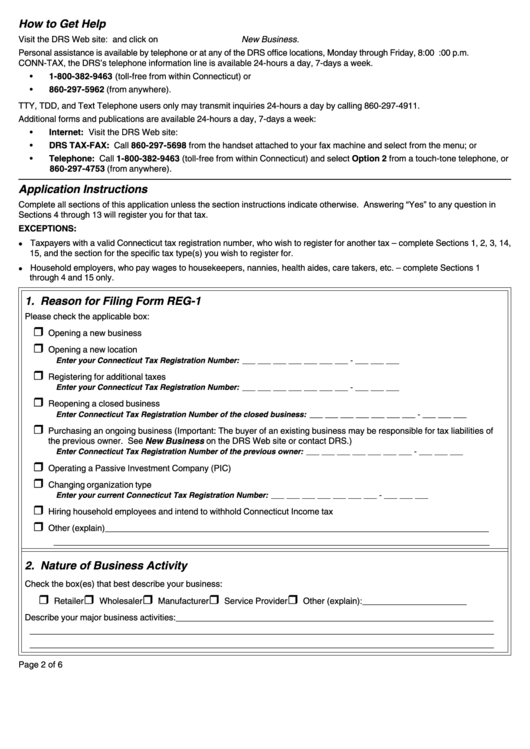

How to Get Help

Visit the DRS Web site: and click on New Business.

Personal assistance is available by telephone or at any of the DRS office locations, Monday through Friday, 8:00 a.m. to 5:00 p.m.

CONN-TAX, the DRS’s telephone information line is available 24-hours a day, 7-days a week.

•

1-800-382-9463 (toll-free from within Connecticut) or

•

860-297-5962 (from anywhere).

TTY, TDD, and Text Telephone users only may transmit inquiries 24-hours a day by calling 860-297-4911.

Additional forms and publications are available 24-hours a day, 7-days a week:

•

Internet: Visit the DRS Web site:

•

DRS TAX-FAX: Call 860-297-5698 from the handset attached to your fax machine and select from the menu; or

•

Telephone: Call 1-800-382-9463 (toll-free from within Connecticut) and select Option 2 from a touch-tone telephone, or

860-297-4753 (from anywhere).

Application Instructions

Complete all sections of this application unless the section instructions indicate otherwise. Answering “Yes” to any question in

Sections 4 through 13 will register you for that tax.

EXCEPTIONS:

Taxpayers with a valid Connecticut tax registration number, who wish to register for another tax – complete Sections 1, 2, 3, 14,

15, and the section for the specific tax type(s) you wish to register for.

Household employers, who pay wages to housekeepers, nannies, health aides, care takers, etc. – complete Sections 1

through 4 and 15 only.

1. Reason for Filing Form REG-1

Please check the applicable box:

Opening a new business

Opening a new location

Enter your Connecticut Tax Registration Number: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Registering for additional taxes

Enter your Connecticut Tax Registration Number: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Reopening a closed business

Enter Connecticut Tax Registration Number of the closed business: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Purchasing an ongoing business (Important: The buyer of an existing business may be responsible for tax liabilities of

the previous owner. See New Business on the DRS Web site or contact DRS.)

Enter Connecticut Tax Registration Number of the previous owner: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Operating a Passive Investment Company (PIC)

Changing organization type

Enter your current Connecticut Tax Registration Number: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Hiring household employees and intend to withhold Connecticut Income tax

Other (explain) _________________________________________________________________________________

____________________________________________________________________________________________

2. Nature of Business Activity

Check the box(es) that best describe your business:

Retailer

Wholesaler

Manufacturer

Service Provider

Other (explain): ______________________

Describe your major business activities: ___________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

Page 2 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5