Form Reg-1 - Business Taxes Registration Application

ADVERTISEMENT

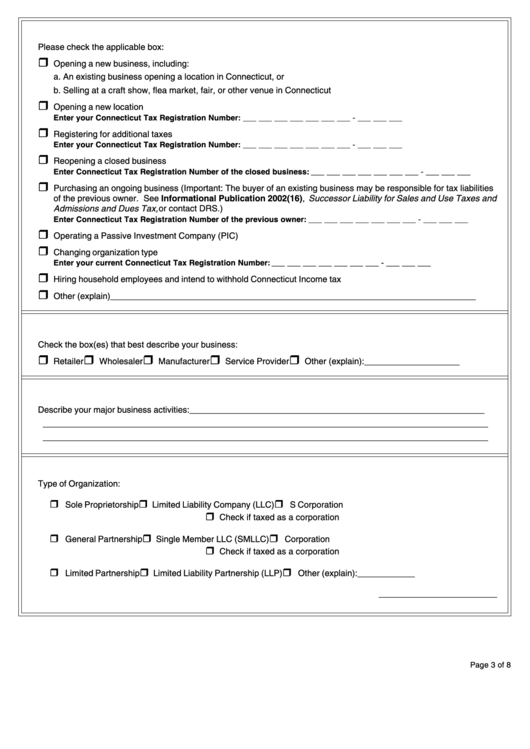

1. Reason for Filing Form REG-1

Please check the applicable box:

Opening a new business, including:

a. An existing business opening a location in Connecticut, or

b. Selling at a craft show, flea market, fair, or other venue in Connecticut

Opening a new location

Enter your Connecticut Tax Registration Number: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Registering for additional taxes

Enter your Connecticut Tax Registration Number: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Reopening a closed business

Enter Connecticut Tax Registration Number of the closed business: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Purchasing an ongoing business (Important: The buyer of an existing business may be responsible for tax liabilities

of the previous owner. See Informational Publication 2002(16), Successor Liability for Sales and Use Taxes and

Admissions and Dues Tax, or contact DRS.)

Enter Connecticut Tax Registration Number of the previous owner: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Operating a Passive Investment Company (PIC)

Changing organization type

Enter your current Connecticut Tax Registration Number: ___ ___ ___ ___ ___ ___ ___ - ___ ___ ___

Hiring household employees and intend to withhold Connecticut Income tax

Other (explain) _____________________________________________________________________________

2. Nature of Business Activity

Check the box(es) that best describe your business:

Retailer

Wholesaler

Manufacturer

Service Provider

Other (explain): ____________________

3. Major Business Activity

Describe your major business activities: ______________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

4. Business Information

Type of Organization:

Sole Proprietorship

Limited Liability Company (LLC)

S Corporation

Check if taxed as a corporation

General Partnership

Single Member LLC (SMLLC)

Corporation

Check if taxed as a corporation

Limited Partnership

Limited Liability Partnership (LLP)

Other (explain): ____________

_________________________

Page 3 of 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6