Private tenants who change address

For some private tenants who change address, we will work out their claims for Housing Benefit under a new system

known as Local Housing Allowance (LHA).

Local Housing Allowance will not apply to you if:

• you pay rent to the council or to a registered social landlord;

• your rent is registered as a fair rent;

• you have a tenancy that is not included in the current Housing Benefit rent restrictions (such as tenancies

that began before 1989);

• the Valuation Office has decided that a large part of the rent you pay includes board and meals (such as

hotel accommodation); or

• you live in a caravan, mobile home, hostel or houseboat.

If you do not know whether Local Housing Allowance applies to you, please call us on 020 8356 3399 for advice.

Under this new scheme, you will receive a standard amount of Local Housing Allowance based on the size of your

household and the area you live in. We will publish these allowances beforehand so that you can find out how much

you could receive before you rent a property.

We normally pay Housing Benefit straight into your bank or building society account. If you think that having your

Local Housing Allowance paid into your bank or building society account will cause you serious problems, we may

be able to pay your LHA to your landlord. We will need to decide if you are having, or are likely to have, problems

managing your money and paying your rent. Please contact our benefit call centre on 020 83563399 for more

information and advice, and ask for a ‘Payment direct to landlord form’

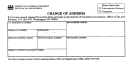

Part 1 About you and your partner

Do you have a partner who

No

normally lives with you?

Yes

If you have a partner you must answer all the questions about them.

You

Your partner

Last name or family name

Other names

Title (Mr, Mrs, Ms and so on)

Your old address with postcode

Date of birth

/

/

/

/

Letter Letters Numbers

Letter

Letters Numbers

National Insurance number

You can find this on your payslips or

letters from social security or the tax

office. We cannot normally decide

your claim if we do not have your

National Insurance number.

Your daytime phone number

You do not have to tell us this,

but it may help us to deal with

your claim more quickly.

Email address

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16