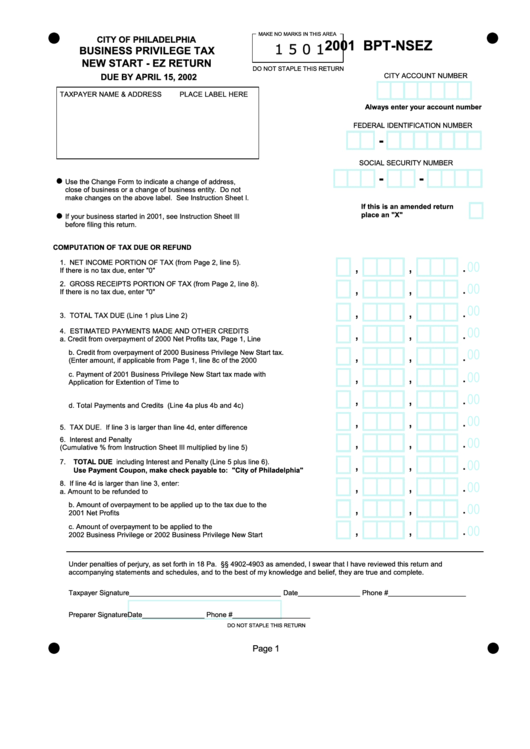

Form Bpt-Nsez - Business Privilege Tax - 2001

ADVERTISEMENT

MAKE NO MARKS IN THIS AREA

CITY OF PHILADELPHIA

2001 BPT-NSEZ

1 5 0 1

BUSINESS PRIVILEGE TAX

NEW START - EZ RETURN

DO NOT STAPLE THIS RETURN

CITY ACCOUNT NUMBER

DUE BY APRIL 15, 2002

TAXPAYER NAME & ADDRESS

PLACE LABEL HERE

Always enter your account number

FEDERAL IDENTIFICATION NUMBER

-

SOCIAL SECURITY NUMBER

-

-

Use the Change Form to indicate a change of address,

close of business or a change of business entity. Do not

make changes on the above label. See Instruction Sheet I.

If this is an amended return

place an "X" here.......................

If your business started in 2001, see Instruction Sheet III

before filing this return.

COMPUTATION OF TAX DUE OR REFUND

1. NET INCOME PORTION OF TAX (from Page 2, line 5).

00

,

,

.

If there is no tax due, enter "0"..................................................................................1.

2. GROSS RECEIPTS PORTION OF TAX (from Page 2, line 8).

00

,

,

.

If there is no tax due, enter "0"................................................................................. 2.

00

,

,

.

3. TOTAL TAX DUE (Line 1 plus Line 2).......................................................................3.

00

,

,

.

4. ESTIMATED PAYMENTS MADE AND OTHER CREDITS

a. Credit from overpayment of 2000 Net Profits tax, Page 1, Line 12b....................4a.

00

b. Credit from overpayment of 2000 Business Privilege New Start tax.

,

,

.

(Enter amount, if applicable from Page 1, line 8c of the 2000 BPT-NSEZ...........4b.

00

,

,

.

c. Payment of 2001 Business Privilege New Start tax made with

Application for Extention of Time to File..............................................................4c.

00

,

,

.

d. Total Payments and Credits (Line 4a plus 4b and 4c)........................................4d.

00

,

,

.

5. TAX DUE. If line 3 is larger than line 4d, enter difference here.................................5.

,

,

.

00

6. Interest and Penalty

(Cumulative % from Instruction Sheet III multiplied by line 5)....................................6.

,

,

.

00

7. TOTAL DUE including Interest and Penalty (Line 5 plus line 6).

Use Payment Coupon, make check payable to: "City of Philadelphia"..............7.

,

,

.

00

8. If line 4d is larger than line 3, enter:

a. Amount to be refunded to taxpayer.....................................................................8a.

b. Amount of overpayment to be applied up to the tax due to the

,

,

.

00

2001 Net Profits tax.............................................................................................8b.

,

,

.

c. Amount of overpayment to be applied to the

00

2002 Business Privilege or 2002 Business Privilege New Start tax......................8c.

Under penalties of perjury, as set forth in 18 Pa. C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return and

accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature_______________________________________

Date________________ Phone #____________________

Preparer Signature

Date________________ Phone #____________________

DO NOT STAPLE THIS RETURN

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2