Form Bpt-Ez - Business Privilege Tax - 2004

ADVERTISEMENT

MAKE NO MARKS IN THIS AREA

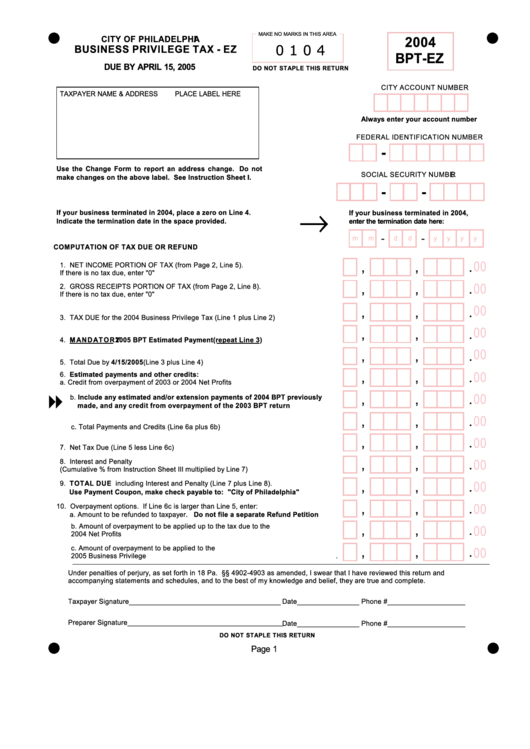

CITY OF PHILADELPHIA

2004

0 1 0 4

BUSINESS PRIVILEGE TAX - EZ

BPT-EZ

DUE BY APRIL 15, 2005

DO NOT STAP LE THIS RETURN

CITY ACCOUNT NUMBER

TAXPA Y ER NAME & A DDRESS

PLACE LA BEL HERE

Always enter your account number

FEDERA L IDENTIFICA TION NUMB ER

-

Us e the Change Form to report an address change. Do not

SOCIA L SECURITY NUMBER

make changes on the above label. See Instruction Sheet I.

-

-

→

If your business terminated in 2004, place a zero on Line 4.

If your business terminated in 2004,

Indicate the termination date in the space provided.

enter the termination date here:

-

-

m

m

d

d

y

y

y

y

COM PUTATION OF TAX DUE OR REFUND

00

,

,

.

1. NE T INCOME PORTION OF TA X (from Page 2, Line 5).

If there is no tax due, enter "0"............................ ............... ............... ............... ............1.

00

,

,

.

2. GROSS RECEIPTS PORTION OF TA X (from Page 2, Line 8).

If there is no tax due, enter "0"............................ ............... ............... ............... ........... 2.

00

,

,

.

3. TA X DUE f or the 2004 Business Privilege Tax (Line 1 plus Line 2)................... ...........3.

00

,

,

.

4. M ANDATORY 2005 BPT Es timated Payment (repeat Line 3)....................... ............4.

00

,

,

.

5. Total Due by 4/15/2005 (Line 3 plus Line 4)............... ............... ............... ............... .....5.

00

,

,

.

6. Es timated payments and other credits:

a. Credit f rom overpayment of 2003 or 2004 Net Prof its Tax................ ............... .......6a.

00

,

,

.

b. Include any estimated and/or extension payments of 2004 BPT previously

made, and any credit from overpayment of the 2003 BPT return.................. ...6b.

00

,

,

.

c. Total Payments and Credits (Line 6a plus 6b)........................ ............... ............... .6c.

,

,

.

00

7. Net Tax Due (Line 5 less Line 6c)....................... ............... .............................. ............7.

,

,

.

00

8. Interest and Penalty

(Cumulative % from Instruction Sheet III multiplied by Line 7)................. ............... .....8.

,

,

.

00

9. TOTAL DUE including Interest and Penalty (Line 7 plus Line 8).

Use Payment Coupon, make check payable to: "City of Philadelphia".................9.

,

,

.

00

10. Overpayment options. If Line 6c is larger than Line 5, enter:

a. A mount to be ref unded to taxpayer. Do not file a separate Re fund Petition....10a.

,

,

.

b. A mount of overpayment to be applied up to the tax due to the

00

2004 Net P rofits tax.................... ............... ............... ............... ............... .............10b.

,

,

.

c. Amount of overpayment to be applied to the

00

2005 Business Privilege tax............................ ............... ............... ............... ........10c.

Under penalties of perjury, as set forth in 18 Pa. C.S . §§ 4902-4903 as amended, I swear that I have reviewed this return and

accompanying statements and schedules, and to the best of my knowledge and belief , they are true and complete.

Taxpayer Signature_______________________________________

Date________________ Phone #____________________

Preparer Signature________________________________________ Date________________ Phone #____________________

DO NOT STAPLE THIS RETURN

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2