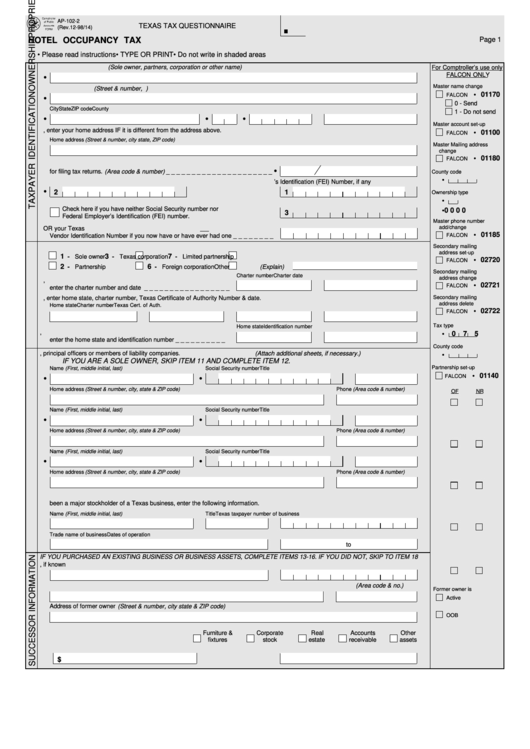

AP-102-2

TEXAS TAX QUESTIONNAIRE

(Rev.12-98/14)

Page 1

HOTEL OCCUPANCY TAX

• Please read instructions

• TYPE OR PRINT

• Do not write in shaded areas

1. Legal name of owner (Sole owner, partners, corporation or other name)

For Comptroller’s use only

FALCON ONLY

Master name change

2. Mailing address (Street & number, P.O. Box or rural route and box number)

• 01170

FALCON

0 - Send

City

State

ZIP code

County

1 - Do not send

Master account set-up

3. If you are a sole owner, enter your home address IF it is different from the address above.

• 01100

FALCON

Home address (Street & number, city state, ZIP code)

Master Mailing address

change

• 01180

FALCON

3a. Enter the phone number of the person primarily responsible

for filing tax returns. (Area code & number) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

County code

•

5. Federal Employer’s Identification (FEI) Number, if any

4. Social Security number if you are a sole owner

2

1

Ownership type

•

Check here if you have neither Social Security number nor

• 0 0 0 0

3

Federal Employer’s Identification (FEI) number.

Master phone number

add/change

6. Enter your taxpayer number for reporting any Texas tax OR your Texas

• 01185

Vendor Identification Number if you now have or have ever had one _ _ _ _ _ _ _ _

FALCON

7. Indicate how your business is owned.

Secondary mailing

address set-up

1

3

7

- Sole owner

- Texas corporation

- Limited partnership

• 02720

FALCON

2

6

- Partnership

- Foreign corporation

Other (Explain)

Secondary mailing

Charter number

Charter date

address change

8. If your business is a Texas corporation,

• 02721

FALCON

enter the charter number and date _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Secondary mailing

9. If your business is a foreign corporation, enter home state, charter number, Texas Certificate of Authority Number & date.

address delete

Home state

Charter number

Texas Cert. of Auth. no.

Cert. of Auth. date

• 02722

FALCON

Tax type

Home state

Identification number

10. If your business is a limited partnership,

•

0 7 5

enter the home state and identification number _ _ _ _ _ _ _ _ _ _

County code

11. List all general partners, principal officers or members of liability companies. (Attach additional sheets, if necessary.)

•

IF YOU ARE A SOLE OWNER, SKIP ITEM 11 AND COMPLETE ITEM 12.

Partnership set-up

Name (First, middle initial, last)

Social Security number

Title

• 01140

FALCON

Home address (Street & number, city, state & ZIP code)

Phone (Area code & number)

OF

NR

Name (First, middle initial, last)

Social Security number

Title

Home address (Street & number, city, state & ZIP code)

Phone (Area code & number)

Name (First, middle initial, last)

Social Security number

Title

Home address (Street & number, city, state & ZIP code)

Phone (Area code & number)

12. If you or any individual named in Item 11 have ever been in business or owned another hotel in Texas as sole owner or general partner or

been a major stockholder of a Texas business, enter the following information.

Name (First, middle initial, last)

Title

Texas taxpayer number of business

Trade name of business

Dates of operation

to

IF YOU PURCHASED AN EXISTING BUSINESS OR BUSINESS ASSETS, COMPLETE ITEMS 13-16. IF YOU DID NOT, SKIP TO ITEM 18

13. Trade name of former owner

Taxpayer number of former owner, if known

14. Legal name of former owner

Phone (Area code & no.)

Former owner is

Active

Address of former owner (Street & number, city state & ZIP code)

OOB

Furniture &

Corporate

Real

Accounts

Other

15. Check each of the following items you purchased.

fixtures

stock

estate

receivable

assets

16. Purchase price of the business or assets purchased.

Date of purchase.

$

1

1 2

2