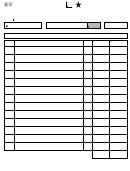

AP-102-3

TEXAS TAX QUESTIONNAIRE

(Rev.12-98/14)

Page 2

HOTEL OCCUPANCY TAX

• Please read instructions

• TYPE OR PRINT

• Do not write in shaded areas

17. Legal name of owner (Same as Item 1)

For Comptroller’s use only

18. Trade name of your business (Actual name under which you operate)

Business phone (Area code & no.)

FEEAPP

Job name

00991

19. Location of your business (Use street & no.or directions - NOT P.O. Box or Rural Route no.)

Fee type/reason

7 5 2 0

City

State

ZIP code

County

Reference number

ITEMS 20-28 REFER TO THE LOCATION AND CITY NAMED IN ITEM 19

20. Is this location inside the city limits? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO If “YES,” leave Item 21 blank.

Outlet/location set-up

• 01300

FALCON

21 Is this location engaged in business in cities that collect Texas Local Sales and Use Tax? _ _ _ _ _ _ _ _ _ _

YES

NO

22. Is this location in a Metropolitan Transit Authority (MTA)/City Transit Department (CTD)?

_ _ _ _ _ _ _ _ _ _

YES

NO

Outlet number

23. For this location, list any MTA(s) or CTD(s) in which you are engaged in business.

•

24. If this location is in an MTA/CTD, will you be shipping outside the MTA/CTD?

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

County code

•

25 Is this location engaged in business in counties other than the county named in Item 19

that collect Texas county sales and use tax?

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

Jurisdiction code

26. Is this location engaged in business in other counties that impose Texas county tax?

_ _ _ _ _ _ _ _ _ _ _ _

YES

NO

City

MTA/CTD

•

•

27. Is this location in a Special Purpose District?

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

YES

NO

CNTY

SPD

28. For this location, list all SPD(s) in which you are engaged in business.

•

•

Business code

29. Describe your Texas business and the goods or services you sell.

•

30. Enter the date you began operation of this hotel/motel. (Month, day, year) _ _ _ _ _ _ _ _ _

XAPERM

First rental date

31. Enter the number of rentable rooms in this hotel/motel. (See instructions.) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

mm

dd

yyyy

•

32. Do you own or rent/lease the real property at this location? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

OWN

RENT/LEASE

If you rent or lease the real property, enter the property owner’s name and address.

Number of rooms

Property owner’s name

•

Filing type

Property owner’s address

•

Sole owner, all general partners or corporation president, vice-president, secretary or treasurer must sign this application.

(Attach additional sheets if necessary.)

Date of application

33. I (We) declare that the information in this document and any attachments is true and correct to the best of my (our) knowledge and belief.

Type or print name of sole owner, partner, officer or member

Sole owner, partner or officer

sign

here

Type or print name of partner or officer

Partner or officer

sign

here

Type or print name of partner or officer

Partner or officer

sign

here

Field office

COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Enforcement officer

Number

Austin, Texas 78774-0100

Date

1

1 2

2