Instructions

What is the Lodging Facility Use Tax?

Montana has collected a lodging tax since 1987. People who stay in Montana lodging facilities

must pay a tax on the lodging charge. The tax is known as the Lodging Facility Use Tax (also

known as the “bed” tax or “accommodations” tax). The tax rate is 4%.

Businesses who provide the lodging must collect the tax and forward it to the Department of

Revenue on a quarterly basis. Proceeds from the tax are transferred to the Montana Heritage

Commission for the preservation of its historic properties; the university system for a Montana

travel research program; the Department of Fish, Wildlife and Parks for the maintenance of

facilities in state parks; the Montana Historical Society for signage and maintenance of historic

sites; and the Department of Commerce for tourism promotion and for the promotion of Montana

as a location for the production of motion pictures and television commercials.

What is the Lodging Facility Sales and Use Tax?

In June of 2003, an additional 3% sales and use tax was enacted to provide additional revenue

to the state general fund. A vendor allowance was enacted to effect the timely collection of the

sales and use tax.Combined, there is now a total of 7% tax on accommodations in the State of

Montana.

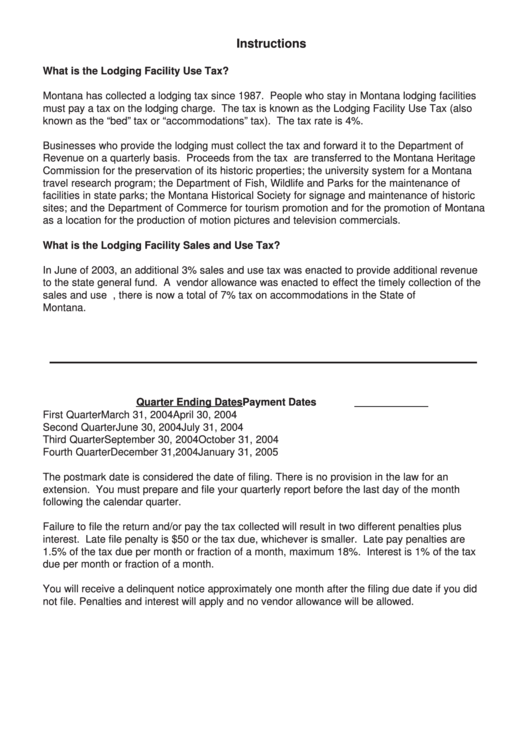

Quarter Ending Dates

Payment Dates

First Quarter

March 31, 2004

April 30, 2004

Second Quarter

June 30, 2004

July 31, 2004

Third Quarter

September 30, 2004

October 31, 2004

Fourth Quarter

December 31,2004

January 31, 2005

The postmark date is considered the date of filing. There is no provision in the law for an

extension. You must prepare and file your quarterly report before the last day of the month

following the calendar quarter.

Failure to file the return and/or pay the tax collected will result in two different penalties plus

interest. Late file penalty is $50 or the tax due, whichever is smaller. Late pay penalties are

1.5% of the tax due per month or fraction of a month, maximum 18%. Interest is 1% of the tax

due per month or fraction of a month.

You will receive a delinquent notice approximately one month after the filing due date if you did

not file. Penalties and interest will apply and no vendor allowance will be allowed.

1

1 2

2