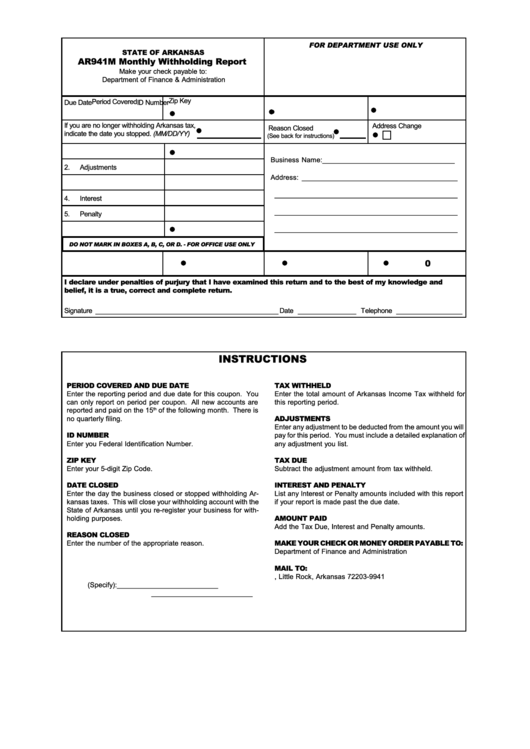

FOR DEPARTMENT USE ONLY

STATE OF ARKANSAS

AR941M Monthly Withholding Report

Make your check payable to:

Department of Finance & Administration

Zip Key

Period Covered

Due Date

ID Number

If you are no longer withholding Arkansas tax,

Address Change

Reason Closed

indicate the date you stopped. (MM/DD/YY)

(See back for instructions)

1.

Tax Withheld

Business Name: __________________________________

2.

Adjustments

Address: ________________________________________

3.

Tax Due

_______________________________________________

4.

Interest

_______________________________________________

5.

Penalty

_______________________________________________

6.

Amount Paid

DO NOT MARK IN BOXES A, B, C, OR D. - FOR OFFICE USE ONLY

0

A.

B.

C.

D.

I declare under penalties of purjury that I have examined this return and to the best of my knowledge and

belief, it is a true, correct and complete return.

Signature _______________________________________________ Date _______________ Telephone _________________

INSTRUCTIONS

PERIOD COVERED AND DUE DATE

TAX WITHHELD

Enter the reporting period and due date for this coupon. You

Enter the total amount of Arkansas Income Tax withheld for

can only report on period per coupon. All new accounts are

this reporting period.

reported and paid on the 15

th

of the following month. There is

ADJUSTMENTS

no quarterly filing.

Enter any adjustment to be deducted from the amount you will

ID NUMBER

pay for this period. You must include a detailed explanation of

Enter you Federal Identification Number.

any adjustment you list.

ZIP KEY

TAX DUE

Enter your 5-digit Zip Code.

Subtract the adjustment amount from tax withheld.

DATE CLOSED

INTEREST AND PENALTY

Enter the day the business closed or stopped withholding Ar-

List any Interest or Penalty amounts included with this report

kansas taxes. This will close your withholding account with the

if your report is made past the due date.

State of Arkansas until you re-register your business for with-

AMOUNT PAID

holding purposes.

Add the Tax Due, Interest and Penalty amounts.

REASON CLOSED

MAKE YOUR CHECK OR MONEY ORDER PAYABLE TO:

Enter the number of the appropriate reason.

1. Business discontinued.

Department of Finance and Administration

2. Business transferred to successor.

MAIL TO:

3. Change in organization.

4. Discharged all employee but continuing business.

P.O. Box 9941, Little Rock, Arkansas 72203-9941

5. Other. (Specify): __________________________

__________________________

1

1