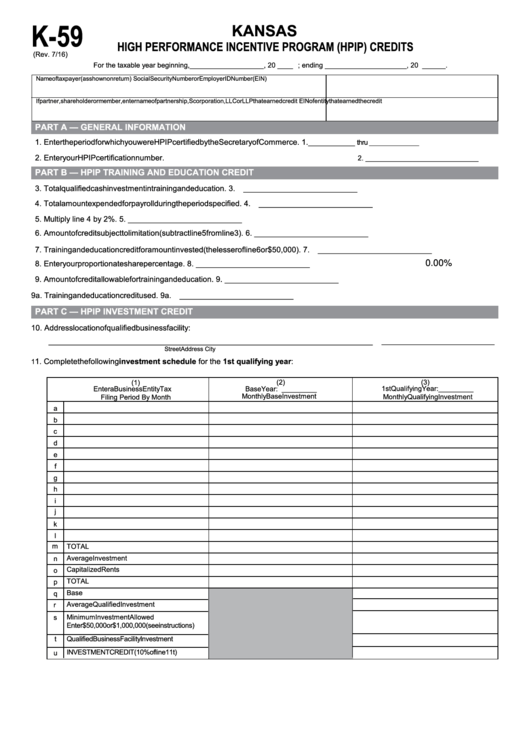

K-59

KANSAS

HIGH PERFORMANCE INCENTIVE PROGRAM (HPIP) CREDITS

(Rev. 7/16)

For the taxable year beginning,___________________ , 20 ____ ; ending _____________________, 20 ______.

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP that earned credit

EIN of entity that earned the credit

PART A — GENERAL INFORMATION

1. Enter the period for which you were HPIP certified by the Secretary of Commerce.

1.

____________ thru

________________

2. Enter your HPIP certification number.

2.

_____________________________

PART B — HPIP TRAINING AND EDUCATION CREDIT

3. Total qualified cash investment in training and education.

3. __________________________

4. Total amount expended for payroll during the period specified.

4. __________________________

5. Multiply line 4 by 2%.

5. __________________________

6. Amount of credit subject to limitation (subtract line 5 from line 3).

6. __________________________

7. Training and education credit for amount invested (the lesser of line 6 or $50,000).

7. __________________________

0.00%

8. Enter your proportionate share percentage.

8. __________________________

9. Amount of credit allowable for training and education.

9. __________________________

9a. Training and education credit used.

9a. __________________________

PART C — HPIP INVESTMENT CREDIT

10. Address location of qualified business facility:

__________________________________________________________________________

_____________________________

Street Address

City

1. Complete the following investment schedule for the 1st qualifying year:

1

(1)

(2)

(3)

1st Qualifying Year:_________

Enter a Business Entity Tax

Base Year: _________

Filing Period By Month

Monthly Base Investment

Monthly Qualifying Investment

a

b

c

d

e

f

g

h

i

j

k

l

m

TOTAL

n

Average Investment

o

Capitalized Rents

p

TOTAL

q

Base

r

Average Qualified Investment

Minimum Investment Allowed

s

Enter $50,000 or $1,000,000 (see instructions)

t

Qualified Business Facility Investment

u

INVESTMENT CREDIT (10% of line 11t)

1

1 2

2