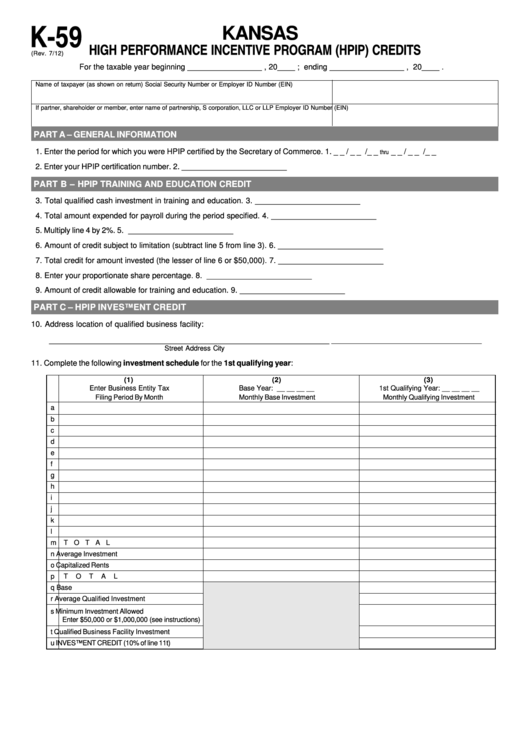

K-59

KANSAS

HIGH PERFORMANCE INCENTIVE PROGRAM (HPIP) CREDITS

(Rev. 7/12)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – GENERAL INFORMATION

1. Enter the period for which you were HPIP certified by the Secretary of Commerce.

1. _ _ / _ _ /_ _

thru

_ _ / _ _ /_ _

2. Enter your HPIP certification number.

2. ________________________

PART B – HPIP TRAINING AND EDUCATION CREDIT

3. Total qualified cash investment in training and education.

3. ________________________

4. Total amount expended for payroll during the period specified.

4. ________________________

5. Multiply line 4 by 2%.

5. ________________________

6. Amount of credit subject to limitation (subtract line 5 from line 3).

6. ________________________

7. Total credit for amount invested (the lesser of line 6 or $50,000).

7. ________________________

8. Enter your proportionate share percentage.

8. ________________________

9. Amount of credit allowable for training and education.

9. ________________________

PART C – HPIP INVESTMENT CREDIT

10. Address location of qualified business facility:

________________________________________________________________

____________________________________________

Street Address

City

11. Complete the following investment schedule for the 1st qualifying year:

(1)

(2)

(3)

Enter Business Entity Tax

Base Year: __ __ __ __

1st Qualifying Year: __ __ __ __

Filing Period By Month

Monthly Base Investment

Monthly Qualifying Investment

a

b

c

d

e

f

g

h

i

j

k

l

m TOTAL

n

Average Investment

o

Capitalized Rents

p

TOTAL

q

Base

r

Average Qualified Investment

s

Minimum Investment Allowed

Enter $50,000 or $1,000,000 (see instructions)

t

Qualified Business Facility Investment

u

INVESTMENT CREDIT (10% of line 11t)

1

1 2

2 3

3 4

4