Schedule Ct K-1 Template - Member'S Share Of Certain Connecticut Items 2004

ADVERTISEMENT

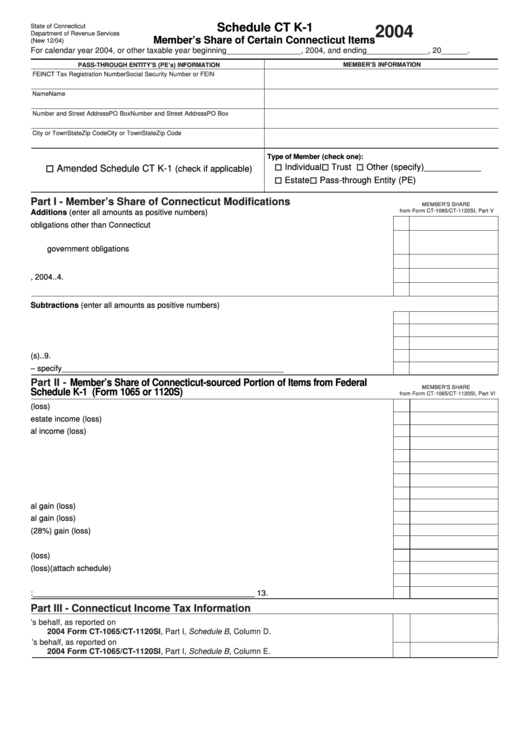

Schedule CT K-1

State of Connecticut

2004

Department of Revenue Services

Member’s Share of Certain Connecticut Items

(New 12/04)

For calendar year 2004, or other taxable year beginning _________________ , 2004, and ending ______________ , 20 ______ .

PASS-THROUGH ENTITY’S (PE’s) INFORMATION

MEMBER’S INFORMATION

FEIN

CT Tax Registration Number

Social Security Number or FEIN

Name

Name

Number and Street Address

PO Box

Number and Street Address

PO Box

City or Town

State

Zip Code

City or Town

State

Zip Code

Type of Member (check one):

Individual

Trust

Other (specify) ____________

Amended Schedule CT K-1

(check if applicable)

Estate

Pass-through Entity (PE)

Part I - Member’s Share of Connecticut Modifications

MEMBER’S SHARE

from Form CT-1065/CT-1120SI, Part V

Additions (enter all amounts as positive numbers)

1.

Interest on state and local obligations other than Connecticut ............................................................ 1.

2.

Mutual fund exempt-interest dividends from non-Connecticut state or municipal

government obligations ........................................................................................................................ 2.

3.

Certain deductions relating to income exempt from Connecticut income tax ..................................... 3.

4.

Special depreciation allowance for qualified property placed in service prior to September 11, 2004 .. 4.

5.

Other - specify__________________________________________________ ................................. 5.

Subtractions (enter all amounts as positive numbers)

6.

Interest on U.S. government obligations .............................................................................................. 6.

7.

Exempt dividends from certain qualifying mutual funds derived from U.S. government obligations .. 7.

8.

Certain expenses related to income exempt from federal income tax but subject to Connecticut tax ... 8.

9.

Special depreciation allowance for qualified property placed in service during the preceding year(s) .. 9.

10. Other – specify__________________________________________________ ................................ 10.

Part II -

Member’s Share of Connecticut-sourced Portion of Items from Federal

MEMBER’S SHARE

Schedule K-1 (Form 1065 or 1120S)

from Form CT-1065/CT-1120SI, Part VI

1.

Ordinary business income (loss) ..........................................................................................................

1.

2.

Net rental real estate income (loss) .....................................................................................................

2.

3.

Other net rental income (loss) ..............................................................................................................

3.

4.

Guaranteed payments ..........................................................................................................................

4.

5.

Interest income .....................................................................................................................................

5.

6a. Ordinary dividends ............................................................................................................................... 6a.

6b. Qualified dividends ............................................................................................................................... 6b.

7.

Royalties ...............................................................................................................................................

7.

8.

Net short-term capital gain (loss) .........................................................................................................

8.

9a. Net long-term capital gain (loss) .......................................................................................................... 9a.

9b. Collectibles (28%) gain (loss) .............................................................................................................. 9b.

9c. Unrecaptured section 1250 gain .......................................................................................................... 9c.

10. Net section 1231 gain (loss) ................................................................................................................. 10.

11. Other income (loss) (attach schedule) ................................................................................................. 11.

12. Section 179 deduction .......................................................................................................................... 12.

13. Other deductions:__________________________________________________ ............................ 13.

Part III - Connecticut Income Tax Information

1.

Connecticut income tax paid by PE on the member’s behalf, as reported on

2004 Form CT-1065/CT-1120SI, Part I, Schedule B, Column D. ......................................................

1.

2.

Interest on underpayment of estimated tax paid by PE on the member’s behalf, as reported on

2004 Form CT-1065/CT-1120SI, Part I, Schedule B, Column E. .......................................................

2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1