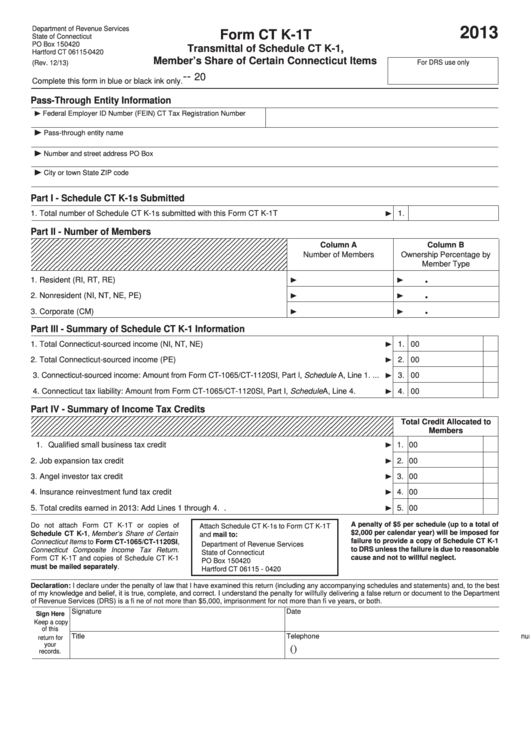

Department of Revenue Services

2013

Form CT K-1T

State of Connecticut

PO Box 150420

Transmittal of Schedule CT K-1,

Hartford CT 06115-0420

Member’s Share of Certain Connecticut Items

For DRS use only

(Rev. 12/13)

-

-

20

Complete this form in blue or black ink only.

Pass-Through Entity Information

Federal Employer ID Number (FEIN)

CT Tax Registration Number

Pass-through entity name

Number and street address

PO Box

City or town

State

ZIP code

Part I - Schedule CT K-1s Submitted

1. Total number of Schedule CT K-1s submitted with this Form CT K-1T ............................................

1.

Part II - Number of Members

Column A

Column B

Number of Members

Ownership Percentage by

Member Type

.

1. Resident (RI, RT, RE) .........................................................................

.

2. Nonresident (NI, NT, NE, PE) .............................................................

.

3. Corporate (CM) .................................................................................

Part III - Summary of Schedule CT K-1 Information

1. Total Connecticut-sourced income (NI, NT, NE) ...............................................................................

1.

00

2. Total Connecticut-sourced income (PE) ...........................................................................................

2.

00

3. Connecticut-sourced income: Amount from Form CT-1065/CT-1120SI, Part I, Schedule A, Line 1. ...

3.

00

4. Connecticut tax liability: Amount from Form CT-1065/CT-1120SI, Part I, Schedule A, Line 4. .........

4.

00

Part IV - Summary of Income Tax Credits

Total Credit Allocated to

Members

1. Qualifi ed small business tax credit ...................................................................................................

1.

00

2. Job expansion tax credit ...................................................................................................................

2.

00

3. Angel investor tax credit ..................................................................................................................

3.

00

4. Insurance reinvestment fund tax credit ............................................................................................

4.

00

5. Total credits earned in 2013: Add Lines 1 through 4. .......................................................................

5.

00

A penalty of $5 per schedule (up to a total of

Do not attach Form CT K-1T or copies of

Attach Schedule CT K-1s to Form CT K-1T

$2,000 per calendar year) will be imposed for

Schedule CT K-1, Member’s Share of Certain

and mail to:

failure to provide a copy of Schedule CT K-1

Connecticut Items to Form CT-1065/CT-1120SI,

Department of Revenue Services

to DRS unless the failure is due to reasonable

Connecticut Composite Income Tax Return.

State of Connecticut

cause and not to willful neglect.

Form CT K-1T and copies of Schedule CT K-1

PO Box 150420

must be mailed separately.

Hartford CT 06115 - 0420

Declaration: I declare under the penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best

of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department

of Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both.

Signature

Date

Sign Here

Keep a copy

of this

Title

Telephone number

return for

your

(

)

records.

1

1 2

2