Form Il-2220 - Instructions - Illinois Department Of Revenue - 2015

ADVERTISEMENT

Illinois Department of Revenue

IL-2220 Instructions

2015

General Information

An additional penalty will be assessed if you do not file a processable

return within 30 days of the date we notify you that we are not able

What is the purpose of this form?

to process your return. This additional penalty is equal to the greater

of $250 or 2 percent of the tax shown due on your return, determined

This form allows you to calculate penalties you may owe if you did not

without regard to payments and credits, and may be assessed up

• make timely estimated payments,

to a maximum of $5,000. For more information, see Publication 103,

• pay the tax you owe by the original due date, or

Penalties and Interest for Illinois Taxes.

• file a processable return by the extended due date.

What if I underpaid my estimated tax because of a

The late-payment penalty for underpayment of estimated tax is

change in the law during the tax year?

based on the tax shown due on your original return. Do not use the tax

shown on an amended return filed after the extended due date of the

If a change in the IITA enacted during the tax year increased your liability,

return to compute your required installments in Step 2.

and the new statute does not specifically provide for relief from penalties,

you may reduce or eliminate your penalty for underpayment of estimated

In addition, this form must be used if your income was not received

tax by using the annualized income installment method in Step 6 and

evenly throughout the year, and you choose to annualize your income.

computing your income and liability for each period according to the IITA

The annualized income installment method may be able to lower or

in effect as of the end of that period. See Specific Instructions for Step 6.

eliminate the amount of your required installments.

Do I need to complete this form if I owe penalties?

Specific Instructions

No, you do not need to complete this form if you owe penalties. We

If a specific line is not referenced, follow the

encourage you to let us figure your penalties and send you a bill instead

instructions on the form.

of completing and filing this form yourself. If you let us figure your

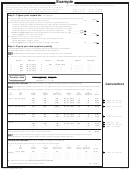

Step 2: Figure your required installments

penalties, complete your return as usual and do not attach Form IL-2220.

(

Y

ou must complete this form if you are using the annualized

Form IL-1120 filers only)

income installment method for late-payment penalty for underpayment of

Line 5 —

Enter in Column A the total net income and replacement tax

estimated tax in Step 6.

and surcharge entered on your 2015 Form IL-1120, Step 8, Line 53.

For more information, see Publication 103, Penalties and Interest for

Enter in Column B the total net income and replacement tax entered on

Illinois Taxes. To receive a copy of this publication, visit our website at

your 2014 Form IL-1120, Step 8, Line

53.

tax.illinois.gov.

If the preceding year’s return was for a short tax year, or you reported

What is late-payment penalty?

zero total net tax, enter “N/A” in Column B.

“N/A” does not equal zero. If you entered “N/A” on Step 2,

A late-payment penalty is assessed when you fail to pay the tax you owe

Column B, Line 5, you may still be required to make installments. See the

by the due date. This penalty could result from two different underpayment

instructions for Line 7.

situations and is assessed at either 2 percent or 10 percent of the unpaid

liability based on the number of days the payment is late. The penalty

Line 7 —

If Column A, Line 5 is $400 or less, enter “0” and go to

rates used on this form are for returns due on or after January 1, 2005.

Step 3. Otherwise, enter the lesser of Column A, Line 6, or Column B,

For returns due before January 1, 2005, see Publication 103.

Line 5. If you entered “N/A” in Column B, Line 5, enter the amount

from Column A, Line 6.

You will be assessed a late-payment penalty for unpaid tax if you do

not pay the total tax you owe by the original due date of the return. An

You do not owe the late-payment penalty for underpayment

extension of time to file does not extend the amount of time you

of estimated tax if you made timely estimated installment payments

have to make your payment.

equaling at least 90 percent of this year’s tax liability or 100 percent of

the prior year’s tax liability (provided you reported a tax liability in the prior

You will be assessed a late-payment penalty for underpayment of

year and it was not a short taxable year). You will still be assessed the

estimated tax if you were required to make estimated tax payments and

late-payment penalty for underpayment of estimated tax if you failed to pay

failed to do so, or failed to pay the required amount by the payment due date.

the required installment amount by each installment due date.

You do not owe the late-payment penalty for underpayment of estimated

Line 10 —

Enter the amount of your required installment for each due

taxes if

date. For most taxpayers, this is the amount shown on Line 8. (In this

• you are not filing Form IL-1120;

case, the total amount of all columns of Line 10 should equal Line 7.)

• you were not required to file Form IL-1120 for last year; or

However, if you are annualizing your income, you must complete Step 6

• your current year’s net tax liability (Form IL-1120, Step 8,

and enter the required installments from Line 45.

Line 53) is $400 or less.

Annualized income installment method: If your income

If in the previous taxable year you filed a short year return or a

was not received evenly throughout the year, you may be able to

return showing no liability, you may still owe the late-payment penalty for

lower or eliminate the amount of your required installments by using

underpayment of estimated tax. See the specific instructions for details.

the annualized income installment method in Step 6. If you choose

to annualize your income in Step 6, you must use this method for all

What is late-filing or nonfiling penalty?

installments.

A late-filing or nonfiling penalty is a penalty assessed for failure to file

Line 11 —

a processable return by the extended due date. The penalty is the lesser

•

Gambling withholding: If you received a Form W-2G, Gambling

of $250 or 2 percent of the tax amount required to be shown due on your

Withholding, include the amount of withholding in four equal

return, reduced by any payments made by the original due date and any

installments.

credits allowed on your return.

Page 1 of 5

IL-2220 Instructions (R-12/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5