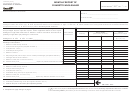

Form 72a161 - Monthly Report Page 2

ADVERTISEMENT

INSTRUCTIONS

➤

WHO MUST FILE

Each licensed liquefied petroleum gas dealer must file this report with applicable

supporting schedule, Form 72A178, each month. This report is required even

though there may be no liquefied petroleum gas motor fuel gallons sold.

➤

WHEN TO FILE

The report is due on or before the 25th day of the month following the month

covered by the report. Example: The January report is due on February 25.

Failure to timely file a monthly report may result in imposition of late filing

penalties.

➤

PAYMENT

Payment of the tax due must accompany the report. The payment must be by

certified or cashier's check made payable to Kentucky State Treasurer. Failure

to timely remit all tax due may result in imposition of late pay penalties and

interest.

➤

TAX RATE

The liquefied petroleum gas tax rate is set quarterly and is effective for a

quarterly period. Notification of the tax rate is mailed 20 days before the

beginning of each calendar quarter. Example: Dealers are notified by March

10 of the tax rate effective for April, May and June.

RECORDS

➤

RETENTION

Licensed dealers must maintain complete records of inventories, purchases,

sales, use and other dispositions of liquefied petroleum gas for a period of two

years. Such records include manifests of lading, invoices, correspondence and

other papers pertaining to this motor fuel activity.

ASSISTANCE AND

➤

INFORMATION

Telephone

(502) 564-3853

Address Correspondence

Department of Revenue

Motor Fuels Tax Compliance Section

P.O. Box 1303, Station 63

Frankfort, KY 40602-1303

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2