Form Pet 371 - End User Claim For Refund - Tennessee Department Of Revenue Page 2

ADVERTISEMENT

For additional information, contact the Taxpayer Services Division in one of our Department of Revenue Offices:

Memphis

Chattanooga

Jackson

Johnson City

Knoxville

Nashville

(731) 423-5747

(423) 854-5321

(865) 594-6100

(901) 213-1400

(615) 253-0600

(423) 634-6266

3150 Appling Road

3rd Floor

Suite 350

Room 405 B

204 High Point Drive

Room 606

Lowell Thomas Building

State Office Building

Bartlett, TN

Andrew Jackson Building

State Office Building

500 Deaderick Street

540 McCallie Avenue

225 Martin Luther King Blvd.

531 Henley Street

Tennessee residents can also call our statewide toll free number at 1-800-342-1003.

Out-of-state callers must dial (615) 253-0600.

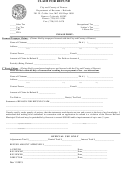

END USER CLAIM FOR REFUND

This form is used by End Users to obtain a refund of diesel tax on purchases of undyed diesel fuel used in a non-taxable manner. All claims

submitted to the Tennessee Department of Revenue must be documented, supporting records must be maintained for the statutory period, and are

subject to investigation either before or after the claim is paid.

End Users may request refund of the diesel tax when undyed diesel fuel is used as heating oil or for other non-highway purposes. The refund

must be submitted with supporting documentation and is allowed only on product which is not exempt from the diesel tax and purchased on a taxable

basis. Sales and Use Tax is due when diesel tax is refunded.

The End User Claim for Refund may be filed at the end of each calendar quarter, but not later than one year from the date of the last purchase

represented in the claim. The End User claim is subject to a minimum amount of $250.00 in diesel tax excluding any reduction for Sales and Use Tax due.

A claim which totals more than $250.00 may be filed at the end of each calendar quarter, but not later than one year from the date of the last purchase

represented in the claim. For each quarter the total claim exceeds the minimum, a one year statute of limitations will be applied.

If the claim totals less than the required minimum, the taxpayer may attach a completed claim form to subsequent claims until the total exceeds the

$250.00 minimum. Claims exceeding the one year filing limit will be examined for minimum requirements. A maximum statute of two years applies to

quarterly claims totaling less than $250.00.

Manufacturers have an Industrial Machinery Authorization Exemption Certificate and provide an exemption number. There is no diesel tax

exemption for taxable use by manufacturers. All manufacturers either pay the diesel tax for use in motor vehicles, or apply the correct sales tax rate

for use. Applicable rates are:

(1) the full state rate at 7% for general use at a non-manufacturing location;

(2) a reduced state rate of 1.5% for general energy use at a manufacturing location; or

(3) totally exempt if the diesel fuel is used directly in the manufacturing process.

Farmers must attach a copy of Schedule F from the most current year of the federal income tax return if the non-highway use of undyed diesel

fuel is for agricultural purposes. Farmers' use in motor vehicles is subject to diesel tax. No refund is allowed for farmers’ use of diesel fuel in the tanks

of their motor vehicles.

“Motor Vehicle” means a vehicle that is propelled by an internal combustion engine or motor and is designed to permit the vehicle’s use on

highways. The term does not include: (a) farm machinery, including machinery designed for off-road use but capable of movement on roads at low

speeds; or (b) a vehicle operated on rails; or (c) machinery designed principally for off-road use, unless such machinery is licensed to operate on

Tennessee highways.

Refund Claim Line Instructions:

Line 1.

Inventory. Enter the beginning inventory gallons for the End User storage.

Line 2.

Purchases. (Attach copies of invoices) (Schedule A required) Submit copies of all bulk purchase invoices to support the entry on Line

2B. Either copies of retail invoices or vendor statements detailing each retail purchase may be submitted to support the entry on Line 2A.

Line 3.

Use. Enter the total gallons used for heating fuel (Line 3A), fabricating (Line 3B), any other non-highway use (Line 3C), or for taxable uses

(Line 3D).

Line 3C:

Describe fully all non-highway use of undyed diesel fuel (Schedule B required). List each type of non-highway use, the equipment used,

and the fuel used for the period.

Line 5.

Ending inventory. Enter the actual ending inventory.

Line 6.

Total of Line 3A, 3B, and 3C. These are the total gallons of undyed diesel fuel on which the end user is requesting a refund of diesel tax

for non-taxable use.

Line 7.

Maximum Refund Amount - Line 6 multiplied by Diesel Tax Rate per gallon. Calculate the End User refund request amount.

Minimum refund available: $250.00. This amount is subject to reduction for the use tax due.

Sales and Use Tax Calculation Schedule - This schedule should be used to calculate the amount of sales and use tax due on all petroleum

products. If the amount has been previously paid, attach supporting documentation.

Rate: 7%

Rate: 1.5%

Rate: Exempt

A. Gallons from Line 6 of the claim.

Total Sales & Use

B. Total Purchase Amount. (A times Avg. Price/Gallon)

$

$

$

Tax Liability

C. Use Tax due. (Rate times B)

$

$

$

$

INSTRUCTIONS:

Enter the correct Sales & Use Tax rate to be applied to the gallons accepted for refund of diesel tax. Use separate columns for each applicable rate.

Line A.

Enter either a portion or the total gallons from Line 6 on the front of the claim.

Line B.

For each column determine the total purchase amount. Multiply the gallons from Line A time the Average Price per Gallon from the bottom of

Schedule A (Bulk Purchases). If the gallons are from the exempt column, enter a zero.

Line C.

For each column, determine the Use Tax due. Multiply the applicable Sales & Use tax rate for the column times Line B (Total Purchase Amount).

IMPORTANT: Retain a copy of this claim for Sales and Use Tax purposes.

Refund claims must be submitted with acceptable proof of diesel taxes paid at the time of purchase and non-taxable use.

Mail this claim to the Tennessee Department of Revenue, Andrew Jackson State Office Bldg., 500 Deaderick Street, Nashville, TN 37242.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4