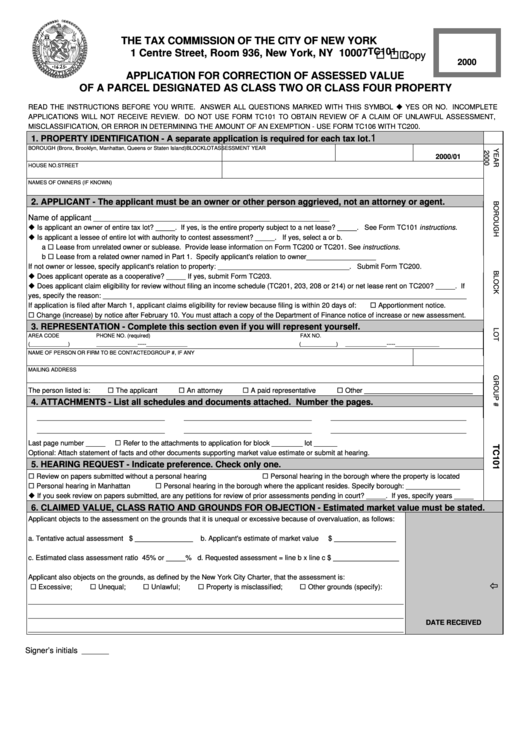

Form Tc101 - Application For Correction Of Assessed Value Of A Parcel Designated As Class Two Or Class Four Property

ADVERTISEMENT

THE TAX COMMISSION OF THE CITY OF NEW YORK

TC101

1 Centre Street, Room 936, New York, NY 10007

! ! ! ! Copy

2000

APPLICATION FOR CORRECTION OF ASSESSED VALUE

OF A PARCEL DESIGNATED AS CLASS TWO OR CLASS FOUR PROPERTY

READ THE INSTRUCTIONS BEFORE YOU WRITE. ANSWER ALL QUESTIONS MARKED WITH THIS SYMBOL " YES OR NO. INCOMPLETE

APPLICATIONS WILL NOT RECEIVE REVIEW. DO NOT USE FORM TC101 TO OBTAIN REVIEW OF A CLAIM OF UNLAWFUL ASSESSMENT,

MISCLASSIFICATION, OR ERROR IN DETERMINING THE AMOUNT OF AN EXEMPTION - USE FORM TC106 WITH TC200.

1

1. PROPERTY IDENTIFICATION - A separate application is required for each tax lot.

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

ASSESSMENT YEAR

2000/01

HOUSE NO.

STREET

NAMES OF OWNERS (IF KNOWN)

2. APPLICANT - The applicant must be an owner or other person aggrieved, not an attorney or agent.

Name of applicant

_____________________________________________________________

" Is applicant an owner of entire tax lot? _____. If yes, is the entire property subject to a net lease? _____. See Form TC101 instructions.

" Is applicant a lessee of entire lot with authority to contest assessment? _____. If yes, select a or b.

a ! Lease from unrelated owner or sublease. Provide lease information on Form TC200 or TC201. See instructions.

b ! Lease from a related owner named in Part 1. Specify applicant's relation to owner__________________

If not owner or lessee, specify applicant's relation to property: __________________________________. Submit Form TC200.

" Does applicant operate as a cooperative? _____ If yes, submit Form TC203.

" Does applicant claim eligibility for review without filing an income schedule (TC201, 203, 208 or 214) or net lease rent on TC200? _____. If

yes, specify the reason: ______________________________________________________________________________________________

! Apportionment notice.

If application is filed after March 1, applicant claims eligibility for review because filing is within 20 days of:

! Change (increase) by notice after February 10. You must attach a copy of the Department of Finance notice of increase or new assessment.

3. REPRESENTATION - Complete this section even if you will represent yourself.

AREA CODE

PHONE NO. (required)

FAX NO.

(_____________)

______________-----______________

(____________)

______________-----_______________

NAME OF PERSON OR FIRM TO BE CONTACTED

GROUP #, IF ANY

MAILING ADDRESS

! The applicant

! An attorney

! A paid representative

! Other ____________________________

The person listed is:

4. ATTACHMENTS - List all schedules and documents attached. Number the pages.

_________________________________

_________________________________

___________________________________

_________________________________

_________________________________

___________________________________

! Refer to the attachments to application for block ________ lot ______

Last page number _____

Optional: Attach statement of facts and other documents supporting market value estimate or submit at hearing.

5. HEARING REQUEST - Indicate preference. Check only one.

! Review on papers submitted without a personal hearing

! Personal hearing in the borough where the property is located

! Personal hearing in Manhattan

! Personal hearing in the borough where the applicant resides. Specify borough: ______________

" If you seek review on papers submitted, are any petitions for review of prior assessments pending in court? _____. If yes, specify years _____

6. CLAIMED VALUE, CLASS RATIO AND GROUNDS FOR OBJECTION - Estimated market value must be stated.

Applicant objects to the assessment on the grounds that it is unequal or excessive because of overvaluation, as follows:

a. Tentative actual assessment $ _______________

b. Applicant's estimate of market value

$ ________________

c. Estimated class assessment ratio 45% or _____% d. Requested assessment = line b x line c $ _________________

Applicant also objects on the grounds, as defined by the New York City Charter, that the assessment is:

#

! Excessive;

! Unequal;

! Unlawful;

! Property is misclassified;

! Other grounds (specify):

_________________________________________________________________________________________________

_________________________________________________________________________________________________

DATE RECEIVED

_________________________________________________________________________________________________

Signer’s initials

_______

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2