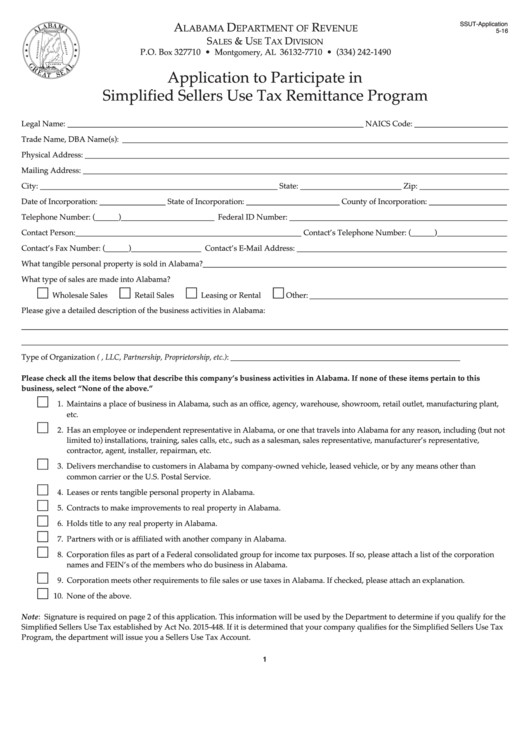

SSUT Application

5 16

A

D

R

LABAMA

EPARTMENT OF

EvENUE

S

& U

T

D

ALES

SE

Ax

IvISION

P.O. B

327710 • M

A

36132-7710 • (334) 242-1490

ox

ontgomery,

L

RESET

Application to Participate in

Simplified Sellers Use Tax Remittance Program

Legal Name: ____________________________________________________________________________ NAICS Code: ________________________

Trade Name, DBA Name(s): ___________________________________________________________________________________________________

Physical Address: _____________________________________________________________________________________________________________

Mailing Address: _____________________________________________________________________________________________________________

City: _____________________________________________________________ State: __________________________ Zip: _______________________

Date of Incorporation: _________________ State of Incorporation: ________________________ County of Incorporation: ____________________

Telephone Number: (______)________________________ Federal ID Number: ________________________________________________________

Contact Person:__________________________________________________________ Contact’s Telephone Number: (______)__________________

Contact’s Fax Number: (______)__________________ Contact’s E-Mail Address: ______________________________________________________

What tangible personal property is sold in Alabama?______________________________________________________________________________

What type of sales are made into Alabama?

Wholesale Sales

Retail Sales

Leasing or Rental

Other: ___________________________________________________

Please give a detailed description of the business activities in Alabama:

_____________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________

Type of Organization (i.e. Corporation, LLC, Partnership, Proprietorship, etc.): ___________________________________________________________

Please check all the items below that describe this company’s business activities in Alabama. If none of these items pertain to this

business, select “None of the above.”

1. Maintains a place of business in Alabama, such as an office, agency, warehouse, showroom, retail outlet, manufacturing plant,

etc.

2. Has an employee or independent representative in Alabama, or one that travels into Alabama for any reason, including (but not

limited to) installations, training, sales calls, etc., such as a salesman, sales representative, manufacturer’s representative,

contractor, agent, installer, repairman, etc.

3. Delivers merchandise to customers in Alabama by company-owned vehicle, leased vehicle, or by any means other than

common carrier or the U.S. Postal Service.

4. Leases or rents tangible personal property in Alabama.

5. Contracts to make improvements to real property in Alabama.

6. Holds title to any real property in Alabama.

7. Partners with or is affiliated with another company in Alabama.

8. Corporation files as part of a Federal consolidated group for income tax purposes. If so, please attach a list of the corporation

names and FEIN’s of the members who do business in Alabama.

9. Corporation meets other requirements to file sales or use taxes in Alabama. If checked, please attach an explanation.

10. None of the above.

Note: Signature is required on page 2 of this application. This information will be used by the Department to determine if you qualify for the

Simplified Sellers Use Tax established by Act No. 2015-448. If it is determined that your company qualifies for the Simplified Sellers Use Tax

Program, the department will issue you a Sellers Use Tax Account.

1

1 2

2