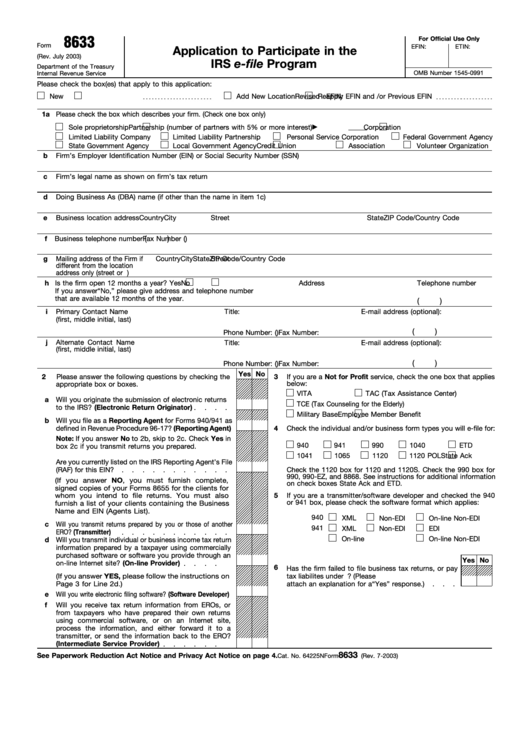

8633

For Official Use Only

Form

EFIN:

ETIN:

Application to Participate in the

(Rev. July 2003)

IRS e-file Program

Department of the Treasury

OMB Number 1545-0991

Internal Revenue Service

Please check the box(es) that apply to this application:

New

Revised EFIN:

Add New Location

Reapply EFIN and /or Previous EFIN

1a

Please check the box which describes your firm. (Check one box only)

Sole proprietorship

Partnership (number of partners with 5% or more interest)

Corporation

Limited Liability Company

Limited Liability Partnership

Personal Service Corporation

Federal Government Agency

State Government Agency

Local Government Agency

Credit Union

Association

Volunteer Organization

b

Firm’s Employer Identification Number (EIN) or Social Security Number (SSN)

c

Firm’s legal name as shown on firm’s tax return

d

Doing Business As (DBA) name (if other than the name in item 1c)

e

Business location address

Country

Street

City

State

ZIP Code/Country Code

(

)

f

Business telephone number

Fax Number (

)

g

Mailing address of the Firm if

Country

Street

City

State

ZIP Code/Country Code

different from the location

address only (street or P.O. box)

h

Is the firm open 12 months a year? Yes

No

Address

Telephone number

If you answer “No,” please give address and telephone number

that are available 12 months of the year.

(

)

i

Primary Contact Name

Title:

E-mail address (optional):

(first, middle initial, last)

(

)

Phone Number: (

)

Fax Number:

j

Alternate Contact Name

Title:

E-mail address (optional):

(first, middle initial, last)

(

)

Phone Number: (

)

Fax Number:

Yes No

2

Please answer the following questions by checking the

3

If you are a Not for Profit service, check the one box that applies

below:

appropriate box or boxes.

VITA

TAC (Tax Assistance Center)

a

Will you originate the submission of electronic returns

TCE (Tax Counseling for the Elderly)

to the IRS? (Electronic Return Originator)

Military Base

Employee Member Benefit

b

Will you file as a Reporting Agent for Forms 940/941 as

defined in Revenue Procedure 96-17? (Reporting Agent)

4

Check the individual and/or business form types you will e-file for:

Note: If you answer No to 2b, skip to 2c. Check Yes in

940

941

990

1040

ETD

box 2c if you transmit returns you prepared.

1041

1065

1120

1120 POL

State Ack

Are you currently listed on the IRS Reporting Agent’s File

(RAF) for this EIN?

Check the 1120 box for 1120 and 1120S. Check the 990 box for

990, 990-EZ, and 8868. See instructions for additional information

(If you answer NO, you must furnish complete,

on check boxes State Ack and ETD.

signed copies of your Forms 8655 for the clients for

whom you intend to file returns. You must also

5

If you are a transmitter/software developer and checked the 940

or 941 box, please check the software format which applies:

furnish a list of your clients containing the Business

Name and EIN (Agents List).

940

XML

Non-EDI

On-line Non-EDI

c

Will you transmit returns prepared by you or those of another

941

XML

Non-EDI

EDI

ERO? (Transmitter)

On-line

On-line Non-EDI

d

Will you transmit individual or business income tax return

information prepared by a taxpayer using commercially

purchased software or software you provide through an

Yes No

on-line Internet site? (On-line Provider)

6

Has the firm failed to file business tax returns, or pay

(If you answer YES, please follow the instructions on

tax liabilites under U.S. Internal Revenue laws? (Please

Page 3 for Line 2d.)

attach an explanation for a “Yes” response.)

e

Will you write electronic filing software? (Software Developer)

f

Will you receive tax return information from EROs, or

from taxpayers who have prepared their own returns

using commercial software, or on an Internet site,

process the information, and either forward it to a

transmitter, or send the information back to the ERO?

(Intermediate Service Provider)

8633

See Paperwork Reduction Act Notice and Privacy Act Notice on page 4.

Cat. No. 64225N

Form

(Rev. 7-2003)

1

1 2

2