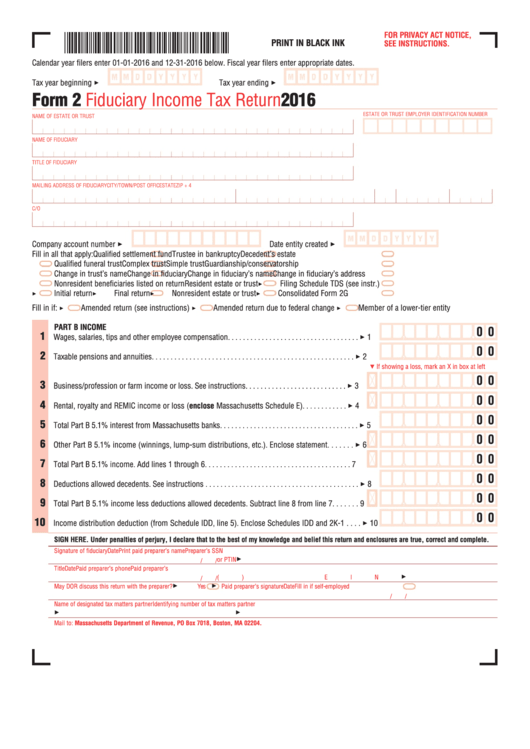

Form 2 - Fiduciary Income Tax Return - 2016

ADVERTISEMENT

File pg. 1

FOR PRIVACY ACT NOTICE,

PRINT IN BLACK INK

SEE INSTRUCTIONS.

Calendar year filers enter 01-01-2016 and 12-31-2016 below. Fiscal year filers enter appropriate dates.

Tax year beginning 3

Tax year ending 3

Form 2

Fiduciary Income Tax Return

2016

ESTATE OR TRUST EMPLOYER IDENTIFICATION NUMBER

NAME OF ESTATE OR TRUST

NAME OF FIDUCIARY

TITLE OF FIDUCIARY

MAILING ADDRESS OF FIDUCIARY

CITY/TOWN/POST OFFICE

STATE

ZIP + 4

C/O

Company account number 3

Date entity created 3

Fill in all that apply:

Qualified settlement fund

Trustee in bankruptcy

Decedent’s estate

Qualified funeral trust

Complex trust

Simple trust

Guardianship/conservatorship

Change in trust’s name

Change in fiduciary

Change in fiduciary’s name

Change in fiduciary’s address

Nonresident beneficiaries listed on return

Resident estate or trust

Filing Schedule TDS (see instr.)

3

Initial return

Final return

Nonresident estate or trust

Consolidated Form 2G

3

3

3

3

Fill in if:

Amended return (see instructions)

Amended return due to federal change

Member of a lower-tier entity

3

3

3

PART B INCOME

0 0

1

Wages, salaries, tips and other employee compensation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

0 0

2

Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

If showing a loss, mark an X in box at left

5

0 0

3

Business/profession or farm income or loss. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

0 0

4

Rental, royalty and REMIC income or loss (enclose Massachusetts Schedule E) . . . . . . . . . . . . 3 4

0 0

5

Total Part B 5.1% interest from Massachusetts banks. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

0 0

6

Other Part B 5.1% income (winnings, lump-sum distributions, etc.). Enclose statement. . . . . . . 3 6

0 0

7

Total Part B 5.1% income. Add lines 1 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

0 0

8

Deductions allowed decedents. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

0 0

9

Total Part B 5.1% income less deductions allowed decedents. Subtract line 8 from line 7 . . . . . . . 9

0 0

10

Income distribution deduction (from Schedule IDD, line 5). Enclose Schedules IDD and 2K-1 . . . . 3 10

SIGN HERE. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Signature of fiduciary

Date

Print paid preparer’s name

Preparer’s SSN

or PTIN

3

/

/

Title

Date

Paid preparer’s phone

Paid preparer’s

(

)

EIN

3

/

/

May DOR discuss this return with the preparer?

3

Yes

3

Paid preparer’s signature

Date

Fill in if self-employed

/

/

Name of designated tax matters partner

Identifying number of tax matters partner

3

3

Mail to: Massachusetts Department of Revenue, PO Box 7018, Boston, MA 02204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3