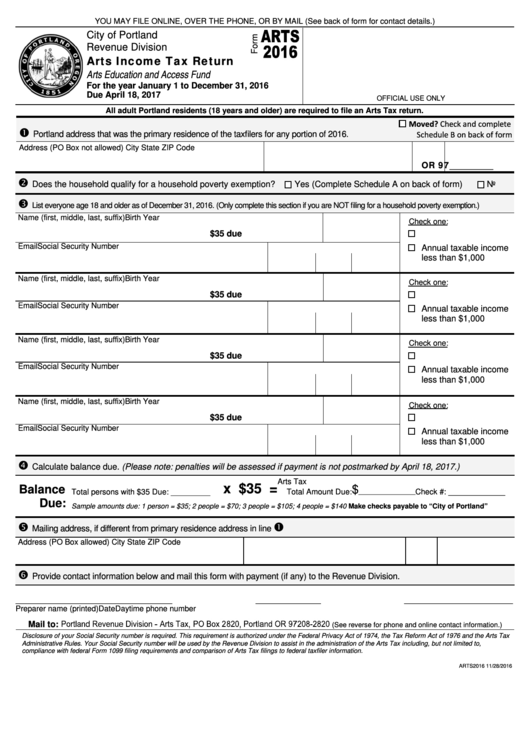

Form Arts - Arts Income Tax Return - 2016

ADVERTISEMENT

YOU MAY FILE ONLINE, OVER THE PHONE, OR BY MAIL (See back of form for contact details.)

City of Portland

Revenue Division

Arts Income Tax Return

Arts Education and Access Fund

For the year January 1 to December 31, 2016

Due April 18, 2017

OFFICIAL USE ONLY

All adult Portland residents (18 years and older) are required to file an Arts Tax return.

Moved? Check and complete

Portland address that was the primary residence of the taxfilers for any portion of 2016.

Schedule B on back of form

Address (PO Box not allowed)

City

State

ZIP Code

OR

97__________

Does the household qualify for a household poverty exemption?

Yes (Complete Schedule A on back of form)

No

List everyone age 18 and older as of December 31, 2016. (Only complete this section if you are NOT filing for a household poverty exemption.)

Name (first, middle, last, suffix)

Birth Year

Check one:

$35 due

Email

Social Security Number

Annual taxable income

less than $1,000

Name (first, middle, last, suffix)

Birth Year

Check one:

$35 due

Email

Social Security Number

Annual taxable income

less than $1,000

Name (first, middle, last, suffix)

Birth Year

Check one:

$35 due

Email

Social Security Number

Annual taxable income

less than $1,000

Name (first, middle, last, suffix)

Birth Year

Check one:

$35 due

Email

Social Security Number

Annual taxable income

less than $1,000

Calculate balance due. (Please note: penalties will be assessed if payment is not postmarked by April 18, 2017.)

Arts Tax

x $35 =

Balance

$

_____________ Check #: _____________

Total persons with $35 Due: _________

Total Amount Due:

Due:

Sample amounts due: 1 person = $35; 2 people = $70; 3 people = $105; 4 people = $140

Make checks payable to “City of Portland”

Mailing address, if different from primary residence address in line

Address (PO Box allowed)

City

State

ZIP Code

Provide contact information below and mail this form with payment (if any) to the Revenue Division.

____________________________________

_______________

_________________________

Preparer name (printed)

Date

Daytime phone number

Mail to:

(See reverse for phone and online contact information.)

Disclosure of your Social Security number is required. This requirement is authorized under the Federal Privacy Act of 1974, the Tax Reform Act of 1976 and the Arts Tax

Administrative Rules. Your Social Security number will be used by the Revenue Division to assist in the administration of the Arts Tax including, but not limited to,

compliance with federal Form 1099 filing requirements and comparison of Arts Tax filings to federal taxfiler information.

ARTS2016 11/28/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3