PRINT FORM

CLEAR FORM

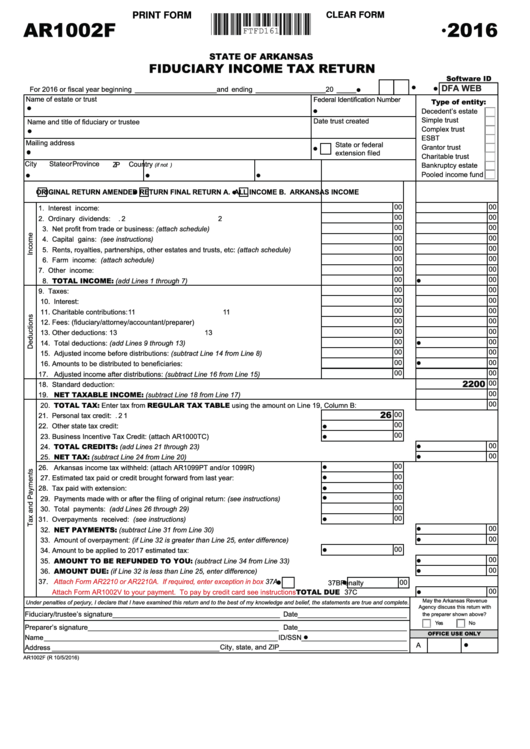

AR1002F

2016

FTFD161

STATE OF ARKANSAS

FIDUCIARY INCOME TAX RETURN

Software ID

DFA WEB

)RU ���� RU ¿VFDO \HDU EHJLQQLQJ _____________________ and ending __________________ 20 _____

1DPH RI HVWDWH RU WUXVW

)HGHUDO ,GHQWL¿FDWLRQ 1XPEHU

Type of entity:

'HFHGHQW¶V HVWDWH

6LPSOH WUXVW

'DWH WUXVW FUHDWHG

1DPH DQG WLWOH RI ¿GXFLDU\ RU WUXVWHH

&RPSOH[ WUXVW

(6%7

Mailing address

6WDWH RU IHGHUDO

*UDQWRU WUXVW

H[WHQVLRQ ¿OHG

&KDULWDEOH WUXVW

State or Province

City

&RXQWU\

ZIP

(if not U.S.)

%DQNUXSWF\ HVWDWH

3RROHG LQFRPH IXQG

ORIGINAL RETURN

AMENDED RETURN

FINAL RETURN

A. ALL INCOME

B. ARKANSAS INCOME

00

00

1. Interest income: .............................................................................................................. 1

1

00

00

2. Ordinary dividends: ........................................................................................................ 2

2

00

00

�� 1HW SUR¿W IURP WUDGH RU EXVLQHVV� (attach schedule) ...................................................... 3

3

00

00

4. Capital gains: (see instructions) ..................................................................................... 4

4

00

00

�� 5HQWV� UR\DOWLHV� SDUWQHUVKLSV� RWKHU HVWDWHV DQG WUXVWV� HWF� (attach schedule) ............. 5

5

00

00

6. Farm income: (attach schedule) ..................................................................................... 6

6

00

00

7. Other income: ................................................................................................................. 7

7

00

00

8. TOTAL INCOME: (add Lines 1 through 7) .................................................................. 8

8

00

00

9. Taxes: ............................................................................................................................. 9

9

00

00

10. Interest: ........................................................................................................................ 10

10

00

00

��� &KDULWDEOH FRQWULEXWLRQV� ................................................................................................11

11

00

00

��� )HHV� �¿GXFLDU\�DWWRUQH\�DFFRXQWDQW�SUHSDUHU� ............................................................ 12

12

00

00

��� 2WKHU GHGXFWLRQV� ......................................................................................................... 13

13

00

00

��� 7RWDO GHGXFWLRQV� (add Lines 9 through 13) .................................................................. 14

14

00

00

��� $GMXVWHG LQFRPH EHIRUH GLVWULEXWLRQV� (subtract Line 14 from Line 8) .......................... 15

15

00

00

��� $PRXQWV WR EH GLVWULEXWHG WR EHQH¿FLDULHV� .................................................................. 16

16

00

00

��� $GMXVWHG LQFRPH DIWHU GLVWULEXWLRQV� (subtract Line 16 from Line 15) ........................... 17

17

00

2200

��� 6WDQGDUG GHGXFWLRQ� .......................................................................................................................................................18

00

19. NET TAXABLE INCOME: (subtract Line 18 from Line 17) .......................................................................................19

00

20. TOTAL TAX: (QWHU WD[ IURP REGULAR TAX TABLE XVLQJ WKH DPRXQW RQ /LQH ��� &ROXPQ %� ............................20

26

00

21. Personal tax credit: ....................................................................................................... 21

00

22. Other state tax credit: ................................................................................................... 22

00

��� %XVLQHVV ,QFHQWLYH 7D[ &UHGLW� �DWWDFK $5����7&�...................................................... 23

00

24. TOTAL CREDITS: (add Lines 21 through 23) ............................................................................................................24

00

25. NET TAX: (subtract Line 24 from Line 20) ...................................................................................................................25

00

��� $UNDQVDV LQFRPH WD[ ZLWKKHOG� �DWWDFK $5����37 DQG�RU ����5� .............................. 26

00

��� (VWLPDWHG WD[ SDLG RU FUHGLW EURXJKW IRUZDUG IURP ODVW \HDU� ........................................ 27

00

28. Tax paid with extension: ............................................................................................... 28

00

��� 3D\PHQWV PDGH ZLWK RU DIWHU WKH ¿OLQJ RI RULJLQDO UHWXUQ� (see instructions) ................. 29

00

30. Total payments: (add Lines 26 through 29) .................................................................. 30

00

31. Overpayments received: (see instructions) .................................................................. 31

00

32. NET PAYMENTS: (subtract Line 31 from Line 30) .....................................................................................................32

00

��� $PRXQW RI RYHUSD\PHQW� (if Line 32 is greater than Line 25, enter difference) ..............................................................33

00

��� $PRXQW WR EH DSSOLHG WR ���� HVWLPDWHG WD[� ............................................................... 34

00

35. AMOUNT TO BE REFUNDED TO YOU: (subtract Line 34 from Line 33)..............................................................35

00

36. AMOUNT DUE: (if Line 32 is less than Line 25, enter difference) ..............................................................................36

37.

Attach Form AR2210 or AR2210A. If required, enter exception in box

37A

00

Penalty

��%

00

$WWDFK )RUP $5����9 WR \RXU SD\PHQW� 7R SD\ E\ FUHGLW FDUG VHH LQVWUXFWLRQV

...............................TOTAL DUE 37C

0D\ WKH $UNDQVDV 5HYHQXH

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, the statements are true and complete.

$JHQF\ GLVFXVV WKLV UHWXUQ ZLWK

)LGXFLDU\�WUXVWHH¶V VLJQDWXUHBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBB

Date____________________________

WKH SUHSDUHU VKRZQ DERYH"

Yes

No

3UHSDUHU¶V VLJQDWXUHBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBB

Date____________________________

OFFICE USE ONLY

Name ____________________________________________________________

,'�661BBBBBBBBBBBBBBBBBBBBBBBBBBB

A

Address ___________________________________________

City, state, and ZIP_________________________________

$5����) �5 ����������

1

1 2

2