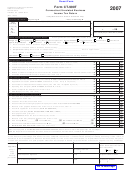

(See Instructions)

Divide Column A by Column B

(Carry to six places)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1. (a) Inventories

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

(b) Tangible Property

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

PROPERTY

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

(c) Real Property

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

(Average Value)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

(d) Capitalized Rent

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

DECIMAL NOTATION

•

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

2. (a) Sales of Tangibles

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

(b) Services

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

(c) Rentals

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

RECEIPTS

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

(d) Other

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

DECIMAL NOTATION

•

DECIMAL NOTATION

WAGES, SALARIES

AND OTHER

COMPENSATION

•

DECIMAL NOTATION

4.

(Add Lines 1, 2 and 3 in Column C)

•

DECIMAL NOTATION

5. Apportionment fraction (Divide Line 4 by number of factors used)

Enter here and on front of page, Computation of Tax, Line 2.

•

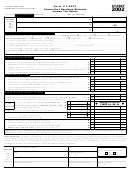

1. 1993 Connecticut net operating loss (from 1993 Form CT-990T, Schedule C, Line 5) ............................ 1

2. 1994 Connecticut net operating loss (from 1994 Form CT-990T, Schedule C, Line 5) ........................... 2

3. 1995 Connecticut net operating loss (from 1995 Form CT-990T, Schedule C, Line 5) ........................... 3

4. 1996 Connecticut net operating loss (from 1996 Form CT-990T, Schedule C, Line 5) ........................... 4

5. 1997 Connecticut net operating loss (from 1997 Form CT-990T, Schedule C, Line 5) ........................... 5

6.

(Add Lines 1 through 5) Enter here and on Computation of Tax, Line 4 ...................................... 6

1. Enter amount from Computation of Income, Line 6, if less than zero ......................................................... 1

2. Add back Specific Deduction (from 1998 federal Form 990T, Part II, Line 33) ......................................... 2

3. Subtotal (Add Line 1 and Line 2) ................................................................................................................. 3

4. Apportionment fraction (Schedule A, Line 5) ............................................................................................... 4

•

5. 1998 Connecticut net operating loss available for carryforward (Multiply Line 3 by Line 4) ................... 5

Form CT-990T Back (Rev. 12/98)

1

1 2

2