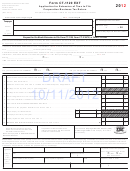

Form Ct-1120 - Corporation Business Tax Return - 2012 Page 2

ADVERTISEMENT

Schedule A – Computation of Tax on Net Income

00

1. Net income: Enter amount from Schedule D, Line 22. If 100% Connecticut, enter also on Line 3. ... .

1

2. Apportionment fraction: Carry to six places. See instructions. .............................................................

2

0.

00

3. Connecticut net income: Multiply Line 1 by Line 2. ..............................................................................

3

00

4. Operating loss carryover from Form CT-1120 ATT, Schedule H, Line 14, Column D ..........................

4

00

5. Income subject to tax: Subtract Line 4 from Line 3. .............................................................................

5

00

6. Tax: Multiply Line 5 by 7.5% (.075). .....................................................................................................

6

Schedule B – Computation of Minimum Tax on Capital

00

1. Minimum tax base from Schedule E, Line 6, Column C. If 100% Connecticut, enter also on Line 3.

1

2. Apportionment fraction: Carry to six places. See instructions. .............................................................

2

0.

00

3. Multiply Line 1 by Line 2. ......................................................................................................................

3

4. Number of months covered by this return .............................................................................................

4

00

5. Multiply Line 3 by Line 4, divide the result by 12. .................................................................................

5

00

6. Tax (3 and 1/10 mills per dollar): Multiply Line 5 by .0031. Maximum tax for Schedule B is $1,000,000. ...

6

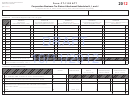

Schedule D – Computation of Net Income

00

1. Federal taxable income (loss) before net operating loss and special deductions .................................

1

00

2. Interest income wholly exempt from federal tax ....................................................................................

2

00

3. Unallowable deduction for corporation tax from Schedule F, Line 8 .....................................................

3

00

4. Interest expenses paid to a related member from

.........................

4

Form CT-1120AB, Part I A, Line 1

00

5. Intangible expenses and costs paid to a related member from

.....

5

Form CT-1120AB, Part I B, Line 3

00

6. Federal bonus depreciation: See instructions. .....................................................................................

6

7. Reserved for future use .........................................................................................................................

7

00

8. IRC §199 domestic production activities deduction from federal Form 1120, Line 25...........................

8

00

9. Other: Attach explanation. ....................................................................................................................

9

00

10. Total: Add Lines 1 through 9. ...............................................................................................................

10

00

11. Dividend deduction from Form CT-1120 ATT, Schedule I, Line 5 ........................................................

11

00

12. Capital loss carryover (if not deducted in computing federal capital gain) ............................................

12

00

13. Capital gain from sale of preserved land ...............................................................................................

13

00

14. Federal bonus depreciation recovery from Form CT-1120 ATT, Schedule J, Line 13 .........................

14

00

15. Exceptions to interest add back from Form CT-1120AB, Part II A, Line 1 ...........................................

15

00

16. Exceptions to interest add back from Form CT-1120AB, Part II A, Line 2 ...........................................

16

00

17. Exceptions to interest add back from Form CT-1120AB, Part II A, Line 3 ...........................................

17

18. Exceptions to add back of intangible expenses paid to a related member from

00

.......................................................................................................

18

Form CT-1120AB, Part II B, Line 1

19. Reserved for future use ........................................................................................................................

19

00

20. Other: See instructions. ........................................................................................................................

20

00

21. Total: Add Lines 11 through 20. ............................................................................................................

21

00

22. Net income: Subtract Line 21 from Line 10. Enter here and on Schedule A, Line 1. ..........................

22

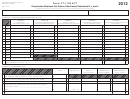

Schedule E – Computation of Minimum Tax Base

See instructions.

Column A

Column B

Column C

Beginning of Year

End of Year

00

00

1. Capital stock from federal Schedule L, Line 22a and Line 22b ....

(Column A plus

2. Surplus and undivided profits from federal Schedule L,

Column B)

00

00

Lines 23, 24, and 25 ...................................................................

Divided by 2

00

00

3. Surplus reserves: Attach schedule. ...........................................

00

00

00

4. Total: Add Lines 1, 2, and 3. Enter average in Column C. .......

5. Holdings of stock of private corporations: Attach schedule.

00

00

00

Enter average in Column C. ......................................................

00

6. Balance: Subtract Line 5, Column C, from Line 4, Column C. Enter here and on Schedule B, Line 1. ............................

Form CT-1120 (Rev. 12/12)

Page 2 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3