Form Ir - Mt. Healthy Income Tax Return - 2009

ADVERTISEMENT

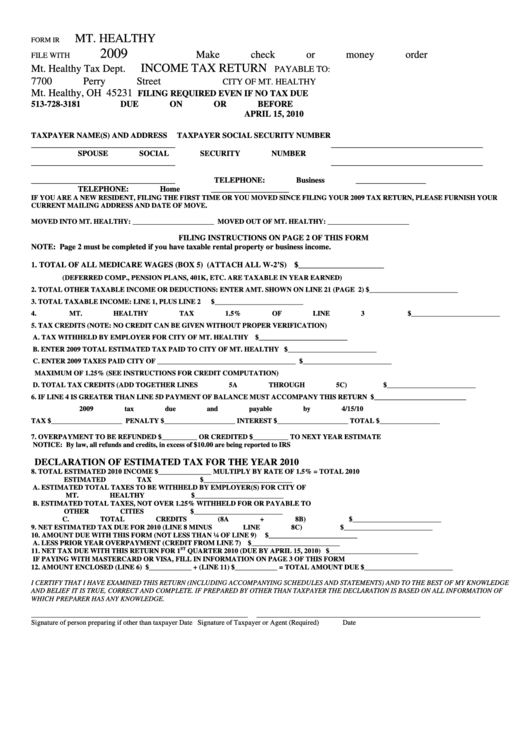

MT. HEALTHY

FORM IR

2009

Make check or money order

FILE WITH

INCOME TAX RETURN

Mt. Healthy Tax Dept.

PAYABLE TO:

7700 Perry Street

CITY OF MT. HEALTHY

Mt. Healthy, OH 45231

FILING REQUIRED EVEN IF NO TAX DUE

513-728-3181

DUE ON OR BEFORE

APRIL 15, 2010

TAXPAYER NAME(S) AND ADDRESS

TAXPAYER SOCIAL SECURITY NUMBER

_____________________________________

_______________________________________

SPOUSE SOCIAL SECURITY NUMBER

_____________________________________

_______________________________________

_____________________________________

TELEPHONE: Business __________________

TELEPHONE: Home ____________________

IF YOU ARE A NEW RESIDENT, FILING THE FIRST TIME OR YOU MOVED SINCE FILING YOUR 2009 TAX RETURN, PLEASE FURNISH YOUR

CURRENT MAILING ADDRESS AND DATE OF MOVE.

MOVED INTO MT. HEALTHY: _______________________

MOVED OUT OF MT. HEALTHY: _______________________

FILING INSTRUCTIONS ON PAGE 2 OF THIS FORM

NOTE: Page 2 must be completed if you have taxable rental property or business income.

1.

TOTAL OF ALL MEDICARE WAGES (BOX 5) (ATTACH ALL W-2’S)

$______________________

(DEFERRED COMP., PENSION PLANS, 401K, ETC. ARE TAXABLE IN YEAR EARNED)

2.

TOTAL OTHER TAXABLE INCOME OR DEDUCTIONS: ENTER AMT. SHOWN ON LINE 21 (PAGE 2)

$_________________________

3.

TOTAL TAXABLE INCOME: LINE 1, PLUS LINE 2

$_________________________

4.

MT. HEALTHY TAX 1.5% OF LINE 3

$_________________________

5.

TAX CREDITS (NOTE: NO CREDIT CAN BE GIVEN WITHOUT PROPER VERIFICATION)

A.

TAX WITHHELD BY EMPLOYER FOR CITY OF MT. HEALTHY

$_________________________

B.

ENTER 2009 TOTAL ESTIMATED TAX PAID TO CITY OF MT. HEALTHY

$_________________________

C.

ENTER 2009 TAXES PAID CITY OF _______________________________________

$_________________________

MAXIMUM OF 1.25% (SEE INSTRUCTIONS FOR CREDIT COMPUTATION)

D.

TOTAL TAX CREDITS (ADD TOGETHER LINES 5A THROUGH 5C)

$_________________________

6.

IF LINE 4 IS GREATER THAN LINE 5D PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN

$__________________________

2009 tax due and payable by 4/15/10

TAX $____________________

PENALTY $____________________

INTEREST $____________________

TOTAL $_________________

7.

OVERPAYMENT TO BE REFUNDED $__________

OR CREDITED $__________ TO NEXT YEAR ESTIMATE

NOTICE: By law, all refunds and credits, in excess of $10.00 are being reported to IRS

DECLARATION OF ESTIMATED TAX FOR THE YEAR 2010

8.

TOTAL ESTIMATED 2010 INCOME $_______________ MULTIPLY BY RATE OF 1.5% = TOTAL 2010

ESTIMATED TAX

$_________________________

A.

ESTIMATED TOTAL TAXES TO BE WITHHELD BY EMPLOYER(S) FOR CITY OF

MT. HEALTHY

$_________________________

B.

ESTIMATED TOTAL TAXES, NOT OVER 1.25% WITHHELD FOR OR PAYABLE TO

OTHER CITIES

$_________________________

C.

TOTAL CREDITS (8A + 8B)

$_________________________

9.

NET ESTIMATED TAX DUE FOR 2010 (LINE 8 MINUS LINE 8C)

$_________________________

10.

AMOUNT DUE WITH THIS FORM (NOT LESS THAN ¼ OF LINE 9)

$_________________________

A.

LESS PRIOR YEAR OVERPAYMENT (CREDIT FROM LINE 7)

$_________________________

ST

11.

NET TAX DUE WITH THIS RETURN FOR 1

QUARTER 2010 (DUE BY APRIL 15, 2010)

$_________________________

IF PAYING WITH MASTERCARD OR VISA, FILL IN INFORMATION ON PAGE 3 OF THIS FORM

12.

AMOUNT ENCLOSED (LINE 6) $____________ + (LINE 11) $____________ = TOTAL AMOUNT DUE

$_________________________

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE

AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY OTHER THAN TAXPAYER THE DECLARATION IS BASED ON ALL INFORMATION OF

WHICH PREPARER HAS ANY KNOWLEDGE.

_____________________________________________________________

_______________________________________________________________

Signature of person preparing if other than taxpayer

Date

Signature of Taxpayer or Agent (Required)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3