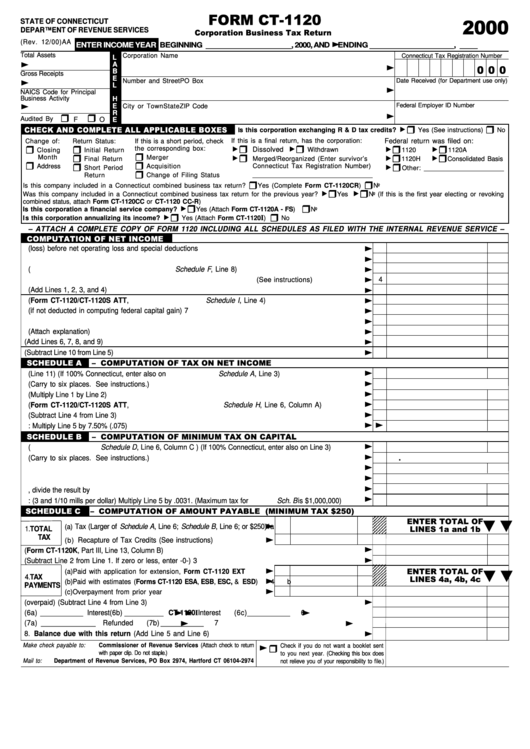

Form Ct-1120 - Corporation Business Tax Return - 2000

ADVERTISEMENT

FORM CT-1120

2000

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

Corporation Business Tax Return

<

(Rev. 12/00)AA

ENTER INCOME YEAR

BEGINNING ____________________, 2000, AND

ENDING ___________________, ____

Total Assets

Corporation Name

Connecticut Tax Registration Number

L

<

<

A

0 0 0

B

Gross Receipts

<

E

Number and Street

PO Box

Date Received (for Department use only)

<

L

NAICS Code for Principal

Business Activity

H

<

Federal Employer ID Number

E

City or Town

State

ZIP Code

<

R

H

H

Audited By

F

O

E

<

H

H

CHECK AND COMPLETE ALL APPLICABLE BOXES

Is this corporation exchanging R & D tax credits?

Yes (See instructions)

No

If this is a final return, has the corporation:

Federal return was filed on:

Change of:

Return Status:

If this is a short period, check

<

<

<

<

H

H

H

H

H

H

the corresponding box:

Dissolved

Closing

Initial Return

Withdrawn

1120

1120A

<

<

<

H

H

H

H

H

Month

Merger

Final Return

Merged/Reorganized (Enter survivor’s

1120H

Consolidated Basis

<

H

H

H

H

Connecticut Tax Registration Number)

Address

Acquisition

Short Period

Other: ______________________

H

_________________________________

Return

Change of Filing Status

H

H

Is this company included in a Connecticut combined business tax return?

Yes (Complete Form CT-1120CR)

No

<

<

H

H

Was this company included in a Connecticut combined business tax return for the previous year?

Yes

No (If this is the first year electing or revoking

combined status, attach Form CT-1120CC or CT-1120 CC-R)

<

H

H

Is this corporation a financial service company?

Yes (Attach Form CT-1120A - FS)

No

<

H

H

I

Is this corporation annualizing its income?

Yes (Attach Form CT-1120

)

No

– ATTACH A COMPLETE COPY OF FORM 1120 INCLUDING ALL SCHEDULES AS FILED WITH THE INTERNAL REVENUE SERVICE –

COMPUTATION OF NET INCOME

<

1. Federal taxable income (loss) before net operating loss and special deductions .......................................

1

<

2. Interest income wholly exempt from federal tax ............................................................................................

2

<

3. Unallowable deduction for corporation tax ( Schedule F , Line 8) .................................................................

3

<

4. Intangible expenses and interest expenses paid to a related member

4

(See instructions) ..........................

<

5. TOTAL (Add Lines 1, 2, 3, and 4) ................................................................................................................

5

<

6. Dividend deduction (Form CT-1120/CT-1120S ATT, Schedule I , Line 4) ..................................................

6

<

7. Capital loss carryover (if not deducted in computing federal capital gain) ...................................................

7

<

8. Capital gain from sale of preserved land .......................................................................................................

8

<

9. Other (Attach explanation) .............................................................................................................................

9

<

10. TOTAL (Add Lines 6, 7, 8, and 9) ................................................................................................................

10

<

11. NET INCOME (Subtract Line 10 from Line 5) ................................................................................................

11

SCHEDULE A

` COMPUTATION OF TAX ON NET INCOME

<

1. Net income (Line 11) (If 100% Connecticut, enter also on Schedule A , Line 3) ...........................................

1

<

2. Apportionment fraction (Carry to six places. See instructions.) ..................................................................

2

0.

<

3. Connecticut net income (Multiply Line 1 by Line 2) ........................................................................................

3

<

4. Operating loss carryover (Form CT-1120/CT-1120S ATT, Schedule H , Line 6, Column A) .....................

4

<

5. Income subject to tax (Subtract Line 4 from Line 3) ......................................................................................

5

< <

6. TAX: Multiply Line 5 by 7.50% (.075) .............................................................................................................

6

SCHEDULE B

` COMPUTATION OF MINIMUM TAX ON CAPITAL

<

1. Minimum tax base ( Schedule D , Line 6, Column C ) (If 100% Connecticut, enter also on Line 3) ...............

1

<

.

2. Apportionment fraction (Carry to six places. See instructions.) ..................................................................

2

0

<

3. Multiply Line 1 by Line 2 ..................................................................................................................................

3

<

4. Number of months covered by this return .....................................................................................................

4

<

5. Multiply Line 3 by Line 4, divide the result by 12 ............................................................................................

5

<

6. TAX: (3 and 1/10 mills per dollar) Multiply Line 5 by .0031. (Maximum tax for Sch. B is $1,000,000) .........

6

?

?

SCHEDULE C

` COMPUTATION OF AMOUNT PAYABLE (MINIMUM TAX $250)

1 2 3 4 5

<

1 2 3 4 5

ENTER TOTAL OF

1 2 3 4 5

1 2 3 4 5

Tax (Larger of Schedule A , Line 6; Schedule B , Line 6; or $250)

1a

(a)

LINES 1a and 1b

1 2 3 4 5

1. TOTAL

1 2 3 4 5

<

1 2 3 4 5

TAX

Recapture of Tax Credits (See instructions) .........................

1b

1

(b)

<

2. Tax Credits (Form CT-1120K, Part III, Line 13, Column B) ..............................................................................

2

<

?

?

3. Balance of tax payable (Subtract Line 2 from Line 1. If zero or less, enter -0-) .............................................

3

1 2 3 4 5

<

1 2 3 4 5

1 2 3 4 5

ENTER TOTAL OF

(a) Paid with application for extension, Form CT-1120 EXT .......

4a

1 2 3 4 5

<

1 2 3 4 5

4. TAX

LINES 4a, 4b, 4c

1 2 3 4 5

1 2 3 4 5

(b) Paid with estimates (Forms CT-1120 ESA, ESB, ESC, & ESD)

4b

1 2 3 4 5

PAYMENTS

<

1 2 3 4 5

(c) Overpayment from prior year .....................................................

4 c

4

<

5. Balance of tax due (overpaid) (Subtract Line 4 from Line 3) ...........................................................................

5

<

<

<

6. Add Penalty

(6a) ___________ Interest

(6b) __________ CT-1120I Interest

(6c) ___________

6

<

<

7. Amount to be credited to 2001 estimated tax

(7a) ______________ Refunded

(7b) ___________

7

<

8. Balance due with this return (Add Line 5 and Line 6) ...............................................................................

8

<

Make check payable to:

Commissioner of Revenue Services (Attach check to return

H

Check if you do not want a booklet sent

with paper clip. Do not staple.)

to you next year. (Checking this box does

Mail to:

Department of Revenue Services, PO Box 2974, Hartford CT 06104-2974

not relieve you of your responsibility to file.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2