Form Ct-1120 - Corporation Business Tax Return - 2010

ADVERTISEMENT

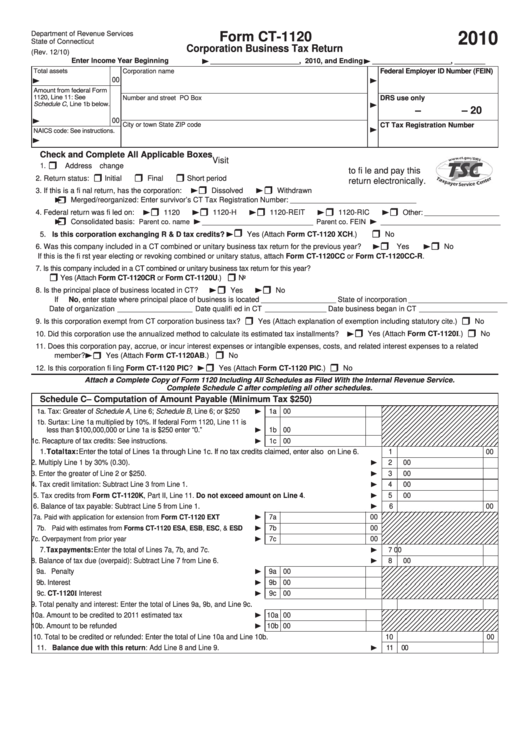

Department of Revenue Services

Form CT-1120

2010

State of Connecticut

Corporation Business Tax Return

(Rev. 12/10)

Enter Income Year Beginning

, 2010, and Ending

,

__________________________

_______________________

_________

Total assets

Corporation name

Federal Employer ID Number (FEIN)

00

Amount from federal Form

1120, Line 11: See

Number and street

PO Box

DRS use only

Schedule C, Line 1b below.

–

– 20

00

CT Tax Registration Number

City or town

State

ZIP code

NAICS code: See instructions.

Check and Complete All Applicable Boxes

Visit

1.

Address change

to fi le and pay this

2. Return status:

Initial

Final

Short period

return electronically.

3. If this is a fi nal return, has the corporation:

Dissolved

Withdrawn

Merged/reorganized: Enter survivor’s CT Tax Registration Number:

_____________________________________

4. Federal return was fi led on:

1120

1120-H

1120-REIT

1120-RIC

Other:

______________________

Consolidated basis:

_____________________________________

Parent co. name

______________________________ Parent co. FEIN

5. Is this corporation exchanging R & D tax credits?

Yes (Attach Form CT-1120 XCH.)

No

Yes

6. Was this company included in a CT combined or unitary business tax return for the previous year?

No

If this is the fi rst year electing or revoking combined or unitary status, attach Form CT-1120CC or Form CT-1120CC-R.

7. Is this company included in a CT combined or unitary business tax return for this year?

Yes (Attach Form CT-1120CR or Form CT-1120U.)

No

8. Is the principal place of business located in CT?

Yes

No

If No, enter state where principal place of business is located

State of incorporation

______________________

_____________________________

Date of organization

Date qualifi ed in CT

Date business began in CT

______________________

__________________

_______________________

9. Is this corporation exempt from CT corporation business tax?

Yes (Attach explanation of exemption including statutory cite.)

No

10. Did this corporation use the annualized method to calculate its estimated tax installments?

Yes (Attach Form CT-1120I.)

No

11. Does this corporation pay, accrue, or incur interest expenses or intangible expenses, costs, and related interest expenses to a related

member?

Yes (Attach Form CT-1120AB.)

No

12. Is this corporation fi ling Form CT-1120 PIC?

Yes (Attach Form CT-1120 PIC.)

No

Attach a Complete Copy of Form 1120 Including All Schedules as Filed With the Internal Revenue Service.

Complete Schedule C after completing all other schedules.

Schedule C – Computation of Amount Payable (Minimum Tax $250)

Tax: Greater of Schedule A, Line 6; Schedule B, Line 6; or $250 .......

1a

00

1a.

Surtax: Line 1a multiplied by 10%. If federal Form 1120, Line 11 is

1b.

less than $100,000,000 or Line 1a is $250 enter “0.” ..........................

1b

00

1c. Recapture of tax credits: See instructions. ..........................................

1c

00

1. Total tax: Enter the total of Lines 1a through Line 1c. If no tax credits claimed, enter also on Line 6. .........

1

00

2. Multiply Line 1 by 30% (0.30). .....................................................................................................................

2

00

3. Enter the greater of Line 2 or $250. ............................................................................................................

3

00

4. Tax credit limitation: Subtract Line 3 from Line 1. .......................................................................................

4

00

5. Tax credits from Form CT-1120K, Part II, Line 11. Do not exceed amount on Line 4. ...........................

5

00

6. Balance of tax payable: Subtract Line 5 from Line 1.

......................................................................................

6

00

7a. Paid with application for extension from Form CT-1120 EXT .................

7a

00

00

7b. Paid with estimates from Forms CT-1120 ESA, ESB, ESC, & ESD ........

7b

00

7c. Overpayment from prior year ...................................................................

7c

7. Tax payments: Enter the total of Lines 7a, 7b, and 7c.

....................................................................................

7

00

8. Balance of tax due (overpaid): Subtract Line 7 from Line 6. ......................................................................

8

00

9a. Penalty ................................................................................................

9a

00

9b. Interest ................................................................................................

9b

00

9c. CT-1120I Interest ................................................................................

9c

00

9. Total penalty and interest: Enter the total of Lines 9a, 9b, and Line 9c. ...........................................................

9

00

10a. Amount to be credited to 2011 estimated tax ....................................

10a

00

10b. Amount to be refunded ......................................................................

10b

00

.................................................................

10. Total to be credited or refunded: Enter the total of Line 10a and Line 10b.

10

00

11. Balance due with this return: Add Line 8 and Line 9. .............................................................................

11

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3