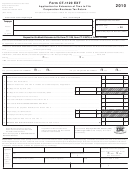

Form Ct-1120 - Corporation Business Tax Return - 2010 Page 3

ADVERTISEMENT

Column A

Column B

Schedule F – Taxes

1. Payroll....................................................................................

00

2. Real property .........................................................................

00

3. Personal property ..................................................................

00

4. Sales and use ........................................................................

00

5. Other: See instructions. ........................................................

00

6. Connecticut corporation business tax deducted in the

computation of federal taxable income ..................................

00

7. Tax on or measured by income or profi ts imposed by other

states or political subdivisions deducted in the computation

of federal taxable income: Attach schedule. .........................

00

8. Total unallowable deduction for corporation business tax purposes: Add Line 6 and Line 7, Column B.

Enter here and on Schedule D, Line 3. .....................................................................................................

00

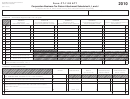

Schedule G – Additional Required Information – Attach a schedule of corporate offi cers’ names, titles, and addresses. See instructions.

1. In which CT town(s) does the corporation own or lease, as lessee, real or tangible personal property, or perform services?

_____________________________________________________________________________________________________________________________________

2. (a) Did this corporation directly or indirectly transfer a controlling interest in an entity owning CT real property?

Yes

No

___________________

If Yes, enter: Entity name

Federal Employer ID Number

_____________________________________

(b) Was there a direct or indirect transfer of a controlling interest in your company owning CT real property?

Yes

No

If Yes, enter: Transferor name

_____________________________________

Federal Employer ID Number

___________________

(c) If the answer to either 2(a) or 2(b) is Yes, enter: Transferee(s) name ___________________________________________________

Date of transfer _________________________ , and attach a list of addresses for all Connecticut realty property transferred.

3. Did any corporation at any time during the year own a majority of the voting stock of this corporation?

Yes

No

If

Yes, enter: Corporation name

Federal Employer ID Number

_______________________________________

_____________________

4. Last taxable year this corporation was audited by the Internal Revenue Service

_______________________

Were adjustments reported to CT?

Yes

No (If No, attach explanation.)

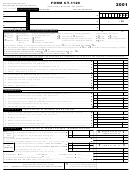

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of

Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other

than the taxpayer is based on all information of which the preparer has any knowledge.

Corporate offi cer’s name (print)

Date

Corporate offi cer’s signature

Telephone number

Sign Here

(

)

Title

May DRS contact the preparer shown below about this return?

Keep a

Yes

No

See instructions, Page 18.

copy

of this

Paid preparer’s name (print)

Date

return for

your

Paid preparer’s signature

Preparer’s SSN or PTIN

records.

Firm’s name and address

FEIN

Telephone number

(

)

Mail paper return with payment to:

Mail paper return without payment to:

Make check payable to:

Department of Revenue Services

Department of Revenue Services

Commissioner of Revenue Services

State of Connecticut

State of Connecticut

Attach check to return with paper clip.

PO Box 2974

PO Box 150406

Do not staple.

Hartford CT 06104-2974

Hartford CT 06115-0406

Page 3 of 3

Form CT-1120 (Rev. 12/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3