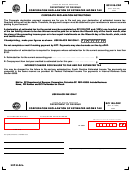

Form D-1 20____ Declaration Of Estimated Income Tax Page 2

ADVERTISEMENT

PAGE 2

.

(A) If you are filing for the first time or your tax status has changed in the past year (for example, you are not working in the Municipality), please check this block and explain below.

At the Present Time

Date Began

Prior to the Present Time

Dates From To

Business Location or

Place of Residence

**

Type of Business or

Occupation, etc.

**

Employer’s Name

(if any)

**

Business Conducted or

Work Done in (Municipality)

**

IF A CLEAR UNDERSTANDING OF YOUR SITUATION CANNOT BE CONVEYED ABOVE, PLEASE ATTACH AN EXPLANATION AND GIVE YOUR LOCAL PHONE NUMBER

GENERAL INFORMATION

DECLARATION OF ESTIMATED TAX IS MAILED TO TAXPAYERS OF RECORD. FILE WITH THE TAX DIVISION (ADDRESS AT

UPPER LEFT FRONT CORNER) WITHIN FOUR MONTHS OF THE BEGINNING OF THE TAXABLE YEAR OR PERIOD, BEGINNING

OF A NEW BUSINESS OR TAKING OF A NEW JOB, ETC. EVERYONE WHOSE ENTIRE TAX LIABILITY WILL NOT BE WITHHELD BY

AN EMPLOYER MUST FILE A DECLARATION OF ESTIMATED TAX.

TO AVOID BEING PENALIZED A TAXPAYER MUST HAVE 100% OF THE PREVIOUS YEAR’S TAX LIABILITY PAID IN, OR 90%

(FOR HAMILTON, PHILLIPSBURG, WEST MILTON, J.E.D.D., J.E.D.D. II, AND BUTLER COUNTY ANNEX,) OR 70% (FOR OXFORD,

EATON AND NEW MIAMI) OF THE CURRENT YEAR’S TAX LIABILITY (LINE 2) COMPLETELY PAID IN BY THE LAST ESTIMATED

TAX DUE DATE. SINCE IT IS DIFFICULT TO DETERMINE YOUR CURRENT TAX LIABILITY, USING YOUR PREVIOUS YEAR’S

LIABILITY OR AN AMOUNT GREATER, IS INSURANCE AGAINST ANY PENALTY FOR UNDER-ESTIMATING FOR HAMILTON,

EATON, OXFORD, NEW MIAMI, PHILLIPSBURG, WEST MILTON, J.E.D.D, J.E.D.D II, OR BUTLER COUNTY ANNEX PURPOSES. A

NEW TAXPAYER WITHOUT BASIS ON WHICH TO MAKE A BETTER ESTIMATE MAY MAKE A VALID ESTIMATE BY DECLARING

$200.00 AS THE FIRST YEAR TAX ESTIMATE. IF FILING YOUR FIRST DECLARATION, OR IF YOUR STATUS HAS CHANGED

DURING THE PAST YEAR, PLEASE COMPLETE (A), (B), AND (C) ON THE FORM AND THE ABOVE EXPLANATION, OR BY

ATTACHMENT. PLEASE NOTIFY THE TAX OFFICE PROMPTLY OF ANY LATER CHANGES. IF YOUR NAME, ADDRESS AND/OR

ACCOUNT NUMBER HAS BEEN PRINTED AND THE INFORMATION SHOWN IS NOT CORRECT, PLEASE MAKE ANY NECESSARY

CHANGES JUST BELOW SUCH IMPRINT.

HOW TO FILL OUT SECTION D. ON LINE 1, ENTER YOUR ESTIMATE OF THE INCOME SUBJECT TO TAX WHICH YOU EXPECT

TO RECEIVE THIS YEAR. ON LINE 2, IF YOU ARE A HAMILTON, J.E.D.D., J.E.D.D. II, OR BUTLER COUNTY ANNEX TAXPAYER,

ENTER 2% OF THE AMOUNT ON LINE 1. IF YOU ARE A NEW MIAMI OR OXFORD TAXPAYER, ENTER 1.75% OF THE AMOUNT ON

LINE 1. IF YOU ARE EATON, PHILLIPSBURG, OR WEST MILTON TAXPAYER, ENTER 1.5% OF THE AMOUNT ON LINE 1. ON LINE

4, ENTER THE AMOUNT OF YOUR ESTIMATED TAX LIABILITY OVER AND ABOVE THAT WHICH YOUR EMPLOYER WILL

WITHHOLD FOR YOU (LINE 2 LESS LINE 3). ON LINE 5, LIST ANY ALLOWABLE CREDITS WHICH CAN BE APPLIED FROM YOUR

PREVIOUS YEAR’S TAX. ON LINE 6, ENTER THE BALANCE OF LINE 4 AFTER SUBTRACTING ANY AMOUNT ON LINE 5. THIS IS

YOUR ESTIMATED TAX FOR THE YEAR.

ON LINE 7, ENTER THE AMOUNT YOU WILL PAY WITH THE FILING OF THIS

DECLARATION OR SPREAD EQUALLY OVER THE PAYMENT DATES OF 4-30, 7-31, 10-31 AND 1-31 FOR ALL TAXPAYERS.

FISCAL YEAR TAXPAYERS SHOULD FILE WITHIN 4 MONTHS AFTER THE BEGINNING OF THE FISCAL YEAR AND ADJUST

QUARTERLY PAYMENTS ACCORDINGLY.

*PLEASE NOTE: WE DO NOT BILL FOR THE FIRST QUARTER WHICH IS DUE 4-30 OR WITHIN 4 MONTHS AFTER YOUR TAX

PERIOD BEGINS. ONCE YOU FILE THIS DECLARATION OF ESTIMATED TAX FORM, THE SYSTEM WILL GENERATE QUARTERLY

PAYMENT VOUCHERS FOR YOU TO USE IN REMITTING YOUR SECOND, THIRD AND FOURTH QUARTER TAX PAYMENTS. IF

NOT PAID TIMELY YOU MAY RECEIVE DELINQUENT NOTICES. THE RETURN OF THIS FORM, UNLESS SIGNED, DATED AND

ACCOMPANIED BY PAYMENT OF AT LEAST 25% OF THE ESTIMATED TAX SHOWN ON LINE 4 DOES NOT CONSTITUTE THE

LEGAL FILING OF A DECLARATION.

**THE AMOUNT OF EACH QUARTERLY BILLING WILL BE DETERMINED BY DIVIDING LINE 4 BY FOUR. ANY CREDIT OR

PREVIOUS PAYMENTS RECEIVED WILL BE DEDUCTED FROM THE MOST CURRENT PAYMENT DUE.

***J.E.D.D. IS DEFINED AS JOINT ECONOMIC DEVELOPMENT DISTRICT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2