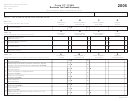

Form Ct-1120k - Business Tax Credit Summary - 2003 Page 2

ADVERTISEMENT

D

A

B

C

E

PART I-D

Amount

Carryforward

2003

Amount

Carryforward

Tax Credits With

Applied to

Amount From

Credit

Applied to

Amount to

Other Taxes

Previous

Amount

Corporation Tax

2004

Carryforward Provisions

or Exchanged

Income Years

Claimed

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

14 Housing Program Contribution (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

00

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

(Form CT-1120 HPC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

15 Employer-Assisted Housing (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

00

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

(Form CT-1120 EAH)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

16 Hiring Incentive (Form CT-1120 HIC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

00

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

17 Clean Alternative Fuel-Vehicles, Equipment,

and Related Filling or Recharging Stations

00

00

00

00

00

(Form CT-1120 CAF)

18 Research and Experimental Expenditures

(Form CT-1120RC. Enter amount exchanged

in Column D.)

00

00

00

00

00

19 Research and Development (Form CT-1120 RDC.

Enter amount exchanged in Column D.)

00

00

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

20 Fixed Capital Investment (Form CT-1120 FCIC)

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

21 Human Capital Investment (Form CT-1120 HCIC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

00

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

22 Insurance Reinvestment Fund (Form CT-IRF)

00

00

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

23 Small Business Administration Guaranty Fee

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

00

(Form CT-1120 SBA)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

24 Historic Homes Rehabilitation

00

00

00

00

00

(Form CT-1120 HHR)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

25 Donation of Open Space Land (Form CT-1120 DOS)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

00

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

26 Air Pollution (Form CT-1120AP)

00

00

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

27 TOTAL PART I-D (Add Lines 14 through 26 in

Columns A through E. For Column D, do not

00

00

00

00

00

include Line 18 and Line 19 in the total amount.)

D

A

B

C

E

PART I-E

Amount

Electronic Data Processing

Carryforward

2003

Amount

Carryforward

Applied to

Amount From

Credit

Applied to

Amount to

Equipment Property

Other Taxes

Previous

Amount

Corporation Tax

2004

Tax Credit

Income Years

Claimed

28 Electronic Data Processing Equipment

00

00

00

00

00

Property Tax Credit (Form CT-1120 EDPC)

Form CT-1120K (Rev. 12/03)

Page 2 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3