Form Ct-1120k - Business Tax Credit Summary - 2003 Page 3

ADVERTISEMENT

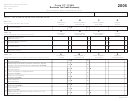

PART II - TAX CREDITS APPLIED TO THE CORPORATION BUSINESS TAX

(Combined return filers – Do not complete Part II.)

00

1 Tax Credit Limitation (Enter amount from Form CT-1120, Schedule C , Line 4)

2 Financial Institutions Credit (Enter amount from Form CT-1120K, Part I-A, Line 1, Column B.

00

Do not exceed amount on Line 1.)

00

3 Creditable corporation business tax balance (Subtract Line 2 from Line 1)

4 Tax Credits With Carryback Provisions (Enter amount from Form CT-1120K, Part I-B, Line 5, Column B.

00

Do not exceed amount on Line 3.)

00

5 Creditable corporation business tax balance (Subtract Line 4 from Line 3)

6 Tax Credits Without Carryback or Carryforward Provisions (Enter amount from Form CT-1120K,

00

Part I-C, Line 13, Column B. Do not exceed amount on Line 5.)

00

7 Creditable corporation business tax balance (Subtract Line 6 from Line 5)

8 Tax Credits With Carryforward Provisions (Enter amount from Form CT-1120K, Part I-D, Line 27, Column C.

Do not exceed amount on Line 7. Carryforward credits that expire first should be claimed before any credit carryforward

00

that will expire later or not at all.)

00

9 Creditable corporation business tax balance (Subtract Line 8 from Line 7)

10 Electronic Data Processing Equipment Property Tax Credit (Enter amount from Form CT-1120K, Part I-E, Line 28,

Column C. Carryforward credit that expires first should be claimed before any credit carryforward that will expire later.

00

Do not exceed amount on Line 9.)

11 TOTAL CORPORATION BUSINESS TAX CREDITS APPLIED (Add Part II, Lines 2, 4, 6, 8, and 10.

00

Enter here and on Form CT-1120, Schedule C , Line 5. Do not exceed amount on Line 1.)

PART III - TAX CREDITS APPLIED TO TAXES OTHER THAN CORPORATION BUSINESS TAX

Name of tax: __________________________ (Duplicate Part III as necessary.)

1 Tax (Enter the actual tax amount from the appropriate tax form)

00

2 Tax Credits With Carryback Provisions (Enter amount from Form CT-1120K, Part I-B, Line 5,

00

Column C. Do not exceed amount on Line 1.)

3 Tax balance (Subtract Line 2 from Line 1)

00

4 Tax Credits Without Carryback or Carryforward Provisions (Enter amount from Form CT-1120K,

00

Part I-C, Line 13, Column C. Do not exceed the amount on Line 3.)

5 Tax balance (Subtract Line 4 from Line 3)

00

Tax Credits With Carryforward Provisions (Enter amount from Form CT-1120K, Part I-D, Line 27, Column D.

6

Do not exceed amount on Line 5.)

00

7 Tax balance (Subtract Line 6 from Line 5)

00

Electronic Data Processing Equipment Property Tax Credit (Enter amount from Form CT-1120K, Part I-E, Line 28,

8

Column D. Do not exceed amount on Line 7.)

00

9 TOTAL TAX CREDITS APPLIED TO TAX OTHER THAN CORPORATION BUSINESS TAX

(Add Part III, Lines 2, 4, 6, and 8. Enter here and on the appropriate tax return. Do not exceed amount on Line 1.)

00

Form CT-1120K (Rev. 12/03)

Page 3 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3