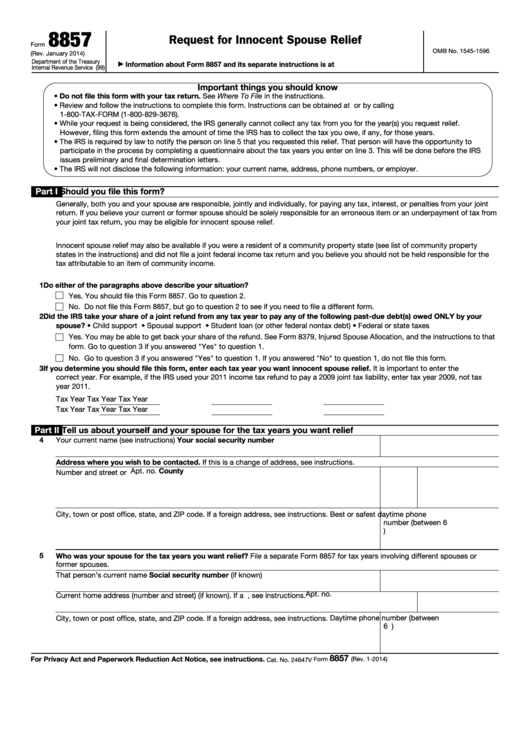

8857

Request for Innocent Spouse Relief

Form

OMB No. 1545-1596

(Rev. January 2014)

Department of the Treasury

Information about Form 8857 and its separate instructions is at

▶

Internal Revenue Service (99)

Important things you should know

• Do not file this form with your tax return. See Where To File in the instructions.

• Review and follow the instructions to complete this form. Instructions can be obtained at or by calling

1-800-TAX-FORM (1-800-829-3676).

• While your request is being considered, the IRS generally cannot collect any tax from you for the year(s) you request relief.

However, filing this form extends the amount of time the IRS has to collect the tax you owe, if any, for those years.

• The IRS is required by law to notify the person on line 5 that you requested this relief. That person will have the opportunity to

participate in the process by completing a questionnaire about the tax years you enter on line 3. This will be done before the IRS

issues preliminary and final determination letters.

• The IRS will not disclose the following information: your current name, address, phone numbers, or employer.

Part I

Should you file this form?

Generally, both you and your spouse are responsible, jointly and individually, for paying any tax, interest, or penalties from your joint

return. If you believe your current or former spouse should be solely responsible for an erroneous item or an underpayment of tax from

your joint tax return, you may be eligible for innocent spouse relief.

Innocent spouse relief may also be available if you were a resident of a community property state (see list of community property

states in the instructions) and did not file a joint federal income tax return and you believe you should not be held responsible for the

tax attributable to an item of community income.

1

Do either of the paragraphs above describe your situation?

Yes. You should file this Form 8857. Go to question 2.

No. Do not file this Form 8857, but go to question 2 to see if you need to file a different form.

2

Did the IRS take your share of a joint refund from any tax year to pay any of the following past-due debt(s) owed ONLY by your

spouse? • Child support • Spousal support • Student loan (or other federal nontax debt) • Federal or state taxes

Yes. You may be able to get back your share of the refund. See Form 8379, Injured Spouse Allocation, and the instructions to that

form. Go to question 3 if you answered "Yes" to question 1.

No. Go to question 3 if you answered "Yes" to question 1. If you answered "No" to question 1, do not file this form.

3

If you determine you should file this form, enter each tax year you want innocent spouse relief. It is important to enter the

correct year. For example, if the IRS used your 2011 income tax refund to pay a 2009 joint tax liability, enter tax year 2009, not tax

year 2011.

Tax Year

Tax Year

Tax Year

Tax Year

Tax Year

Tax Year

Part II

Tell us about yourself and your spouse for the tax years you want relief

Your social security number

4

Your current name (see instructions)

Address where you wish to be contacted. If this is a change of address, see instructions.

Apt. no.

County

Number and street or P.O. box

City, town or post office, state, and ZIP code. If a foreign address, see instructions.

Best or safest daytime phone

number (between 6 a.m. and 5

p.m. Eastern Time)

5

Who was your spouse for the tax years you want relief? File a separate Form 8857 for tax years involving different spouses or

former spouses.

That person’s current name

Social security number (if known)

Apt. no.

Current home address (number and street) (if known). If a P.O. box, see instructions.

Daytime phone number (between

City, town or post office, state, and ZIP code. If a foreign address, see instructions.

6 a.m. and 5 p.m. Eastern Time)

8857

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 1-2014)

Cat. No. 24647V

1

1 2

2 3

3 4

4 5

5 6

6 7

7