Schedule Nd-1s Draft - Allocation Of Income By Same-Sex Individuals Filing A Joint Federal Return - 2013

ADVERTISEMENT

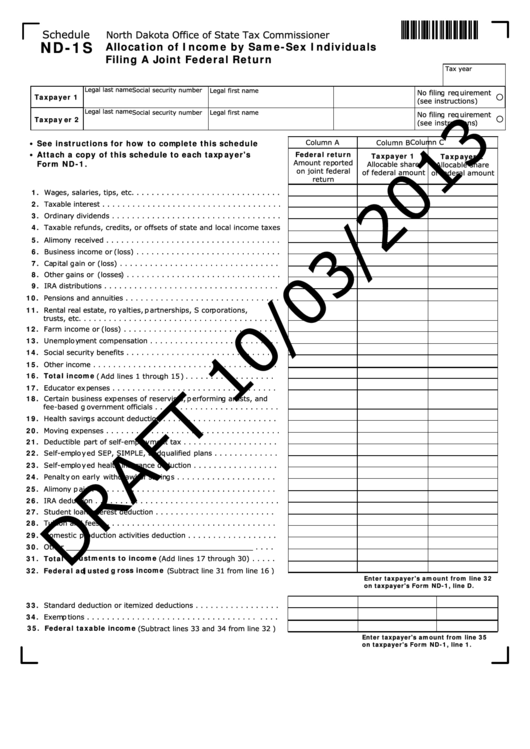

Schedule

North Dakota Office of State Tax Commissioner

ND-1S

Allocation of Income by Same-Sex Individuals

Filing A Joint Federal Return

Tax year

Legal last name

Social security number

Legal first name

No filing requirement

Taxpayer 1

(see instructions)

Legal last name

Social security number

Legal first name

No filing requirement

Taxpayer 2

(see instructions)

Column C

Column A

Column B

See instructions for how to complete this schedule

•

Attach a copy of this schedule to each taxpayer's

Federal return

Taxpayer 1

•

Taxpayer 2

Amount reported

Form ND-1.

Allocable share

Allocable share

on joint federal

of federal amount

of federal amount

return

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Taxable refunds, credits, or offsets of state and local income taxes

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Rental real estate, royalties, partnerships, S corporations,

trusts, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Social security benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Total income (Add lines 1 through 15) . . . . . . . . . . . . . . . . . .

17. Educator expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Certain business expenses of reservists, performing artists, and

fee-based government officials . . . . . . . . . . . . . . . . . . . . . . . . .

19. Health savings account deduction . . . . . . . . . . . . . . . . . . . . . . .

20. Moving expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21. Deductible part of self-employment tax . . . . . . . . . . . . . . . . . . .

22. Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . . . .

23. Self-employed health insurance deduction . . . . . . . . . . . . . . . . .

24. Penalty on early withdrawl of savings . . . . . . . . . . . . . . . . . . . .

25. Alimony paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26. IRA deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27. Student loan interest deduction . . . . . . . . . . . . . . . . . . . . . . . .

28. Tuition and fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29. Domestic production activities deduction . . . . . . . . . . . . . . . . . .

30. Other __________________________________________ . . . .

31. Total adjustments to income (Add lines 17 through 30) . . . . .

32. Federal adjusted gross income (Subtract line 31 from line 16)

Enter taxpayer's amount from line 32

on taxpayer's Form ND-1, line D.

33. Standard deduction or itemized deductions . . . . . . . . . . . . . . . . .

34. Exemptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35. Federal taxable income (Subtract lines 33 and 34 from line 32)

Enter taxpayer's amount from line 35

on taxpayer's Form ND-1, line 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1