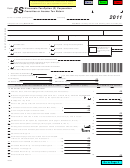

Form 5s - Wisconsin Tax-Option (S) Corporation Franchise Or Income Tax Return (2014) Page 2

ADVERTISEMENT

2 of 4

2014 Form 5S

Page

.

00

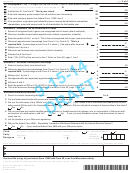

20 Overpayment. If line 17 is larger than the total of lines 11 and 18, enter amount overpaid . . .

20

.

00

21

21

Enter amount of line 20 you want credited to 2015 estimated tax

.

00

22 Subtract line 21 from line 20. This is your refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

.

00

23 Enter total company gross receipts from all activities (see instructions) . . . . . . . . . . . . . . . . . .

23

.

00

24 Enter total company assets from federal Form 1120S, item F . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 If the tax-option corporation paid withholding tax on income distributable to nonresident

.

00

shareholders, enter total amount paid for all shareholders for the taxable year . . . . . . . . . . . .

25

Schedule Q - Additional Tax on Certain Built-In Gains

.

00

1 Excess of recognized built-in gains over recognized built-in losses (attach schedule) . . . . . . . .

1

.

00

2 Wisconsin taxable income before apportionment (attach computation schedule) . . . . . . . . . . .

2

.

00

3 Enter the smaller of line 1 or line 2. This is the net recognized built-in gain (see instructions) . .

3

4 Wisconsin apportionment percentage (from Form A-1 or Form A-2). This is a

.

%

required field. If percentage is from Form A-2, check (

)

the space after the arrow

4

.

00

5 Multiply line 3 by line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.

00

6 Wisconsin net business loss carryforward (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

.

00

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

00

8 Enter 7.9% (0.079) of the amount on line 7. Enter on Form 5S, page 1, line 7 . . . . . . . . . . . . .

8

Schedule S - Economic Development Surcharge

.

00

1 Enter net income (loss) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Wisconsin apportionment percentage (from Form A-1 or Form A-2). This is a

.

%

required field. If percentage is from Form A-2, check (

)

the space after the arrow . .

2

.

00

3 Multiply line 1 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

.

00

4 Nonapportionable and separately apportioned income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.

00

5 Add lines 3 and 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Enter the greater of $25 or 0.2% (0.002) of the amount on line 5, but not more than $9,800.

.

00

This is the economic development surcharge to enter on Form 5S, page 1, line 8 . . . . . . . . . .

6

Additional Information Required

1 Person to contact concerning this return:

Phone #:

Fax #:

2 City and state where books and records are located for audit purposes:

3 Are you the sole owner of any QSubs or LLCs?

Yes

No

If yes, attach a list of the names and federal EINs of your

solely owned QSubs and LLCs. Enclose Schedule DE with this return. Did you include the incomes of these entities in this return?

Yes

No

4 Did you purchase any taxable tangible personal property or taxable services for storage, use, or consumption in Wisconsin with-

out payment of a state sales or use tax?

Yes

No

If yes, you owe Wisconsin use tax. See instructions for how to

report use tax.

5 List the locations of your Wisconsin operations:

6 Did you file federal Form 8886 – Reportable Transaction Disclosure Statement with the Internal Revenue Service?

Yes

No

If yes, enclose federal Form 8886 with your Wisconsin return.

Third

Do you want to allow another person to discuss this return with the department?

Yes

No

Complete the following.

Party

Personal

Designee’s

Phone

identification

Designee

(

)

name

no.

number (PIN)

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief .

Signature of Officer

Title

Date

Date

Preparer’s Signature

Preparer’s Federal Employer ID Number

You must file a copy of your federal Form 1120S with Form 5S, even if no Wisconsin activity.

If you are not filing electronically, make your check payable to and mail your return to:

Wisconsin Department of Revenue

PO Box 8908

Madison WI 53708-8908

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4